简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

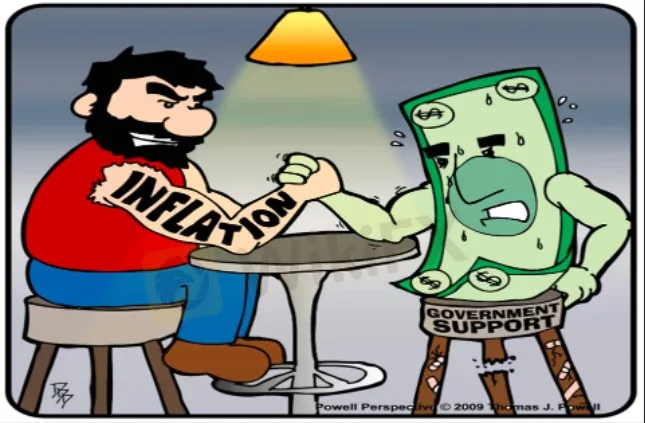

Despite skyrocketing inflation, the strong dollar supports gold prices.

Abstract:Because of the strength of the dollar, gold's traditionally positive performance in an inflationary and rising interest rate environment is hampered.

Click Here: After you read it, Daily Routine with WikiFx

Gold Gets Into The Action

The global commodities shock is increasing, and the 2/10 treasury yield curve – the differential between 2-year and 10-year treasury yields – became negative in early April. These have historically signaled a declining economy or recession. Early April saw gold and the dollar rise as traditional safe havens. On April 18, gold tested $2,000 an ounce with an intraday high of $1,998. On April 21, US Federal Reserve Chair Jerome Powell gave a strong message at an International Monetary Fund (IMF) session, indicating that more aggressive interest rate hikes are needed, presumably to battle inflation. On April 25, news of China's increasing COVID outbreak threatened to reduce demand for basic materials, causing gold to fall. Selling gold was misguided, as gold's drivers are distinct from other commodities. The volatility and falls in the Chinese stock and real estate markets have fueled investment demand for gold.

Dollar-Down

History texts teach us about inflation, the Cold War, and WWII. Ours was a world that would never allow such worldwide chaos or wickedness to occur again. Venezuela, Syria, and Myanmar could never happen in the West. Now we see that civilization isn't as evolved as we thought. The worst of human cycles is currently repeating, with war and nuclear threats. Gold is once again serving as a financial safe haven and wealth repository. Given the recent events, many gold supporters ask why the gold price isn't higher.

A secular bull market began in December 2015, when gold hit a low of roughly $1,050 an ounce. Gold's recent performance hasn't matched the 1970s and 2000s secular bull markets. In the present bull market, the pandemic has exacerbated some macroeconomic and geopolitical risks. One notable distinction may explain gold's poor performance thus far in this bull market. It was in a secular bear market from 1970 to 2000. From 1971 to 1978, the DXY plummeted 46%, and from 2002 to 2008, it fell 41%. The DXY has risen 5.2 percent since December 2015, and is currently testing a twenty-year high. While gold and the dollar often rise together in times of financial duress, their regular trend is downward. We think the strong dollar has slowed gold's current bull market ascent.

China and Europe seem to be leading the world into recession, while the Fed is raising rates. This is good news for the dollar for now. Gold has a lot of fans. The strong dollar is causing financial stress abroad, inflation appears to be out of control, and geopolitical and economic worries should keep driving gold. We expect gold prices will rise, but not to the levels seen in previous secular bull cycles.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Event Theme: Creator Incentive Program

WikiFX's Post Collection Event is about to begin! Dear users, the Creator Incentive Program is set to launch on WikiFX Business Channel! Post with the main hashtag #IncentiveProgram to share a $3,400 prize pool. Users with outstanding works may also receive official collaboration opportunities and interview eligibility.

Risk Management: Turning Potential Into Profit

In Forex Trading, Without Effective Risk Management, You Risk Huge Losses and the Complete Depletion of Your Account.

Is it a good time to buy Korean Won with the current depreciation?

The exchange rate of the South Korean won in 2025 is expected to be highly uncertain, influenced primarily by the dual challenges of economic slowdown and political instability.

US Dollar Surge Dominates Forex Market

The global forex market continues to show volatility, with the U.S. dollar fluctuating last week but overall maintaining a strong upward trend. How long can this momentum last?

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

BlackRock Bitcoin ETF Outflows Hit $332M in Single Day

XRP Price Prediction for 2025: Will It Hit $4.30 or More?

Exnova Scam Alert: Account Blocked, Funds Stolen, and Zero Accountability

T3 Financial Crime Unit Freezes $100M in USDT

Terra Founder Do Kwon Denies Fraud Allegations in U.S. Court

Currency Calculator