简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Monetary policy during the pandemic: the role of the PEPP

Abstract:Speech by Philip R. Lane, Member of the Executive Board of the ECB, at the International Macroeconomics Chair Banque de France – Paris School of Economics

Introduction

It is a pleasure to speak to you here today. While delivering this lecture in person rather than online is a reflection of the declining public health impact of the pandemic (the current high infection rate notwithstanding), the step-by-step transition to the new normal is currently being overshadowed by the Russian invasion of Ukraine. This war not only confronts us with the immediate implications of a war in Europe, but also constitutes a tectonic shock to the global geopolitical and economic order. Above all, the Governing Council of the ECB expresses its full support to the people of Ukraine. We will ensure smooth liquidity conditions and implement the sanctions decided by the European Union and European governments. We will take whatever action is needed to fulfil the ECBs mandate to pursue price stability and to safeguard financial stability.

Turning now to the main focus of this lecture, this is a milestone week: the end of March marks the conclusion of ECB net asset purchases under the pandemic emergency purchase programme (PEPP). This is a good moment to review the conduct of monetary policy during the pandemic, with a primary focus on the PEPP. In addition to this review, I will also discuss the current challenges for monetary policy.[1]

The monetary policy response to the pandemic

From the outset, the pandemic posed three challenges for the ECB: first, stabilising financial markets; second, protecting credit supply; and third, countering the adverse impact of the pandemic on the projected inflation path. Tackling the first pair of challenges was necessary to achieve the inflation target, since market instability or a credit crunch would have made it impossible to run an effective monetary policy.

In relation to the adverse impact on the projected inflation path, the June 2020 Eurosystem staff projections marked down the end-of-horizon annual inflation rate for 2022 from 1.6 per cent to 1.3 percent, while the end-of-horizon inflation rate was modelled to decline even further to 0.9 per cent in a severe pandemic scenario. These large-scale inflation downgrades reflected the projected increase in economic slack due to the substantial declines in GDP that were feared.

From a stance perspective, an insufficient monetary policy response would have implied a longer period of low inflation, putting at risk the timely convergence of inflation to the target rate (now defined as two per cent). Excessively-low inflation would have implied higher real interest rates, thereby weakening the recovery of investment and consumption. Moreover, especially in the context of the effective lower bound on policy rates, a protracted period of low inflation might have fostered a downward drift in inflation expectations that could ultimately become entrenched, making it even more difficult for us to deliver our inflation aim. This concern was subsequently codified in the 2021 monetary policy strategy statement that concluded that the delivery of the symmetric two per cent inflation target requires – when the economy is in the proximity of the lower bound – especially forceful or persistent monetary policy measures to avoid negative deviations from the inflation target becoming entrenched.

Monetary policy was already accommodative before the pandemic shock. The prospect of persistent below-target inflation had resulted in a further easing of the monetary stance in September 2019: the deposit facility rate had been lowered to minus 0.5 per cent and net asset purchases were resumed at a rate of €20 billion per month under the ECBs baseline asset purchase programme (APP). These measures were reinforced by forward guidance that tied future monetary policy decisions to the inflation outlook and developments in underlying inflation dynamics. In addition, credit supply was supported by the third series of targeted longer-term refinancing operations (the TLTRO III programme).

In its initial response to the pandemic crisis in spring 2020, the ECB adopted a comprehensive package of complementary measures. The central elements included: the escalation of asset purchases through the 12 March 2020 decision to add an extra € 120 billion to the already-running APP and the 18 March 2020 launch of the pandemic emergency purchase programme (PEPP), a revision in the structure and pricing of the TLTRO programme, an easing of the collateral framework, and a set of supportive supervisory measures (taken by the supervisory wing of the ECB).

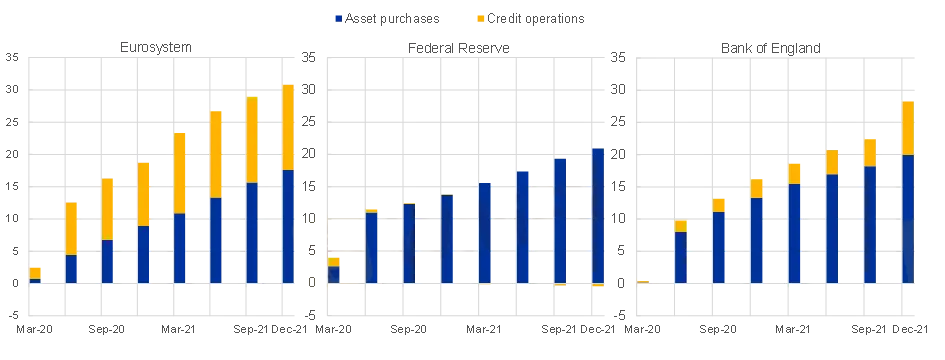

In combination with the forceful fiscal responses at national and EU level – also complemented by the responses of macroprudential and supervisory authorities – these measures have been successful in stabilising financial markets and protecting credit supply. In addition to its market stabilisation role, the additional quantitative easing provided by the PEPP and the extra injection of liquidity through the expansion of the TLTRO programme also eased the overall monetary stance, helping to counter the negative impact of the pandemic on the projected inflation path. The combination of asset purchases and the targeted lending programme led to a substantial expansion of the balance sheet of the Eurosystem, which was of comparable size to the balance sheet increases of the Federal Reserve and the Bank of England (Chart 1).

Chart 1

Change in balance sheets of the Eurosystem, the Federal Reserve and the Bank of England since 2019

(cumulative changes relative to January 2020 in terms of percentages of GDP in Q4 2019)

Sources: ECB, Federal Reserve Bank of New York, Bank of England, Haver Analytics and ECB calculations.

Notes: For the Eurosystem asset purchases include all PEPP and APP purchases. Credit operations include all TLTROs, PELTROs, MROs, and LTROs. For the Federal Reserve asset purchases include all Treasury bills, notes, and bonds as well as inflation-protected Treasuries and floating-rate Treasuries. These also include agency bonds and mortgage-backed securities. Credit operations include all repurchase agreements, loans, and operations under the Commercial Paper Funding Facility II, the Corporate Credit Facility, the Municipal Liquidity Facility, the Main Street Lending Programme, and TALF II. For the Bank of England asset purchases include all Gilts and corporate assets held within the Asset Purchase Facility. Credit operations include all operations within the ILTR, CTRF, TFS and TFSME. The latest observations are for December 2021.

The pandemic measures should be viewed as acting to reinforce the impact of the already-low levels of the key policy rates. Moreover, the ECBs forward guidance about the future setting of its policy measures played a central role in determining the overall monetary stance. In relation to the key policy rates, since September 2019 the forward guidance linked future rate setting to the inflation outlook.[2]

The Governing Council framed its forward guidance on the path of policy rates in terms of a commitment to attaining the inflation target by clarifying that policy rates would be lifted only if the evidence was sufficiently robust to foster a high degree of confidence that the inflation rate would reach two per cent on a durable basis.[3] Such state-contingent forward guidance represents a strong commitment to keep financing conditions at sufficiently accommodative levels for as long as necessary to stabilise inflation at the medium-term inflation target in a sustainable fashion.

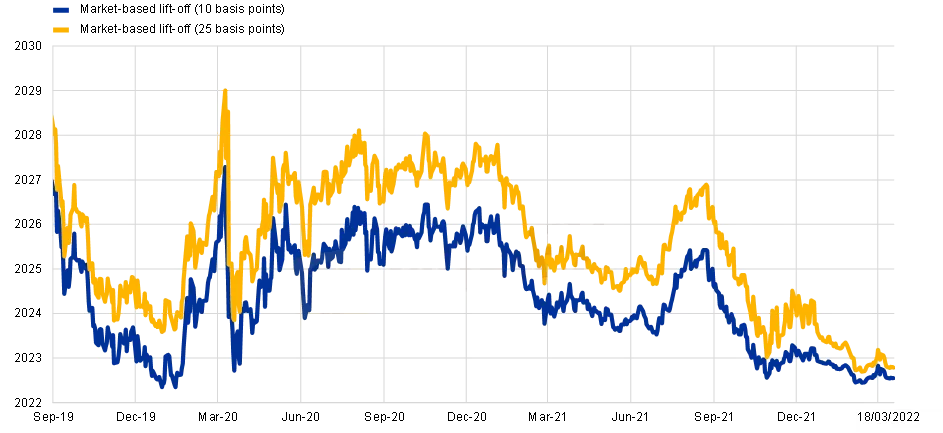

In line with the state-contingent forward guidance, market-based expectations of future policy rates adjusted in response to changes to the inflation outlook. Chart 2 shows the evolution of the expected timing of the first increase in our key policy rates since the introduction of the state-contingent forward guidance on the path of interest rates. In the initial weeks of the pandemic, the lift off date was pushed from 2022 to 2027, before stabilising around 2025/2026 for most of 2020. Over time, the market view of the lift-off date has been pulled forward, in response to the changing outlook for inflation. While time-varying risk premia (possibly also reflecting some uncertainty about the central bank reaction function) means that the scale of movement in the lift off date might not always conform to the most likely path for future policy rates, the directional pattern of adjustments broadly reinforced the monetary policy stance during much of this period.

Chart 2

Market-based lift-off dates

(date of lift-off; date of observation)

Sources: Bloomberg, Refinitiv and ECB calculations.

Notes: The market-based lift-off date is the date during which the €STR forward rate exceeds the current €STR rate by at least 10 basis points or 25 basis points. The latest observations are for 18 March 2022.

As I described in earlier contributions, the PEPP was designed with a dual role.[4] First, alongside the ECBs other monetary policy instruments, asset purchases were the most important mechanism for delivering the additional monetary accommodation required to support the economic recovery and safeguard price stability in the medium term. Second, the flexibility embedded in the PEPP – across time, asset classes and jurisdictions – was essential in enabling the ECB to stabilise financial markets in an efficient and effective manner.

The forward guidance for PEPP was connected to the pandemic: net PEPP purchases would continue until the Governing Council judged that the coronavirus crisis phase was over. In December 2020, the initial calendar guidance that the pandemic crisis phase would last until at least June 2021 was extended to March 2022. The March 2022 end date was confirmed in December 2021, while the calendar guidance on the reinvestment horizon was revised until at least the end of 2024. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

The calibration of the PEPP had to take into account the substantial step up in net issuance of both public and private securities entailed by the pandemic (Chart 3). In the absence of sufficient asset purchasing by the ECB, this extraordinary increase in issuance could have put significant upward pressure on funding costs, putting firms and households under extra financial pressure and running the risk of an adverse real-financial doom loop by which tighter financing conditions and declining activity levels reinforce each other.

Taken together, the APP and PEPP portfolios now amount to €5 trillion. Chart 4 shows the evolution of these holdings for the four largest member countries, expressed in ten-year equivalents. On this maturity-adjusted basis and expressed as a ratio to the total universe of bonds outstanding, the Eurosystems holdings increased from 19 percent to 30 per cent over the period 2020-2021. Chart 5 shows the monthly purchases flows during the pandemic.

While the ex ante flexibility to deviate from the capital key was an essential feature of the PEPP, the ex post deviations from the capital key were relatively limited and also self-corrected over time (Chart 6). In particular, capital key deviations peaked in the early weeks of the PEPP, while subsequent purchasing was generally aligned with the capital key, in view of the rapid stabilisation of spreads in the wake of the PEPP announcement.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bursa Malaysia Dips as Investors Brace for 2025 Uncertainty

Bursa Malaysia saw a slight dip on the final trading day of the year as profit-taking and cautious sentiment dominated. The FBM KLCI declined 3.4 points to 1,634.28, with muted turnover of RM822.07 million due to year-end festivities. Blue-chip stocks, including Tenaga Nasional and Telekom Malaysia, experienced declines, while regional markets remained subdued amid global uncertainties. As 2024 approaches, investors remain cautious, balancing risks with potential opportunities.

Currency Fluctuations: What It Means When a Country's Currency Rises or Falls

When a country’s currency appreciates or depreciates in value, it reflects the underlying shifts in its economy and global market dynamics. For forex traders, understanding what drives these fluctuations—and how to strategically prepare for them—can make the difference between profit and loss in an ever-volatile market.

Yuan Volatility Surges as US Election Approaches

As US elections near, yuan volatility surges. Traders brace for tariff risks and market swings, preparing for potential economic shifts under Trump or Harris policies.

UAE Approves AED Stablecoin for Digital Transactions

UAE grants approval for AED Stablecoin AE Coin, a regulated Dirham-pegged cryptocurrency, transforming blockchain payments for businesses and individuals in the UAE.

WikiFX Broker

Latest News

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Currency Calculator