简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Single Candlestick Patterns

Abstract:let's move on to individual candlestick patterns. If these candles are displayed on the chart, they may indicate a potential market reversal. The four basic single Japanese candlestick patterns are:

Now that you've learned to recognize common candlestick shapes such as tops, malbozas, and doji, let's move on to individual candlestick patterns. If these candles are displayed on the chart, they may indicate a potential market reversal. The four basic single Japanese candlestick patterns are:

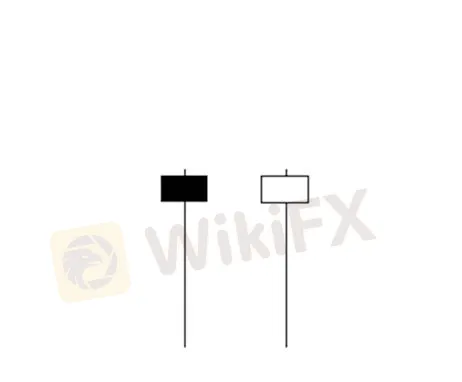

Hammer and Hanging Man

Hammers and hanging men look exactly the same, but their meanings are quite different depending on past price trends. Both have cute little bodies (black or white), long bottom shadows, short or missing top shadows.

The hammer is a bullish trend pattern that develops during a downturn. It was termed as a result of the market's sluggishness.

When the price falls, the hammer is towards the bottom, indicating that the price will rise again.

The extended shadow below indicates that the seller has driven the price down, but the buyer has withstood this deflationary pressure and closed close to the open.

Just because a hammer forms in a downturn does not imply that you should immediately put a purchase order! More bearish confirmation is required before pulling the trigger.

Waiting for a white candlestick to close above the open to the right side of the Hammer is a common illustration of confirmation.

Recognition Criteria for a Hammer

• Long shadows are approximately 2-3 times the size of the thing.

• There are few or no top shadows.

• The entity has reached the transaction range's top limit.

• It is unimportant what colour the entity is.

The hanging man is a bearish inversion pattern that can also signify the resistance level's upper limit or strength.

When the price went up, the development of a Hanging Man implies that sellers are outnumbering buyers.

The extended lower shadow indicates that sellers drove down prices during the session.

Buyers were enabled to raise the price slightly, and yet only nearer the open.

This should raise red flags since it indicates that there are no more buyers to provide the directly correspond to keep rising the price.

Recognition Criteria for a Hanging Man

• A large lower shadow that is two or three times the length of the genuine body; and • little or no upper shadow.

• The real body is trading at the top of the trading session.

•Although the colour of the body is unimportant, a black body is more bearish than a white body.

Inverted Hammer and Shooting Star

Inverted Hammer and Shooting Star both have the same appearance. The only distinction is if you're in an upswing or decline.

A bullish reversal candlestick is an inverted hammer.

A bearish reversal candlestick is called a Shooting Star.

Both candlesticks have small, hollow bodies, extended top shadows, and small or no below shadows.

Inverted Hammer

When the rate has been declining, the Inverted Hammer appears, indicating the chance of a turnaround. Its extended top shadow indicates that bidders attempted to raise the price.

However, when vendors noticed what the purchasers were doing, they exclaimed, “Oh no!” and attempted to lower the price.

Fortunately, the purchasers had consumed enough Wheaties for breakfast and were able to keep the session close to the open.

Because the sellers were unable to drop the price any further, it's safe to assume that everyone who decided to sell has already done so.

Who will be left and if there are no sellers? Buyers.

Shooting Star

The Shooting Star is a bullish reversal pattern that resembles the inverted hammer but happens when the price is rising rather than falling.

Its shape suggests that the price started at the bottom, rebounded, and then fell down to the lower.

This indicates that buyers intended to raise the price, but sellers intervened and defeated them. This is a bearish indicator since there are no more buyers because they've all been overpowered.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator