简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Accessible Forex Trading Methods for You!

Abstract:Price Action Trading has tactics formed merely according to the price changes shown by K-line. Several common forms and trading methods are hereby introduced.

Although fundamental analysis and technical analysis are common ways to make profits, they can be complicated usually. In contrast, Price Action Trading has tactics formed merely according to the price changes shown by K-line. Several common forms and trading methods are hereby introduced:

(1) PinBar

It is a form featuring a nose-like structure with a prominent ceiling or floor price, a situation where the opening price approximates the closing price.

An upward “nose” seen by PinBar is indicative of an upcoming reversal of the trend along with a price decline, which marks the timing to go short.

(2) OutsideBar

This indicates that prices will continuously change in the same direction.

It is time to go long in the wake of a price increase and a bullish OutsideBar.

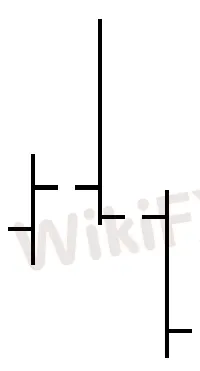

(3) InsideBar

Neither opening nor closing price of bar charts exceeds that of their previous counterparts.

A group of InsideBar is an indicator of the ongoing market consolidation, and the price may embrace a breakout in a certain direction.

Signals of InsideBar are very powerful. More strips occur, more reliable InsideBar is.

(4) False Breakout

This refers to a breakout on the heels of a tested price with a fast market retreat featuring the halt of the trend after the breakout. This form shows the crucial turning point in the market which may give rise to some major changes.

All above-mentioned are just part of Price Action but are enough for you to start your trading!

Download WikiFX to get lessons from experts who have traded forex for over 20 years. (bit.ly/wikifxIN)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Scalping vs Day Trading: What are the Differences

Discover the differences between scalping and day trading in this informative blog post. Learn about their unique strategies, risks, and benefits to help you decide which trading style is best for you.

A Trading Fallacy Regarded as a Myth!

Several trading fallacies considered to be correct are disclosed herein in a bid to help you get away from mistakes.

Scalping in Forex Trading: A Dangerous Game!

Scalping is not an ideal trading method, so employing it in conjunction with other approaches flexibly is better than on its own.

Most Lucrative Techniques in Forex Trading

As forex trading is gradually booming, various trading methods are springing up on the market.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator