简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Prices May Climb Further if US PPI Data Disappoints

Abstract:GOLD, XAU/USD, INFLATION, REAL YIELDS, PRODUCER PRICES - TALKING POINTS Gold gains as CPI data hints that inflation may have peaked US producer price index (PPI) may sway bullion prices further XAU climbs above January high, potentially fueling further gains

Gold prices staged a rebound overnight after inflation cooled slightly in the United States, according to the latest consumer price index (CPI) for April. The CPI crossed the wires at 8.3% on a year-over-year basis. That was higher than the 8.1% Bloomberg consensus estimate. However, it was slightly lower from Marchs 8.5% y/y figure.

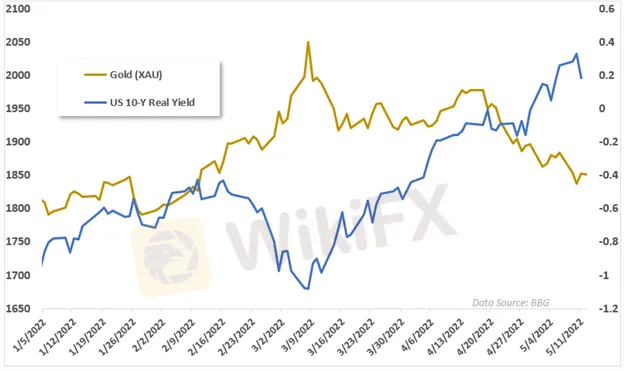

The reaction in gold was likely due to the Treasury markets behavior. Real yields – a major driver for bullion prices, fell following the CPI print. Lower real yields benefit gold because it is a non-interest-bearing asset, which lowers the opportunity cost of gold. The 10-year inflation-indexed rate fell 15-basis points overnight but remain in positive territory. The yellow metal may continue to gain if real yields drop further.

Tonight will bring the US‘s producer price index (PPI) data for April. Analysts see PPI cooling to 0.5% on a month-over-month basis, according to a Bloomberg survey. That would be down from 1.4%, representing a rather significant drawdown. That may help to calm inflationary fears, as factory-gate prices are sometimes seen as a leading indicator for downstream inflation. Gold may move higher if tonight’s data comes in below expectations.

XAU/USD TECHNICAL FORECAST

Gold prices are moving above the January swing high through Asia-Pacific trading, a level that has previously provided support. Holding that level may ignite further bullish energy to drive prices higher. If so, the falling 20-day Simple Moving Average (SMA) may cap upside. Meanwhile, MACD and the RSI oscillators appear to be improving.

XAU/USD DAILY CHART

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Currency Calculator