简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Natural Gas Futures: Upside seems contained near term

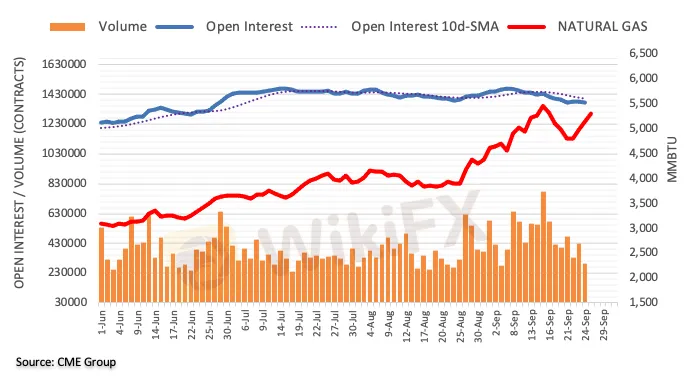

Abstract:According to advanced prints from CME Group for natural gas futures markets, open interest shrank by around 7.4K contracts after two daily builds in a row. In the same line, volume dropped by around 132.1K contracts, extending the choppiness seen as of late.

According to advanced prints from CME Group for natural gas futures markets, open interest shrank by around 7.4K contracts after two daily builds in a row. In the same line, volume dropped by around 132.1K contracts, extending the choppiness seen as of late.

Natural Gas now targets the YTD highs

Prices of natural gas extended the bounce off the $4.70 area last Friday against the backdrop of shrinking open interest and volume. That said, extra gains appear unlikely in the very near term. This view is supported by the commodity approaching the overbought territory, as per the daily RSI. In the longer run, natural gas is expected to re-visit the 2021 tops above $5.60 per MMBtu.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Currency Calculator