简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR/USD stays sluggish around 1.1800, US Durable Goods Orders eyed

Abstract:EUR/USD stays sluggish around 1.1800, US Durable Goods Orders eyed

EUR/USD consolidates the biggest daily gains in two weeks, edges higher of late.

Covid updates sour sentiment, probe DXY pullback ahead of the key GDP signal.

US stimulus talks remain in limbo, Sino–American tussles escalate.

Housing figures, CB Consumer Confidence and pre-Fed notions are important too.

EUR/USD retreats to 1.1800, mostly unchanged on a day, heading into Tuesdays European open. In doing so, the major currency pair fails to hold the week-start optimism virus news and pre-data/events caution defends the US dollar bulls.

Traders began the key week on a positive side as weekend covid numbers from Australia and the UK helped the mood. Also, recently downbeat US data keeps a lid on the need for easy-money policies and corporate earnings season is also rosy this time, fueling Wall Street benchmarks to refresh record top.

It‘s worth mentioning though that the latest virus updates from Australia and the UK, not to forget Delta coronavirus variant woes in the US and Europe, renew market fears. Also negative for the sentiment could be the latest jostling of the US Senators as issues relating to covid funding and waters raise doubts on earlier optimistic passage. Furthermore, the escalating US-China tussles, recently over US visas of Chinese diplomats and Taiwan issues, add to the US dollar’s safe-haven demand.

Amid these plays, the US Dollar Index (DXY) remains pressured near 92.60 whereas the S&P 500 Futures drop 0.14% intraday by the press time.

Looking forward, US CB Consumer Confidence, Housing Price Index and Durable Goods Orders will be the key for EUR/USD traders ahead of Wednesday‘s Federal Open Market Committee (FOMC) meeting. While easing in housing data and downbeat Durable Goods Orders could be US dollar negative, pre-Fed fears and the coronavirus woes can keep the greenback afloat. Additionally, the Senate updates over President Joe Biden’s infrastructure spending plan and the US-China tension are extra details to take care of.

Read: Durable Goods Orders Preview: Why expectations could be too high, data useful for trading GDP

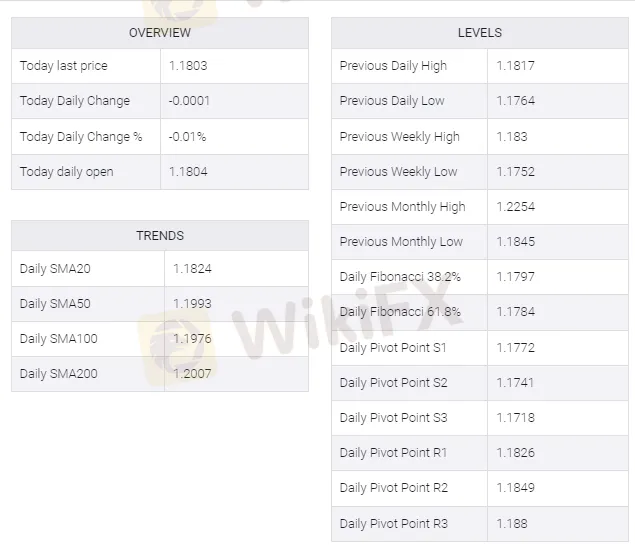

Technical analysisDespite struggling of late, a clear break of a monthly resistance line, now support, keeps EUR/USD bulls hopeful until the quote stays beyond 1.1790. Also challenging the pair sellers is the monthly low near 1.1750.

ADDITIONAL IMPORTANT LEVELS

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Malaysian Pensioner Loses RM823,000 in Fake Investment Scam

Currency Calculator