简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

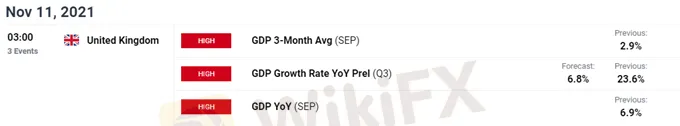

GBP/USD Rate Eyes Yearly Low Ahead of UK GDP Report

Abstract:The update to the UK Gross Domestic Product (GDP) report may produce headwinds for the British Poundas the Bank of England (BoE) expects economic activity in the third quarter of 2021 to expand “at a slower pace than projected in the August Report.”

BRITISH POUND TALKING POINTS

The update to the UK Gross Domestic Product (GDP) report may produce headwinds for the British Poundas the Bank of England (BoE) expects economic activity in the third quarter of 2021 to expand “at a slower pace than projected in the August Report.”

FUNDAMENTAL FORECAST FOR BRITISH POUND: BEARISH

GBP/USD is on the verge of testing the yearly low (1.3509) as the BoE keeps the benchmark interest rate at the record low of 0.10% in November, and it seems as though the central bank will retain the current course for monetary policy as “growth is somewhat restrained by disruption in supply chains.”

As a result, fresh data prints coming out of the UK may keep GBP/USD under pressure as “GDP was expected to grow by around 1.5% in 2021 Q3 and by 1% in Q4 in the November Report projections,” and it seems as though the Monetary Policy Committee (MPC) will stick to the sidelines at its next interest rate decision on December 16 as “GDP was expected to remain below its pre-Covid level until 2022 Q1.”

However, a better-than-expected GDP print may fuel a growing dissent within the BoE as “the Committee had judged that some modest tightening of monetary policy over the forecast period was likely to be necessary to meet the 2% inflation target sustainably in the medium term.” In turn, it remains to be seen if Governor Andrew Bailey and Co. will adjust the forward guidance at its last meeting for 2021 as one member “judged that it would be appropriate to remove some of the monetary stimulus to asset prices by terminating the existing asset purchase programme at this meeting, ahead of any subsequent increase in Bank Rate.”

Until then, the reaction to the BoEs November rate decision casts a bearish outlook for GBP/USD as the exchange rate approaches the yearly low (1.3509), and the British Pound may depreciate against its US counterpart throughout the remainder of the year as the Federal Reserve starts to scale back monetary support.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Myaccount Upgrade Announcement

We are pleased to announce that STARTRADER MyAccount is scheduled for system upgrade starting at 00:00 platform time (GMT+3) on July 6, 2024, and will be completed within the same day.

Trading Hours Adjustment of Cryptocurrency Products

Trading Hours Adjustment of Cryptocurrency Products

STARTRADER Secures 4 Awards at ProFX Awards Ceremony

In an honorable moment, STARTRADER has received 4 prestigious awards at the ProFX Awards ceremony held on 31 May 2024, Queen Elizabeth 2 Hotel in Dubai, UAE.

Today's analysis: USDJPY Set for Potential Increase Amid Intervention Risks and Bullish Trends

USD/JPY is near intervention levels with Japanese officials warning of potential forex actions. Despite a bullish trend, caution is advised due to possible government interference. The pair has risen past 158.25, aiming for 160.20, within a broader uptrend from 150.25. A break below 150.87 could signal a larger correction towards 146.47.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator