简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Best performing mutual funds in Nigeria for June 2022 I

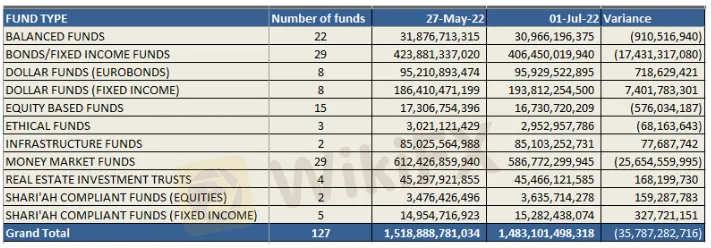

Abstract:Investments in Nigerian Mutual Funds dropped by N35.79 billion in the month of June 2022 to N1.48 trillion from N1.52 trillion recorded the previous month. This is largely due to the negative returns on investment recorded by most of the funds in the review month.

Investments in Nigerian Mutual Funds dropped by N35.79 billion in the month of June 2022 to N1.48 trillion from N1.52 trillion recorded the previous month. This is largely due to the negative returns on investment recorded by most of the funds in the review month.

This is according to the analysis of data extracted from the Securities and Exchange Commission (SEC) between 27th May 2022 and 1st July 2022. The analysis made use of weekly reports released by the Commission hence the extension of the coverage period into May and July.

Further analysis of the data showed that the money market fund category recorded the highest decline in the period under review with N25.65 billion reduction in the net asset value (NAV), while bonds/fixed income funds reduced by N17.43 billion in the same period.

According to SEC, there were 127 mutual funds registered with the Commission as of the 1st of July 2022, most of which are either bonds/fixed income funds or money market funds, while infrastructure fund and Shariah equities complaint funds were the least.

Notably, out of the 127 listed funds, 36.2% of them recorded a decline in their unit prices, 33.9% printed positive returns, and 29.9% maintained their initial prices.

Top Mutual Funds by Net Asset Value

Stanbic IBTC money market fund tops the list of mutual funds with the highest net asset value as of 1st July 2022 with a valuation of N218.15 billion, closely followed by Stanbic IBTC dollar fund with a valuation of N177.41 billion.

In third place is FBN money market fund with N162.45 billion NAV, followed by United Capital fixed income fund and Nigeria infrastructure debt fund with a valuation of N112.44 billion and N78.06 billion respectively.

Others include United Capital Eurobond Fund (N72.05 billion), ARM Money Market Fund (N67.64 billion), Stanbic IBTC Absolut Fund (N64.53 billion), FBN Fixed Income Fund (N64.52 billion), and Stanbic IBTC Bond Fund (N57.39 billion).

Best mutual funds by ROI in June 2022

Stanbic IBTC Dollar Fund – Stanbic IBTC (Dollar fixed income fund)

Stanbic IBTC Dollar Fund (SIDF) in dollar fixed income fund launched by Stanbic IBTC Asset Management in January 2017 that aims to provide currency diversification, income generation, and stable growth in USD.

It seeks to achieve this by investing a minimum of 70% of the portfolio in high-quality Eurobonds, a maximum of 30% in short-term USD deposits, and a maximum of 10% in USD equities approved and registered by the Securities and Exchange Commission of Nigeria.

27th May 2022

Fund Price – N552.07

1st July 2022

Fund Price – N562.74

Return – 1.93%

Ranking – Fifth

The dollar fixed income fund managed by Stanbic IBTC also grew its net asset value by 2.17% to N177.41 billion as of 1st July 2022 from N173.64 billion recorded as of 27th May 2022.

PACAM Eurobond Fund – PAC Asset Management (Dollar Eurobonds fund)

The PACAM Eurobond is a dollar fund that fund seeks to ensure steady stream of income and capital preservation for investors with low-risk appetite who value liquidity and security of assets.

This Fund invests in Fixed Income instruments such as FGN Bonds, Sub National Bonds, Corporate Bonds, and other investment-grade Fixed income instruments giving investors opportunity to invest in secure and high-yielding Bonds offered by Federal and State Governments of Nigeria and large Corporates.

27th May 2022

Fund Price – N49,393.44

1st July 2022

Fund Price – N49,345.15

Return – 1.97%

Ranking – Fourth

The fund also recorded a 2.16% in its subscription pushing its net asset value to N659.38 million as of the review period.

Coronation Fixed Income Fund – Coronation Asset Management (Bonds/Fixed Income Fund)

The Coronation Fixed Income Fund is an open-ended Fund that seeks to achieve an efficient balance between capital appreciation and income for investors.

The fund achieves its investment objectives by investing in medium to long-term FGN, Subnational and Corporate Bonds and other eligible fixed income securities.

27th May 2022

Fund Price – N1.46

1st July 2022

Fund Price – N1.5

Return – 2.89%

Ranking – Third

Following the positive movement in the unit price of the fund, the net asset value also increased by 3.21% to stand at N431.86 million as of 1st July 2022.

Stanbic IBTC Conservative Fund – Stanbic IBTC Asset Management (Bonds/Fixed Income Fund)

The Stanbic IBTC Conservative Fund is a fixed income fund managed by Stanbic IBTC Asset Management with the objective of ensuring the safety of funds with minimal exposure to the equities market in order to benefit from the returns applicable to equities.

Thus, the target asset allocation is biased toward Fixed Income securities. The Fund invests a maximum of 30% of its AUM in listed stocks and a minimum of 70% in Fixed Income securities.

27th May 2022

Fund Price – N4,141.37

1st July 2022

Fund Price – N4,416.59

Return – 6.65%

Ranking – Second

Despite the increase in the unit price, the fund recorded some withdrawals in the month under review as the net asset value dipped 0.4% to stand at N256.95 million.

Nigeria Dollar Income Fund – Chapel Hill Denham Mgt. (Dollar Fixed Income Fund)

The Nigeria Dollar Income Fund is a dollar fixed-income fund that provides unit-holders with an opportunity to invest in US dollar-denominated securities while also ensuring diversification of portfolio against the devaluation of domestic currency.

The Fund proceeds is applied towards investment in Eurobonds, money market instruments and foreign equities

27th May 2022

Fund Price – N1.04

1st July 2022

Fund Price – N433.08

Return – 41,731%

Ranking – First

The unit price of the fund rose astronomically in the period under review (+41,731%), while the net asset value increased by 14.75% to stand at N3.11 billion as of 1st July 2022.

Although this suggests some form of restructuring in the price of the fund as a possible reason for the astronomical return, however, no information was given regarding this, hence the inclusion of the fund as the best performing in the period under review.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator