简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading Support and Resistance

Abstract:Get our trading strategies with our monthly & weekly forecast of currency pairs worth watching using support & resistance for the week of February 21, 2022.

This week I will begin with my monthly and weekly forecasts of the currency pairs worth watching. The first part of my forecast is based upon my research of the past 20 years of Forex prices, which show that the following methodologies have all produced profitable results:

Trading the two currencies that are trending the most strongly over the past 6 months.

Trading against very strong weekly counter-trend movements by currency pairs made during the previous week.

Carry Trade: Buying currencies with high interest rates and selling currencies with low interest rates.

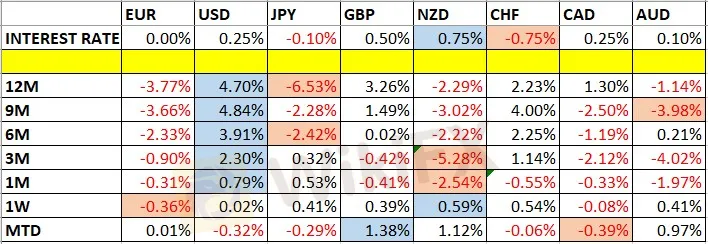

Let us look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Monthly Forecast February 2022

For the month of February, I forecasted that the EUR/USD currency pair will fall in value. The performance to date of this forecast is as follows:

| Currency Pair | Forecast Direction | Interest Rate Differential | Performance to Date |

| EUR/USD | Short ↓ | +0.25% (0.25% - 0.00%) | -0.76% |

Weekly Forecast 20th February 2022

In my previous forecast last week, I made no weekly forecast. I again make no forecast this week.

The Forex market saw its level of directional volatility fall last week, with only 3% of all the important currency pairs or crosses moving by more than 1% in value. Directional volatility is likely to increase or remain the same over this coming week, especially if military conflict between Russia and Ukraine begins.

Last week was dominated by relative strength in the New Zealand Dollar, and relative weakness in the Euro, but the numbers were so small as to be negligible.

You can trade our forecasts in a real or demo Forex brokerage account.

Key Support/Resistance Levels for Popular Pairs

I teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that can be watched on the more popular currency pairs this week.

| Currency Pair | Key Support / Resistance Levels |

| AUD/USD | Support: 0.7157, 0.7082, 0.7006, 0.6963Resistance: 0.7191, 0.7293, 0.7321, 0.7344 |

| EUR/USD | Support: 1.1279, 1.1195, 1.1183, 1.1089Resistance: 1.1418, 1.1671, 1.1688, 1.1711 |

| GBP/USD | Support: 1.3458, 1.3401, 1.3375, 1.3340Resistance: 1.3664, 1.3769, 1.3852, 1.3898 |

| USD/JPY | Support: 114.80, 114.55, 114.23, 113.07Resistance: 115.34, 115.56, 115.71, 115.95 |

| AUD/JPY | Support: 82.41, 81.89, 80.79, 80.40Resistance: 84.35, 84.83, 84.96, 85.20 |

| EUR/JPY | Support: 130.00, 129.31, 128.30, 127.44Resistance: 131.16, 131.51, 131.91, 132.35 |

| USD/CAD | Support: 1.2645, 1.2535, 1.2498, 1.2372Resistance: 1.2812, 1.2901, 1.2959, 1.3025 |

| USD/CHF | Support: 0.9159, 0.9072, 0.9000, 0.8969Resistance: 0.9213, 0.9228, 0.9291, 0.9370 |

That is all for this week. You can trade my forecasts in a real or demo Forex brokerage account to test the strategies and strengthen your self-confidence before investing real funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

RM5.9M Lost to "Davidson Kempner Capital Management" Facebook Scam

A private contractor in Malaysia faced a devastating loss of over RM5.9 million after falling victim to a fraudulent investment scheme promoted on Facebook. Tempted by the scheme’s impressive claims and credentials, the victim began investing in September 2024. The investment process required him to download an application called A-Trade, which was readily available on the Apple Store.

Is There Still Opportunity as Gold Reaches 4-Week High?

Gold Continues to Rise, can the Bulls Keep Going? Recently, gold prices have been on the rise, especially following the release of the non-farm payrolls data, as demand for gold as a safe-haven asset continues to increase.

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

The latest Federal Reserve meeting minutes show that Fed officials are generally concerned about the upward risks to inflation, suggesting that future rate cuts may slow down.

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

Following the successful auction of 30-year government bonds by the UK, the yield on 30-year bonds surged, reaching its highest level in 25 years. This increase reflects growing concerns in the market over the government's fiscal policies and large-scale debt issuance.

WikiFX Broker

Latest News

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Currency Calculator