Score

MaxiFy

United States|1-2 years|

United States|1-2 years| https://maxifyfx.com

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

India

IndiaContact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

MaxiFy FX Limited

MaxiFy

United States

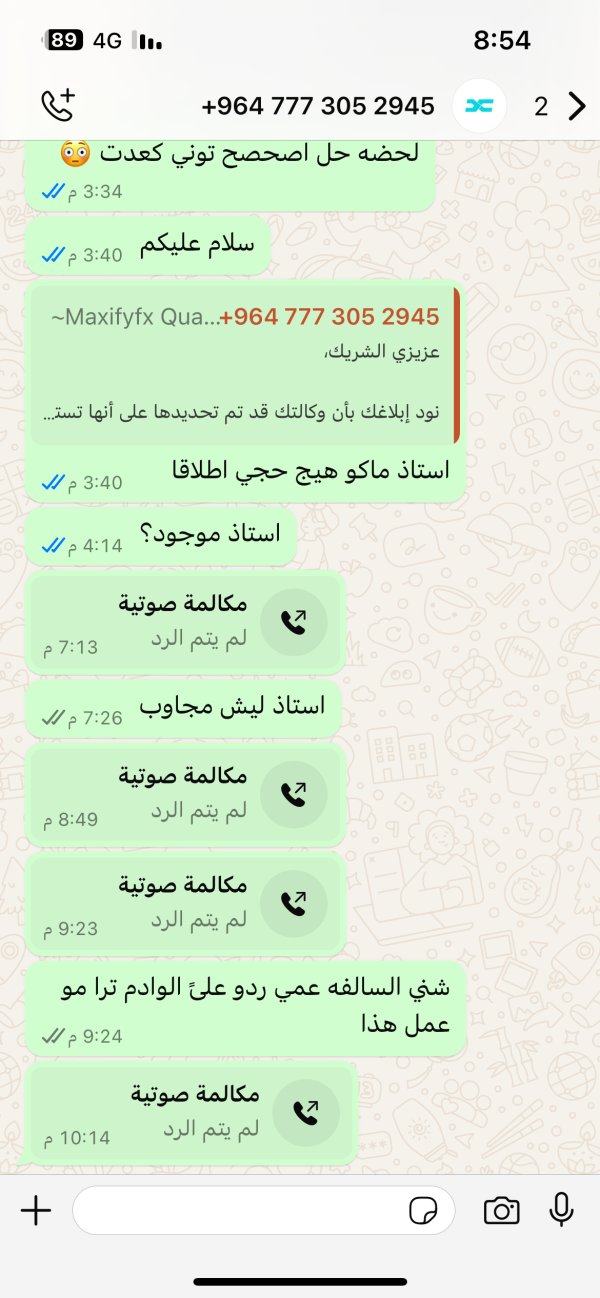

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

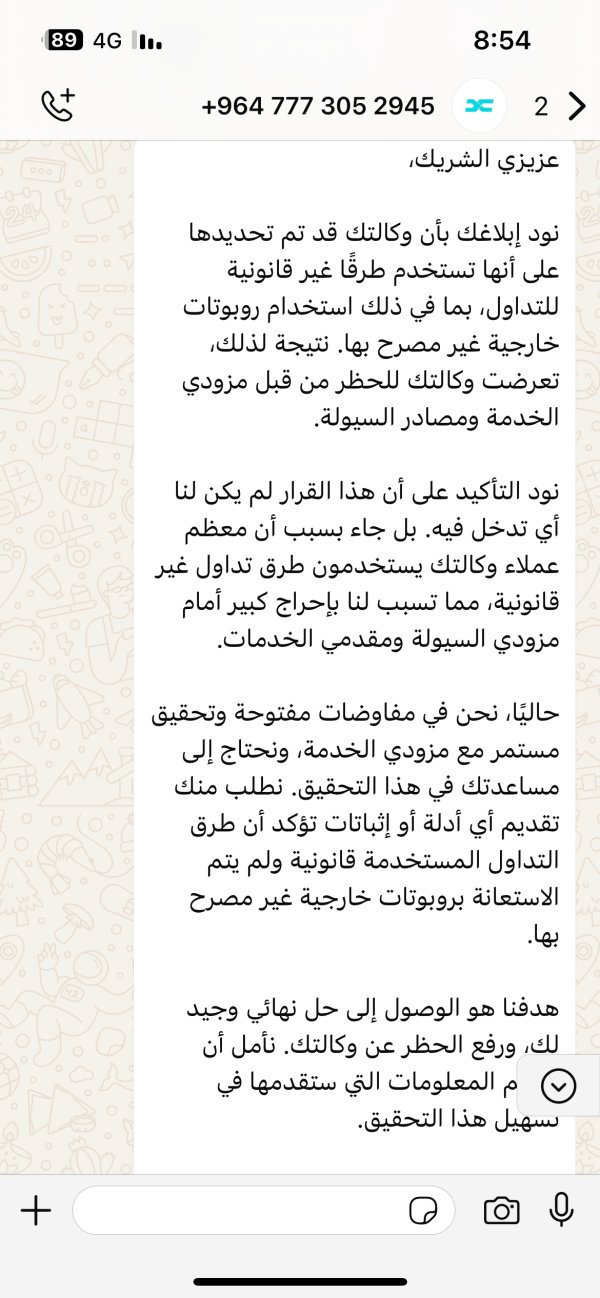

- This broker exceeds the business scope regulated by United Kingdom FCA(license number: 15922488)Common Business Registration Non-Forex License. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 4 for this broker in the past 3 months. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum Deposit | $15 |

| Minimum Spread | from 0.1 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum Deposit | $10000 |

| Minimum Spread | from 0.0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:100 |

| Minimum Deposit | $4500 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $8 |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed MaxiFy also viewed..

XM

MultiBank Group

AUS GLOBAL

Decode Global

MaxiFy · Company Summary

| Company Name | MaxiFy |

| Registered Country | United States |

| Founded Year | 2024 |

| Regulation | FCA(exceeded) |

| Tradable Assets | Currency pairs, stocks, commodities, indices and cryptocurrencies |

| Account Types | Zero Account, Standard Account, Business Account |

| Minimum Deposit | $15 minimum deposit |

| Maximum Leverage | Up to 1:500 |

| Spreads | Start from 0 pips |

| Trading Platforms | MetaTrader 5 |

| Customer Support | Email Support: SUPPORT@MAXIFYFX.COM |

| Deposit & Withdrawal | Credit/debit cards, bank wire transfer, e-wallets |

| Educational Resources | Trading Foundations, Free Mentorship, Video Tutorials, Helpful Articles |

Overview of MaxiFy

Founded in 2024, MaxiFy operates under the company name MaxiFy Ltd. Unlike many traditional brokers, MaxiFy focuses on both forex and CFD trading. The broker provides traders access to a wide range of markets, including major currency pairs, stocks, commodities, indices and cryptocurrencies. While MaxiFy does not offer physical delivery of currencies or commodities due to the CFD nature, it encourages traders to utilize CFDs which replicate the price movements of underlying assets.

Pros and Cons

| Pros | Cons |

|

|

|

|

| |

| |

|

Is MaxiFy legit?

MaxiFy is regulated by FCA with the license number of 15922488, while the current status is exceeded.

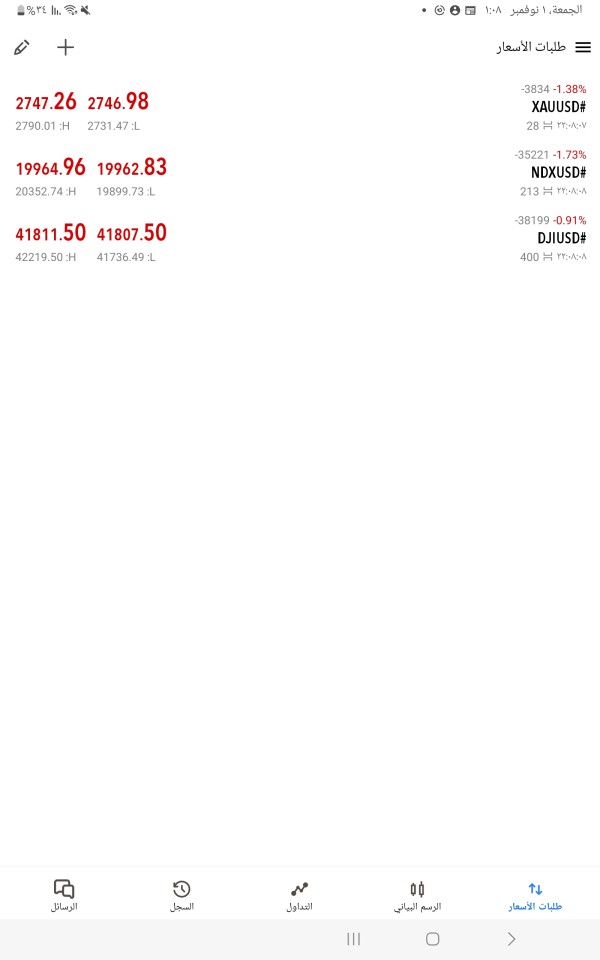

Market Instruments

MaxiFy provides trading services in major currency pairs, stocks of large multinational companies, commodities such as gold and oil, global indices including FTSE 100, DAX and Dow Jones, as well as popular cryptocurrencies. Over 50 tradable assets are currently listed.

Account Types

- Zero Account:This is a free account with no spread. Traders can start trading with 0 spread and the minimum deposit is $4500. Leverage is 1:100.

- Standard Account:Traders can start with a $15 minimum deposit. Leverage is 1:100 with no commission fees.

- Business Account (Coming Soon):This account requires a minimum $10,000 deposit. Leverage can go up to 1:200 and spread starts from 0.0.

MaxiFy also offers a Practice Account for learning and skills development. All accounts are ECN type, support automated trading, VPS, and MetaTrader 5 platform. cTrader platform will be supported soon. Accounts have full trading flexibility and freedom without swap commissions.

Leverage

MaxiFy provides leverage from 1:2 up to 1:500 depending on the type of asset and account held.

Spreads & Commissions

Spreads on major currency pairs start from 0 pips while stocks, indices and commodities may have wider spreads of 3-5 pips. There are no explicit commissions charged per trade. The broker earns from the spreads and swap rates applied to overnight positions.

Other Fees

- Crypto deposits are free of charge

- Crypto withdrawals carry nominal network processing fees

- Fiat withdrawal fees vary depending on country and currency

- Inactivity fees may apply for dormant accounts after 6 months

- Priority services like 24/7 phone support have additional associated rates

Trading Platform

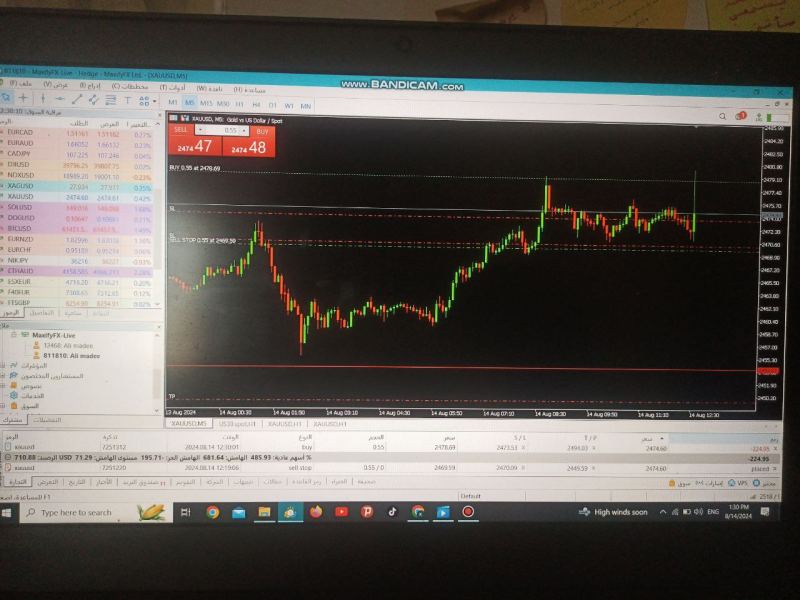

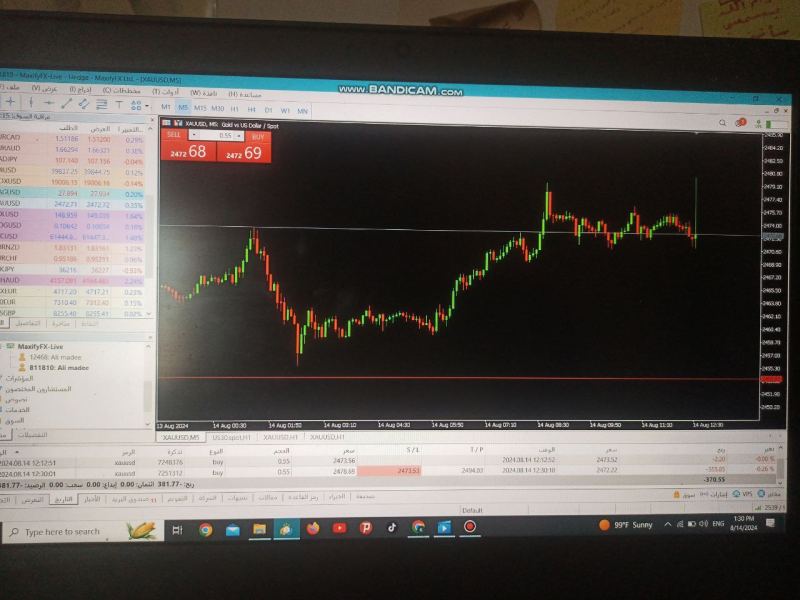

MetaTrader 5: MaxiFy offers an intuitive mobile app distinguished by the MetaTrader 5 platform for iOS and Android users to check real-time market prices and trade on the go. designed to meet your needs in the world of electronic trading with ease and effectiveness.

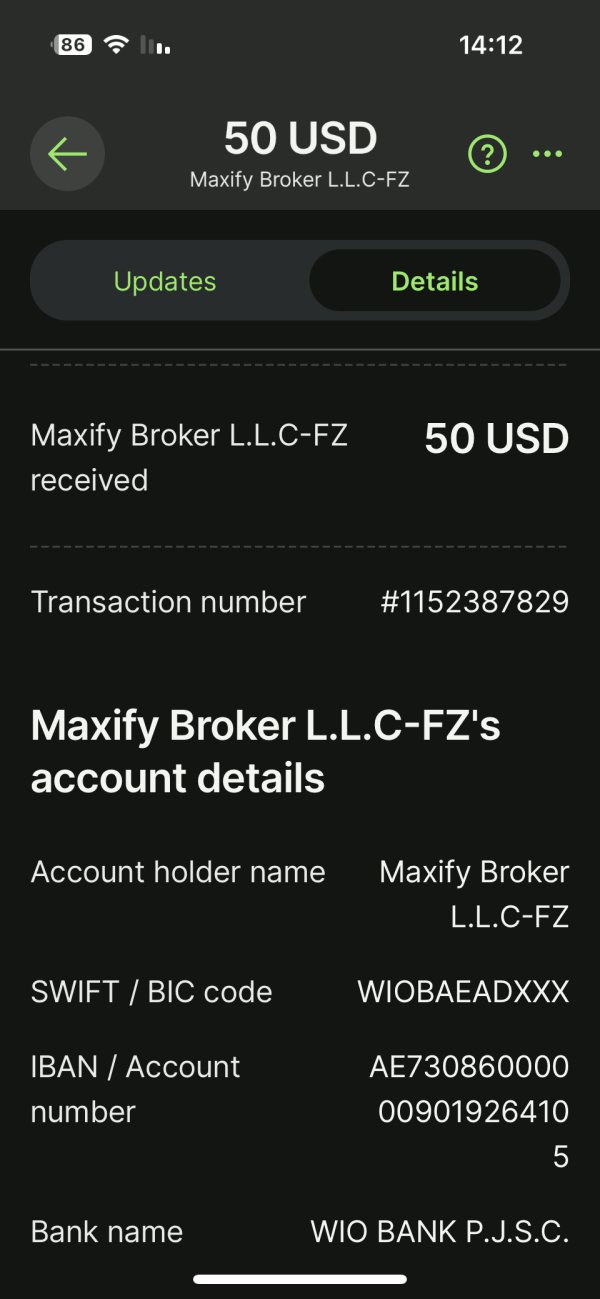

Deposit & Withdrawal

Various secure deposit and withdrawal options offered including credit/debit cards, bank wire transfer, e-wallets and cryptocurrencies such as Bitcoin. Deposits are instant while withdrawals are processed within 1-3 working days once approved.

Customer Support

- Email Support: SUPPORT@MAXIFYFX.COM

- Live Chat: Available on the MaxiFy website for instant assistance from support agents.

- Telephone Support: Telephone numbers are not listed currently but traders can expect live phone support.

- Help Center: FAQs, user guides and tutorials on the MaxiFy website help traders to find answers independently.

- Social Media: Platforms like LinkedIn, Twitter, Facebook allow traders to reach out to MaxiFy.

- Online Forums: Discord channel for community engagement with other traders and representatives.

- Knowledge Base: A centralized support database of common questions and solutions.

- Support Timings: Email support is available 24/5 from Monday to Friday during working hours.

Educational Resources

Trading Foundations: A series of beginner courses covering fundamental topics like contracts, technical analysis, and trading psychology.

- Free Mentorship: Group coaching sessions and access to experienced mentors for personalized guidance.

- Helpful Articles: Trading guides, technical analysis explanations and current market insights on their education portal.

- Video Tutorials: Recorded workshops and strategy threads on MaxiFy's YouTube channel.

- Online Events: Conduct webinars, seminars and live Q&A with industry experts on various topics.

- Learning Management System: Centralized e-learning platform with online courses, tests and certification programs.

- Community Forums: Discussion boards for traders to network, share ideas and get feedback.

- Social Media: LinkedIn, Facebook, Twitter for continuous educational updates.

- MaxiClass: Live virtual classroom featuring interactive sessions with performance coaches.

Conclusion

To summarize, MaxiFy is a broker that delivers a seamless trading experience. With its tight spreads, flexible leverage and all-inclusive trading tools, it is definitely worth considering especially for scalpers and day traders.

FAQs

What account options does MaxiFy provide?

MaxiFy offers Standard, Zero and Business Account types catering to different trading levels. Accounts vary in features such as maximum leverage, spreads, deposit amounts and bonuses offered.

What products can be traded on MaxiFy?

Traders can trade over 50 forex pairs, stocks, indices, commodities and cryptocurrencies via CFDs on MaxiFy's platforms. Some of the traded markets include major currency pairs, gold/oil, FTSE 100, Nasdaq 100 and Bitcoin.

What is MaxiFy's support system like?

Round-the-clock customer support is available via live chat, email and telephone in multiple languages. Queries are usually addressed very promptly.

Risk Warning

Online trading is inherently risky, with the potential to lose everything.

Review 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now