简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Global Prime Review - Forex Trading Ratings 2021

Abstract:Global Prime is an Australian based ECN broker offering leveraged forex and CFD trading. See our review for minimum deposits, fees, regulations and more.

Global Prime is an Australian owned ECN broker, offering trading in forex, CFDs and commodities. The company specialises in low latency connectivity to tier-1 bank liquidity. Our review explores spreads, commission, leverage, opening a live account and more. Make an informed trading decision today.

Global Prime Summary

Global Prime was founded in 2010 and is based in Australia. The brokerage appeals to retail and institutional traders who are offered MT4, TraderEvolution and FIX API in forex, CFD and commodity markets. The company offers straight through processing and promises the best execution as their ECN allows for direct access to 26 liquidity providers.

The Global Prime Group is comprised of a network across Australia (Global Prime PTY Ltd), Vanuatu (Gleneagle Securities PTY Limited), and Seychelles (Global Prime FX Ltd). They are each regulated by the ASIC, VFSC and FSA.

The companys leadership team have a combined experience of 80+ years within financial trading and related markets. Their investing services are used by over 10,000 traders globally and are available in over 194 countries, including the UK, though traders from United States are prohibited from opening an account.

Trading Platforms

Global Prime offers MetaTrader 4, TraderEvolution and FIX API platforms.

MetaTrader 4

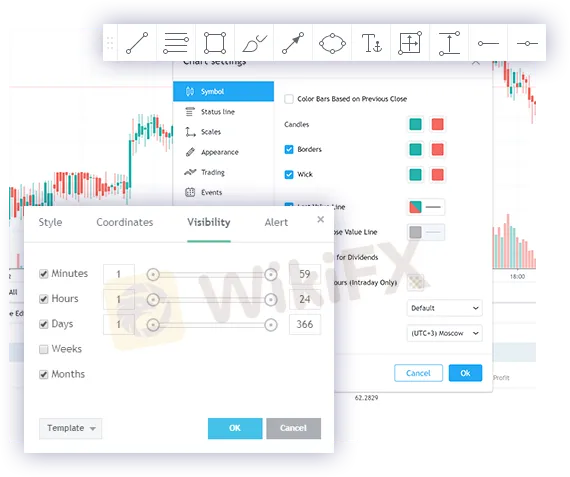

Clients can trade with the popular MT4 platform, best-known for trading on the forex market. MT4 offers advanced charting functionality, 30 built-in indicators, one-click trading, automated investing through APIs, among other features.

The MT4 platform is suitable for clients looking to enjoy institutional style trading or scalping strategies. The platform is also suited to both new and more advanced traders.

MetaTrader 4 is available on Windows, Mac, Web, iOS and Android.

TraderEvolution

The TraderEvolution platform caters to professional traders who seek more advanced functionality for order entry, analysis and algorithmic trading. It comes with 14 fully customisable chart types, multiple time frames, ability to view market depth and one-click trading.

It is equipped with the same pricing and execution as the MT4 platform but offers greater transparency over liquidity, level 2 pricing, DoM trading and volume analysis.

TraderEvolution is available on Windows, iOS and Android.

FIX API

The FIX API solution is also designed for professional traders who are looking to deploy proprietary algorithmic trading solutions with the lowest possible latency. The platform is best suited to experienced traders who want the flexibility to use any programming language.

Whats particularly useful is the ability to connect directly with trading servers in real time, as opposed to going through third-party programs such as MT4. For easy account management and access, trades are drop copied to either an MT4 or TraderEvolution account.

The solution requires a minimum deposit of USD $10,000 and comes with a USD $2,000 monthly commission. With that said, fees may be negotiable with Global Prime customer support services.

Global Prime Assets

Clients can trade in forex, CFD and commodities markets:

Forex – 48 major, minor and exotic currency pairs i.e. GBPUSD and EURUSD

Cryptocurrencies – 5 cryptocurrencies i.e. BCHUSD, ETHUSD and LTCUSD

Commodities – 18 commodities including gold, silver and platinum

Indices – 13 indices such as Nasdaq 100, Nikkei 225 and FTSE 100

Spreads & Commission

Spreads at Global Prime are variable starting from 0.0 pips. Typical spreads on leading pairs EUR/USD are 0.1 and 0.6 on GBPUSD. Typical spreads on FTSE100 are 0.84 and 1 on the Nasdaq 100.

Global Prime only charges commissions on forex and metal trades with the ECN account. Commission charges per standard lot are as follows: 7 AUD, 7 USD, 6.2 EUR, 5.4 GBP, 9.5 SGD, 9 CAD.

The company also offers competitive overnight swap rates, which are taken directly from the interbank market.

Leverage

Global Prime leverage ranges from 1:100 to 1:200. The company asserts that these are the maximum rates traders can utilise without it being detrimental to their profitability or success. 1:100 standard leverage has a 1% margin requirement and 1:200 leverage has a 0.5% margin requirement.

Global Prime does not offer negative balance protection. However, other protections mitigate the possibility of a negative balance, including a 120% margin call level. More details can be found on the brokerages website. Should your account head into negative balance, the user simply has to deposit the amount required to bring the balance back to zero.

Mobile Apps

The company does not currently offer its own mobile app. However MT4 offers iOS and Android versions of its platform. This is free to download from the App Store and Google Play. The MT4 Android and iOS apps have most of the functionality of the web version, with some limitations in charting and viewing options. Overall though, customer reviews and rankings of the mobile solution are excellent.

Payment Methods

Deposit and withdrawal funding requests are actionable through Global Primes client portal. The brokerage offers a wide range of deposit methods. Deposit requirements range from AUD $1 to AUD $200. While all are fee-free, processing times do vary:

Credit/debit cards (Mastercard & Visa) – Instant

POLi – Instant

Skrill – Instant

Neteller – Instant

Zotapay – Instant

FasaPay – Instant

Accentpay – Instant

Dragonpay – Instant

Thai QR payment – Instant

Pagsmile – Within 24 hours (during business days)

PayRetailers – WIthin 24 – 48 hours (during business days)

BPAY – Approximately 24 – 48 hours

Bank wire – 1-2 business days (Australia), 3-5 business says (Intl.)

Note that users are able to deposit funds in 6 base currencies: USD, AUD, GBP, EUR, CAD & SGD.

Withdrawals are available through Mastercard & Visa, bank wire and Neteller. With card payments, processing times range from 1-10 days. Bank wire takes 1-2 business days (AU) and 3-5 business days (Int.). Neteller withdrawals are instant once actioned. Global Prime does not charge any finance or withdrawal fees, but will pass on any bank charges to the client.

Demo Account

Global Prime offers a free demo account across its MT4 and TraderEvolution platforms. Traders can master platform functionalities and practice strategies in a risk-free setting. Once the trader is ready, clients are free to open a live account with real capital. Head to the brokers website to open a demo trading account.

Global Prime Bonuses

Apart from its referral program, Global Prime does not offer any bonus deals or promotions at the time of writing. However, you can check its website and social media pages for news of future promos and competitions.

Regulation Review

Global Prime is fully licensed and regulated as a group of contracting entities across Australia, Vanuatu and Seychelles. Global Prime PTY Ltd is regulated by the Australian Securities and Investments Commission (ASIC) under license number 385620. Gleneagle Securities PTY Limited trading as Global Prime FX is regulated by the Vanuatu Financial Services Commission (VFSC) under license number 40256 and Global Prime FX Ltd is regulated by the Seychelles Financial Services Authority (FSA) under license number 8426189-1.

More experienced traders are likely to take caution with the VFSC and FSA regulatory bodies. The VFSC, for example, allows for the quick and easy setup of companies and offers limited client protection. Fortunately, ASIC is considered a top-tier regulator.

Global Prime conducts regular independent external audits of its financial and compliance arrangements and has no adverse record from any financial regulator, government body or court of law.

Additional Features

Margin calculator – Global Prime offers an FX pip calculator that works out the required position size based on your currency pair, risk level and stop loss.

YouTube channel – Global Prime has an established YouTube channel with over 300+ videos. Content includes educational short-form videos and podcast videos featuring founders and the leadership team.

Trading academy – Traders of all skill levels can benefit from Global Primes comprehensive and structured training program that features various mentors.

Trading community – Global Primes trading community have provided hundreds of positive reviews. Members can communicate with each other and industry mentors on their Discord hangout.

VPS offers – The brokers VPS services improve the quality and speed of trade execution. The VPS is also free for clients who trade more than 20 lots a month.

Account Types

Global Prime only offers one account type – The ECN Account. Global Primes ECN comes as Individual, Joint, Corporate and Trust solutions.

ECN account features include:

AUD $7 commission per lot round turn on FX and metals only

Best execution with 26+ liquidity providers

Variable and tight spreads from 0.0 pips

Execution speeds as low as 1ms

Automated trade receipts

Opening an account is straightforward and simply requires proof of identity and address. Members can also sign in and manage their accounts through the client portal.

Note that minimum first-time deposit for a Global Prime account is AUD $200 or equivalent.

Benefits

Platforms for advanced traders

Wide range of deposit options

Segregated client funds

ECN accounts

VPS

Drawbacks

Regulatory bodies, VFSC and FSA, are not reputable

US and Ontario clients are not accepted

Limited number of non-FX instruments

No MT5 platform

Trading Hours

Trading hours on forex, indices and commodities markets are open 24/5 from Monday to Friday. Specific trading hours for each market can also be viewed on the Global Prime website or on the MT4 and TraderEvolution platforms.

Accepted Countries

Global Prime accepts traders from Australia, Thailand, Canada, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use Global Prime from United States.

Alternatives to Global Prime

If you are looking for alternatives to Global Prime we have compiled a list of the top 5 brokers that are similar to Global Prime below. This list of brokers like Global Prime is in order of similarity and only includes companies that accept traders from your location.

EagleFX – EagleFX is a popular trading broker offering forex, stocks, cryptos & commodities.

Rockfort Markets – Rockfort Markets is a New Zealand broker with a competitive range of assets, trading platforms and market conditions.

Pocket Option – Pocket Option is a global binary options broker with sleek proprietary trading platform and competitive range of assets.

eToro – eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

LQDFX – LQDFX offers online trading with multiple STP accounts and MT4 analysis tools.

FAQ

Is Global Prime regulated?

Yes, Global Prime is licensed and regulated by the Australian Securities and Investments Commission (ASIC) under license number 385620, the Vanuatu Financial Services Commission (VFSC) under license number 40256 and the Seychelles Financial Services Authority (FSA) under license number 8426189-1.

Does Global FX offer a demo account?

Yes, Global Prime offers a demo account where you can place simulated trades, explore platform features and test strategies without risking real money.

How much capital do I need to trade with Global Prime?

The minimum first-time deposit for a Global Prime account is AUD $200. There is a minimum deposit of USD $10,000 required to get FIX API access and it comes with a USD $2,000 monthly commission.

Is Global Prime a good broker?

Global Prime is a legitimate broker that abides by regulations and practices good financial governance. The company also offers competitive tight spreads and offers reputable trading platforms. Its educational tools, coupled with over a decade of experience means we would recommend investing with Global Prime.

Is Global Prime a trustworthy broker?

Global Prime is a regulated and trusted broker with positive user reviews. Client funds are also held in segregated tier-1 accounts. They also promise transparency, providing trade receipts. Furthermore, its ethical dealing model means it doesnt profit off client losses.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator