简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

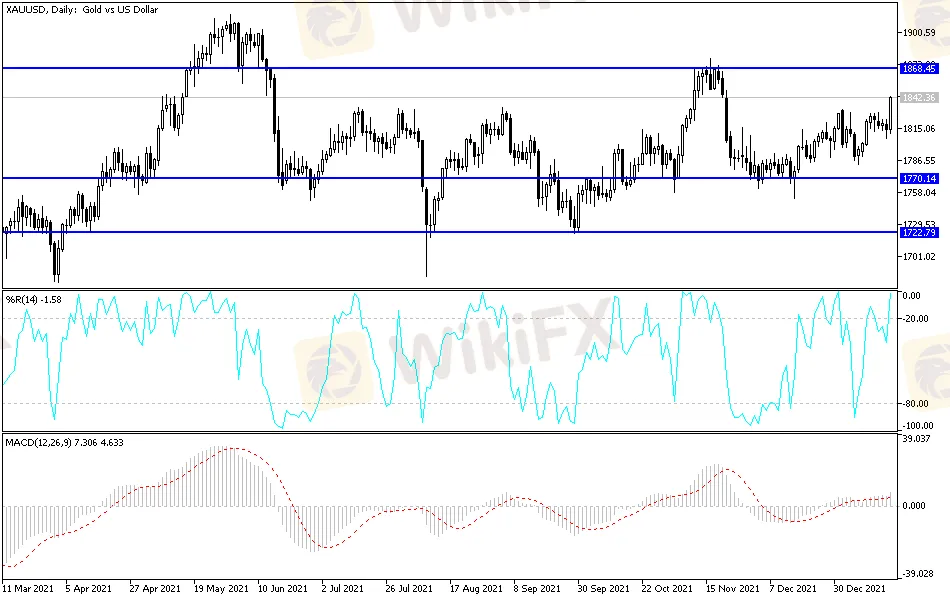

Gold Technical Analysis: Enduring a Bear Market in 2022

Abstract:Amidst the best daily performance of the gold price in more than two months, the price of an ounce of gold moved yesterday, starting from the level of $ 1810, towards the resistance level of $ 1844 per ounce. This is the highest for the yellow metal in two months. Strong gains came, supported by the weakness of the US dollar and the decline in Treasury bond yields. Gold prices enjoyed a good start until 2022, although many market experts indicate that the yellow metal will endure a bear market this year amid the normalization of monetary policy.

Amidst the best daily performance of the gold price in more than two months, the price of an ounce of gold moved yesterday, starting from the level of $ 1810, towards the resistance level of $ 1844 per ounce. This is the highest for the yellow metal in two months. Strong gains came, supported by the weakness of the US dollar and the decline in Treasury bond yields. Gold prices enjoyed a good start until 2022, although many market experts indicate that the yellow metal will endure a bear market this year amid the normalization of monetary policy.

The price of the yellow metal is up more than 2% this week, taking its year-to-date gains to 0.6%.

As for the price of silver, the sister commodity to gold, it is also rising and gained 3.14%, to $24.23 an ounce. The white metal strengthened in the first trading weeks of the year, jumping nearly 4% since the beginning of 2022 to date. Precious metals are trying to challenge the market consensus and launch a bullish wave because it will launch in four sessions. Indeed, the stagnation in the US currency and bonds has supported gold.

However, the US Dollar Index (DXY) fell to 95.53, from an opening at 95.77. So far this year, the index is down 0.45%. A weaker price is bullish for dollar-denominated commodities because it makes them cheaper for foreign investors to buy. Another factor affecting the gold market was the US Treasury market, with the benchmark 10-year yield dropping 0.043% to 1.825%. One-year bond yields fell to 0.539%, while 30-year yields fell to 2.143%. Lower returns are generally beneficial for gold because it reduces the opportunity cost of holding non-return bullion.

Meanwhile, all eyes will turn to next week's Federal Open Market Committee (FOMC) meeting, where the Federal Reserve can provide more guidance on how officials move on interest rates and the balance sheet.

In other metals markets, copper futures rose to $4.467 a pound. Platinum futures jumped to $1028.90 an ounce. Palladium futures rose to 2007 dollars an ounce.

According to the technical analysis of gold: Returning to what we mentioned in the technical analyzes of the future of the gold market, the price is moving towards what we expected exactly. We mentioned with the stability of the gold price above the psychological resistance of 1800 dollars an ounce, the bulls may move amid technical buying deals towards the next ascending levels of 1818, 1827 and 1845 dollars. Attention is now heading to the next psychological top of 1900 dollars per ounce, and this will depend on breaking the levels of 1862 and 1880 dollars, respectively.

On the downside, the general trend of gold will not turn to the downside without moving towards the support level of $1,775 an ounce. The gold price will be affected today by the level of the US dollar and the extent to which investors take risks or not, as well as the reaction from the announcement of US data, the number of weekly jobless claims and the reading of the Philadelphia Industrial Index.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator