简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

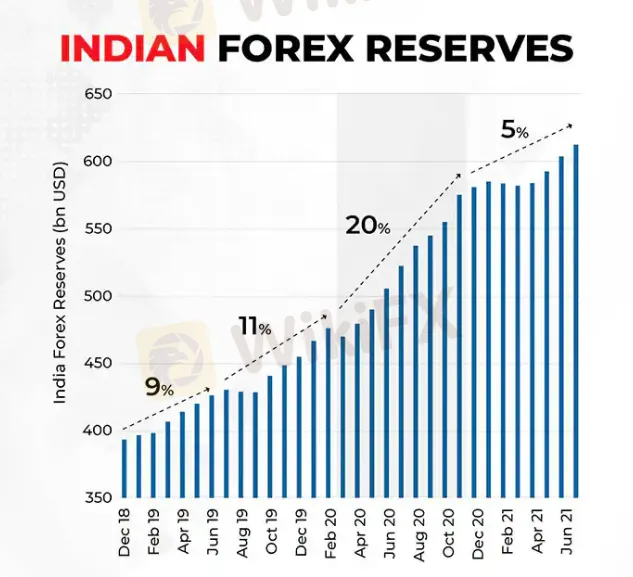

India’s Forex Reserves Saw A Spike

Abstract:India’s forex reserves saw a spike. What to expect in the near future?

Ahead of the latest policy meeting of the United States Federal Reserve on July 28, Indian equity markets corrected for three consecutive sessions fearing negative developments around tapering of the US quantitative easing (QE) programme. However, despite inflation in the US touching a 13-year high at 5.4 percent, the meeting concluded without any exceptionally hawkish comments from the Fed.

Consequently, Nifty 50 proceeded to rally and scale one lifetime high after another. Considering what happened in the 2013 taper tantrum (heavy foreign outflows leading to rupee depreciation, costly imports, and shrunk margins for most corporates), such a reaction of the stock market was not irrational.

Here we will discuss the multi-faceted impact of foreign inflows on the Indian economy. We shall extend the logic to build expectations around what the future may hold as we approach the next QE tapering.

In the wake of the pandemic, countries around the world pulled out all the stops of monetary and fiscal support to help boost flailing economies. As a result, economies were flush with liquidity, some of which made it to emerging markets in search of higher yields.

India was one of the recipient economies, which helped shore up its foreign exchange reserves by a whopping 33 percent from the pre-pandemic levels (~$450 billion) to the current levels of $600+ billion. If we were to look closely at this spike in Indias forex reserves, we would find that most of the accumulation happened between April 2020 and November 2020.

- END -

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator