简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Stock Market is Apolitical

Abstract:A casual observer might assume that who wins or loses the presidency would have a profound effect on both the economy and the stock market, but thats not the case.

The Stock Market is Apolitical

A casual observer might assume that who wins or loses the presidency would have a profound effect on both the economy and the stock market, but thats not the case. History has shown presidents are the unwitting beneficiaries of economic good times (such as Bill Clinton in the 1990s) or unfortunate scapegoats during severe downturns (such as Herbert Hoover at the start of the Great Depression).

Clinton didnt singlehandedly create prosperity any more than Hoover was responsible for calamity, but the public tends to attach the ups and downs of the economy (and the markets) to the occupant of the White House at the time.

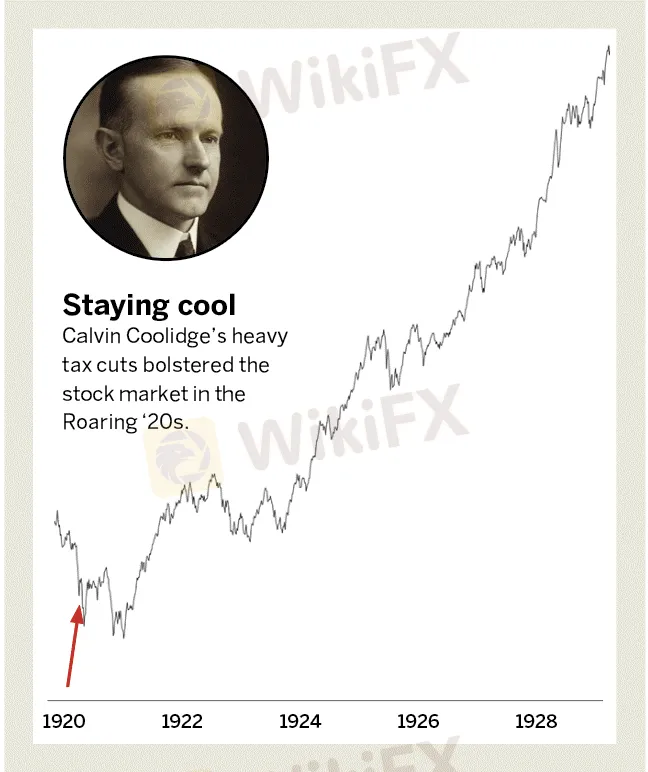

Sometimes, however, an election marks an inflection point in the nation‘s mood and, thus, its economic activity. In the accompanying charts, a red arrow indicates approximately when a particular presidential election was held. All of the charts contain the germane portion of the Dow Jones Industrial Average from just before the election to the next important pivot point in the market, encapsulating the broad reaction of the nation’s economy to its new leadership.

A History of Apathy

In the 1920s, the Warren Harding administration—a notoriously corrupt period of D.C. history—was cut short by Harding‘s death. His Vice President, the taciturn Calvin Coolidge, served the remainder of Harding’s term and won the election in his own right in 1924.

Coolidge and Harding both embraced a “hands-off” approach to business, and Coolidge‘s aggressive reductions in taxes were part of the reason the 1920s were such a bonanza for the stock market. Coolidge’s best-known quote is “The business of America is business,” and he enjoyed tremendous popularity throughout the 1920s because of the nation‘s prosperity. But Coolidge’s successor, Herbert Hoover, would find himself in much different circumstances because the Great Depression plunged the nation into darkness during his first year in office.

Nothing to fear

The Great Depression, which gripped the nation in a stranglehold in late 1929, ground away through 1930, 1931 and 1932. Although no one could have known it at the time, the market finally hit its ultimate low on July 8, 1932, at the nearly inconceivable price of 40.60. (The Dow 30 was about 750 times higher than that in February of 2020.)

In the midst of a worldwide depression, Franklin Roosevelt campaigned successfully against the incumbent Herbert Hoover. FDR won in a landslide with 472 Electoral College votes against Hoovers mere 59. It was a stunningly lopsided election and a humiliating coda for the Hoover administration.

But FDR‘s victory didn’t cause the market to roar higher right away. Back then, the president did not take office until five months after the election. The market continued to fall after the votes were counted. When FDR was sworn in he immediately took dramatic actions, such as declaring a bank holiday and outlawing the possession of gold.

The stock market would enjoy a gain of about 300% from March 1933 until June 1937, when a “second wave” hit the economy and the market. The stock market would not push above 1937 levels for almost a decade, but the period from 1933 to 1937 demonstrated that the market responded positively to the radical reforms FDR executed—to say nothing of the tremendous expansion of the nations money supply, which inflated asset prices.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiFX Review: Is PU Prime a decent broker?

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

Currency Calculator