简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Australian Dollar Outlook: AUD/USD Downside Risks as the US Dollar Soars

Abstract:AUSTRALIAN DOLLAR FUNDAMENTAL FORECAST: BEARISH AUD/USD undermined by US Dollar strength and commodity price declines Fed speakers around Jackson Hole to be closely watched for AUD direction Risk assets to continue to be subject to Delta variant concerns

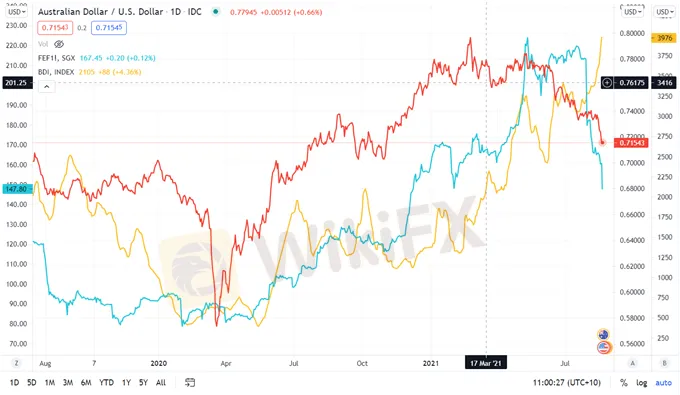

The Australian Dollar broke lower during a week where the US Dollar broadly strengthened. The Delta variant continued spreading as Chinese crackdowns weighed against several local stock market sectors. The strengthening US Dollar pushed commodity prices lower. Iron ore prices have moved sharply lower and the outlook remains negative. China stated that steel production for the rest of the year must be reduced.

This comes at a time of year when Brazil typically ramps up output. A fundamental concern is the cost of shipping. This past week, China closed several major ports due to Delta and this pushed the Baltic dry freight index to 10 year highs. Iron ore is a crucial component of Australias economy. A US$10 move in the iron ore price has a circa AUD 2 billion impact on Australian government revenue. The market will focus on key developments related to the commodity as the direction of the Australian Dollar is closely linked to iron ore prices.

AUD/USD, IRON ORE AND SHIPPING COSTS OF IRON ORE (BALTIC FREIGHT DRY INDEX)

AUSTRALIAN DOLLAR, RISK ASSETS AND THE FED

Recent weakness in global stock markets is likely adding additional downside risk to the Australian Dollar, which can at times also be sensitive to swings in trader sentiment.. This synchronicity appears to be growing as we have seen USD strengthen against most commodities and all currencies, except CHF and JPY, which remained comparably flat this week. If the latter two currencies start being bought aggressively, this could reflect a large risk off event and would likely be associated with more downward pressure on the growth-linked Australian Dollar.

The lead up to the Jackson Hole Symposium on Thursday is likely to see some Fed speakers prepare markets for the event with preliminary speeches. The FOMC minutes revealed the possibility of tapering but circumstances have changed since that meeting and the market will be highly attuned for any clues for action.

In Australia we have building approvals, business capex and retail sales data starting on Wednesday. The market will likely focus mostly on retail sales for an indication of how the consumer is reacting to lockdowns.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

WikiFX Review: Something You Need to Know About Markets4you

North Korean Hackers Steal $1.3bn in Cryptocurrency in 2024

Currency Calculator