简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

JPY Forecast Q2 2022: Will Inflation Surpass the Bank of Japan’s Target?

Abstract:Global government bond yields continued their ascent in the first quarter.

JAPANESE YEN FIRST QUARTER RECAP

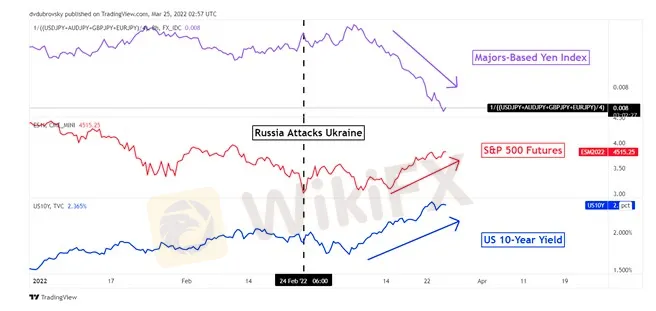

The anti-risk Japanese Yen put in a dismal performance during the first quarter of 2022, particularly as March wrapped up. A majors-based Japanese Yen Index that averages JPY against USD, AUD, GBP and EUR fell as the S&P 500 and 10-year Treasury yield climbed.

Stocks and bond yields rising in tandem can make it difficult for the Japanese currency to shine. Russias attack on Ukraine and a more hawkish Federal Reserve have been unable to break market sentiment in a lasting way, at least for now. Is more pain in store for JPY ahead?

HOW HAWKISH WILL THE FED BE?

At face value, it seems more of the same could remain in store for the Yen in the second quarter. One of the leading causes of JPY weakness likely stems from increasing monetary policy divergence between the Bank of Japan and its major counterparts. Aside from the Swiss National Bank, the BOJ remains one of the most dovish G10 central banks.

Global government bond yields continued their ascent in the first quarter. Looking at Treasury rates, the 2-year surged from 0.75% to above 2.15%. The 10-year started around 1.53% and closed in on 2.4% as March was wrapping up. A more hawkish Fed was a key culprit, with policymakers leaving the door open to hiking rates in 50bps increments to bring price growth to heel. The odds of such a move by May has jumped to a commanding 75% towards the end of March.

JAPANESE YEN FUNDAMENTAL DRIVERS

WILL JAPANESE CPI SURPASS 2% IN THE SECOND QUARTER?

Central banks have been responding to rising global inflation, which seems to be occurring almost everywhere except for Japan. In February, Japans headline CPI rate was 0.9% y/y compared to 7.9% y/y in the United States. In response, the BOJ has done virtually nothing to adjust monetary policy. The target policy balance rate has remained at -0.10%, alongside a 0% “yield curve control” (YCC) cap on the 10-year JGB bond yield. Will this change?

Japan is an importer of key commodities like crude petroleum and coal briquettes. Russia‘s attack on Ukraine has sent the prices of these key inputs soaring as the developed world looked increasingly to other sources. In fact, since Japan is a key energy importer, rising prices may have played a role in the Yen’s depreciation.

On the chart below, I have estimated where Japan‘s headline CPI (YoY) rate could go from here. This is based on a multiple linear regression model that measures the impact of crude oil and coal futures on the country’s inflation since 2015. Since CPI tends to lag prices, Ive delayed the latter by 8 months relative to CPI. This means we can use recent oil and coal prices to project inflation in the period ahead.

According to the model, Japans headline inflation rate may reach above 2% y/y in May. Is the central bank likely to adjust policy when that happens? Probably not. The BOJ may wait until there is evidence of persistently strong CPI data before changing tack. Moreover, the central bank has remained dormant when inflation briefly passed above its target before. Absent a market meltdown, the road ahead for the Yen is likely to remain difficult.

JAPANESE INFLATION PROJECTION

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

How Inflation Rates Affect Forex Prices Globally

In this article, we’ll explore how inflation affects forex prices globally, the relationship between inflation and currency value, and why traders monitor inflation closely.

PH Financial Sector Grows to P32.3T, Up 10.5% in June

The Philippine financial sector expanded by 10.5% in June, reaching P32.3 trillion. Bank resources surged, while positive earnings drove stock market gains.

US Inflation Cools, But Economic Pressures Still Remain

Inflation shows signs of cooling in the U.S., but persistent economic pressures, particularly housing and utilities, continue to challenge growth.

Philippine PSEI Flat Amid July Inflation and Rate Concerns

Philippine PSEI ends flat as July inflation surge and rate hike concerns weigh on investor sentiment. Broader All Shares Index gains slightly.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Currency Calculator