简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WTI Crude Oil Forecast: Oil Recovers After Initial Losses

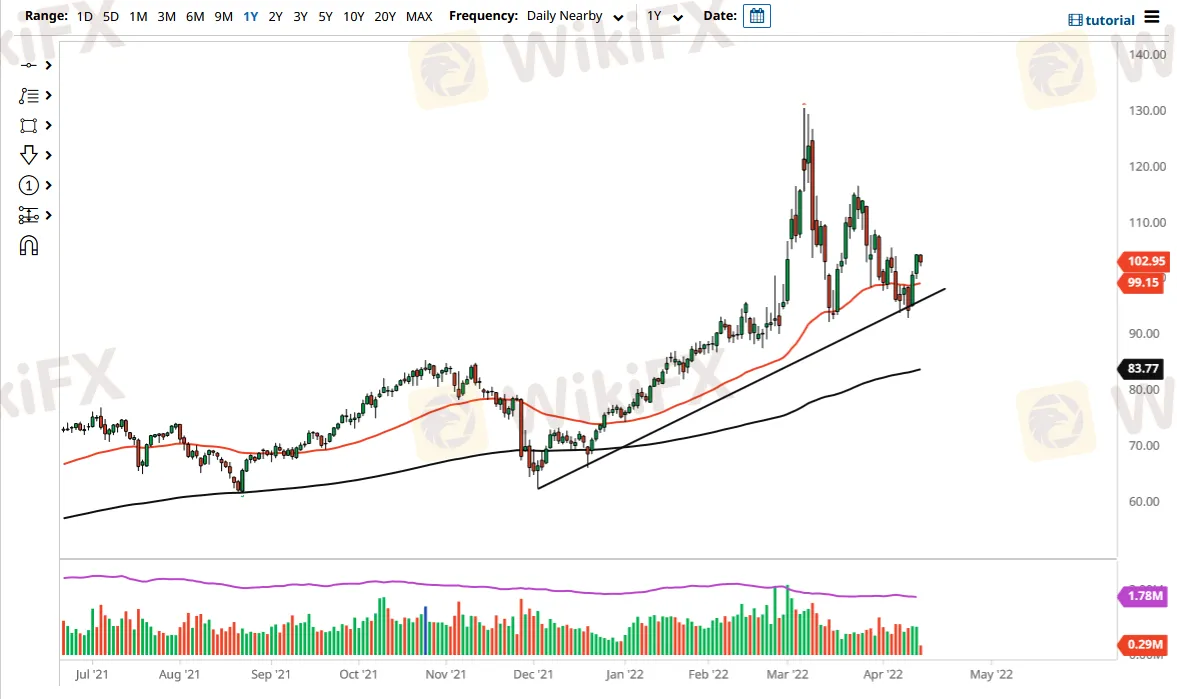

Abstract: The West Texas Intermediate Crude Oil market initially pulled back a bit during the trading session on Thursday, only to turn around and show signs of life again. By forming the candlestick that we have, it is likely that we could break above the $105 level, possibly even looking to get to the $110 level. With this, it would be a very positive turn of events considering just how negative the crude oil market has been.

The West Texas Intermediate Crude Oil market initially pulled back a bit during the trading session on Thursday, only to turn around and show signs of life again. By forming the candlestick that we have, it is likely that we could break above the $105 level, possibly even looking to get to the $110 level. With this, it would be a very positive turn of events considering just how negative the crude oil market has been.

The 50 Day EMA underneath is a significantly important indicator of the trend, and it sits at the $99.21 level. It is very likely that we will see an attempt to support the market in that general vicinity if we do get some type of pullback, but the uptrend line sitting underneath there is also worth paying attention to as well. With that being said, the market is going to continue to see plenty of value hunters until we break down below that level.

If we were to break down below the trend line, then it opens up a bigger move to the downside. As things stand currently, it looks like we are trying to recapture one of the most recent highs, which of course would be a strong turn of events. There is a lot of volatility out there when it comes to the oil market, due to the fact that inflation is hitting extreme highs, but at the same time, there are questions as to whether or not the demand is going to continue due to the fact that there is a high probability of recessions hitting various economies around the world.

To the upside, the $107.50 level could be a target, followed by the $110 level. As I said, I think that the $110 level will be the initial target, assuming that the buyers can continue to push this market higher. It should be said that the price action on Thursday was very encouraging for the buyers. The fact that we are not able to stick to the downside over the last couple of days is a very good sign for the market, at least for the time being. I anticipate that the volatility in this market is probably only going to get worse as we go further into the year, meaning that you should keep an eye on the OVX as well.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator