Score

Grand Capital

Saint Vincent and the Grenadines|5-10 years|

Saint Vincent and the Grenadines|5-10 years| https://grandcapital.org.in/

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

GrandCapital-Demo

Influence

A

Influence index NO.1

Russia 7.15

Russia 7.15MT4/5 Identification

MT4/5 Identification

Full License

Germany

GermanyInfluence

Influence

A

Influence index NO.1

Russia 7.15

Russia 7.15Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Grand Capital also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

Lesotho

Nigeria

South Africa

grandcapital.org.in

Server Location

United States

Website Domain Name

grandcapital.org.in

Website

WHOIS.INREGISTRY.NET

Company

NATIONAL INFORMATICS CENTRE (R12-AFIN)

Domain Effective Date

2004-12-31

Server IP

172.67.155.253

grandbroker.com

Server Location

United States

Website Domain Name

grandbroker.com

Website

WHOIS.INSTRA.NET

Company

INSTRA CORPORATION PTY, LTD.

Domain Effective Date

2011-06-08

Server IP

104.28.2.190

grandcapital.net

Server Location

United States

Most visited countries/areas

United States

Website Domain Name

grandcapital.net

Website

WHOIS.INSTRA.NET

Company

INSTRA CORPORATION PTY LTD.

Domain Effective Date

2007-03-10

Server IP

104.26.13.119

Company Summary

Company Summary

Company profile

General Information

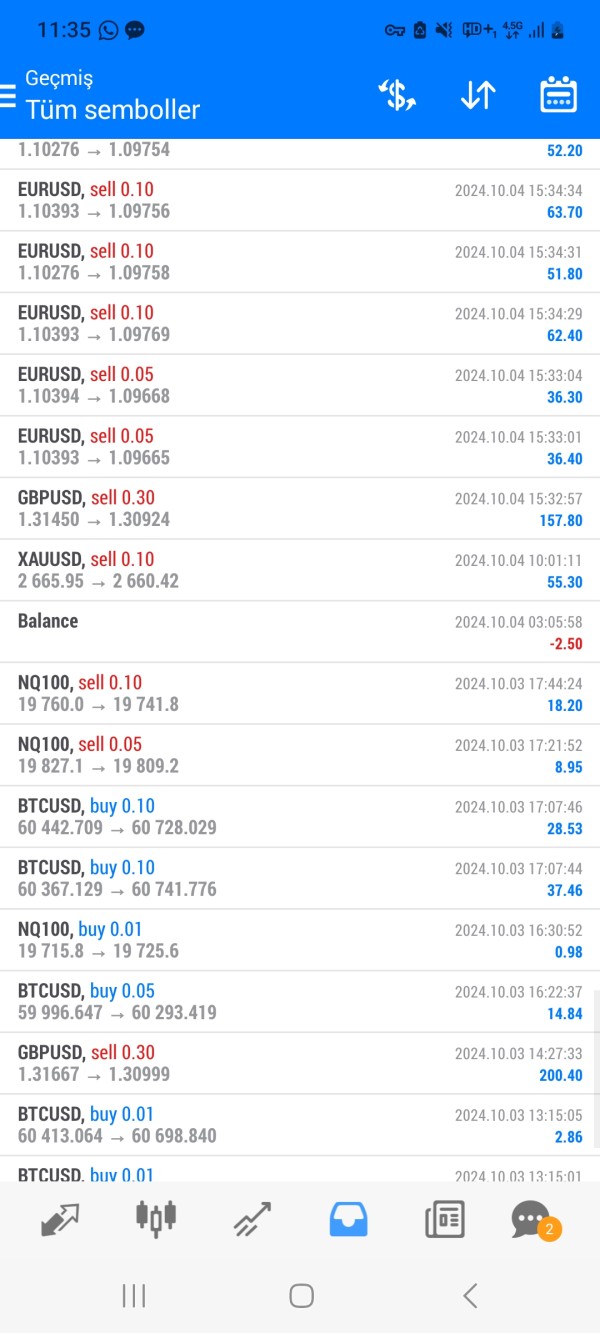

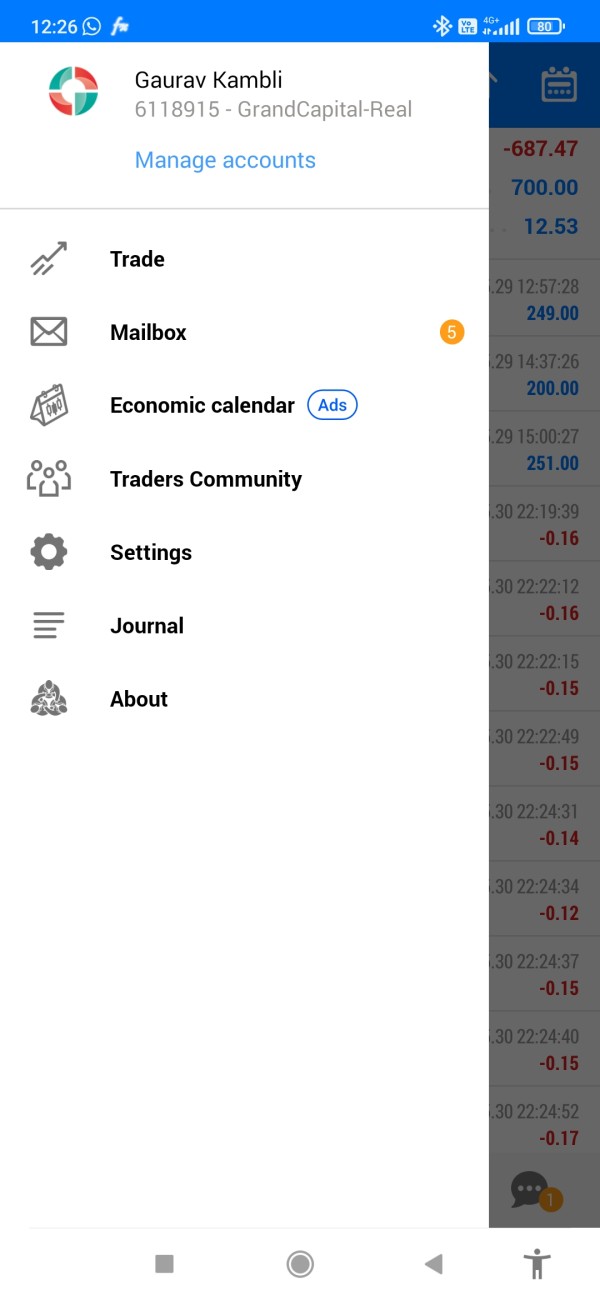

The Grand Capital Group comprises two companies, both named Grand Capital Ltd, based in St Vincent and the Grenadines and the Seychelles.

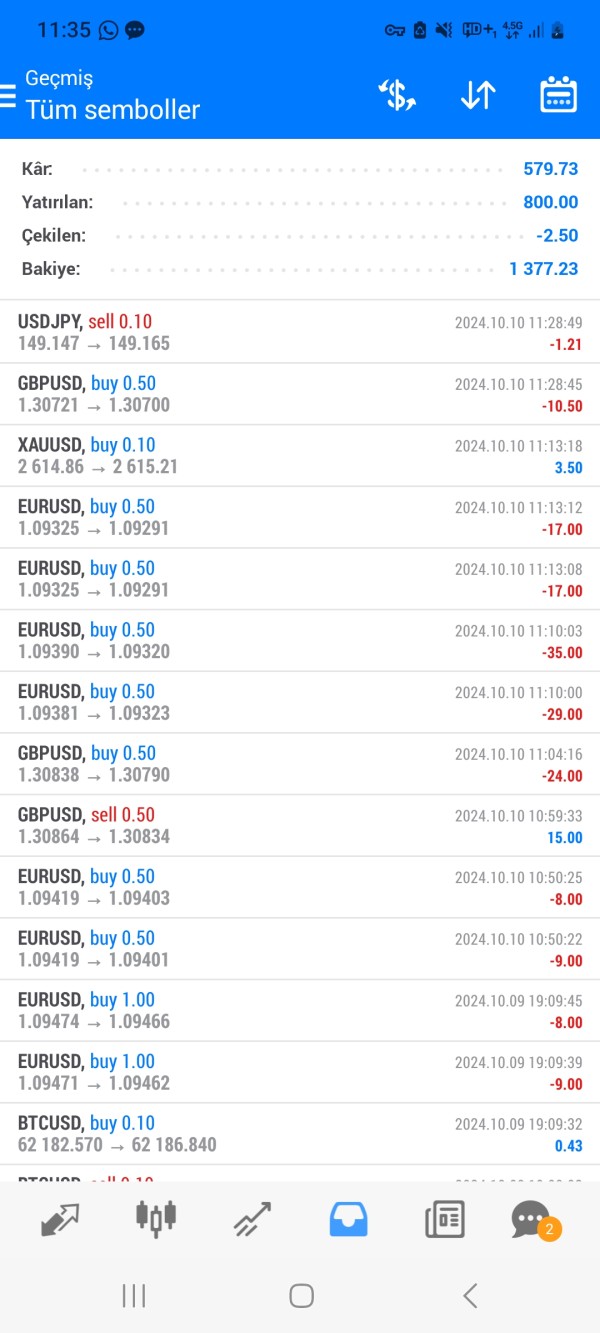

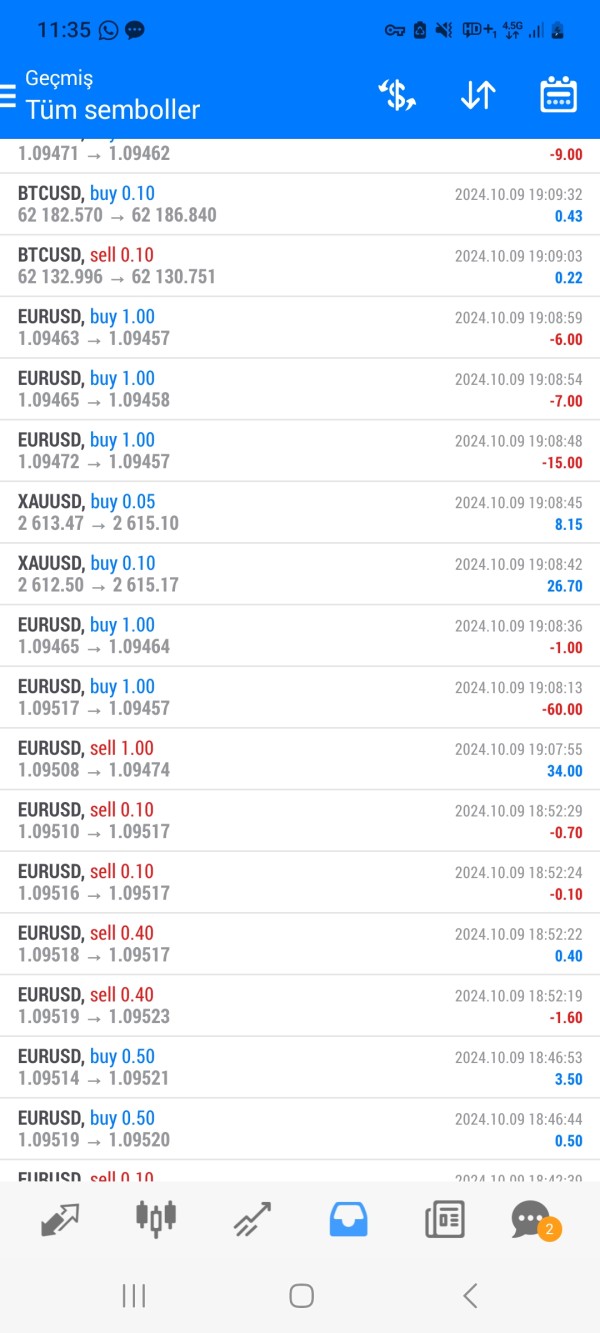

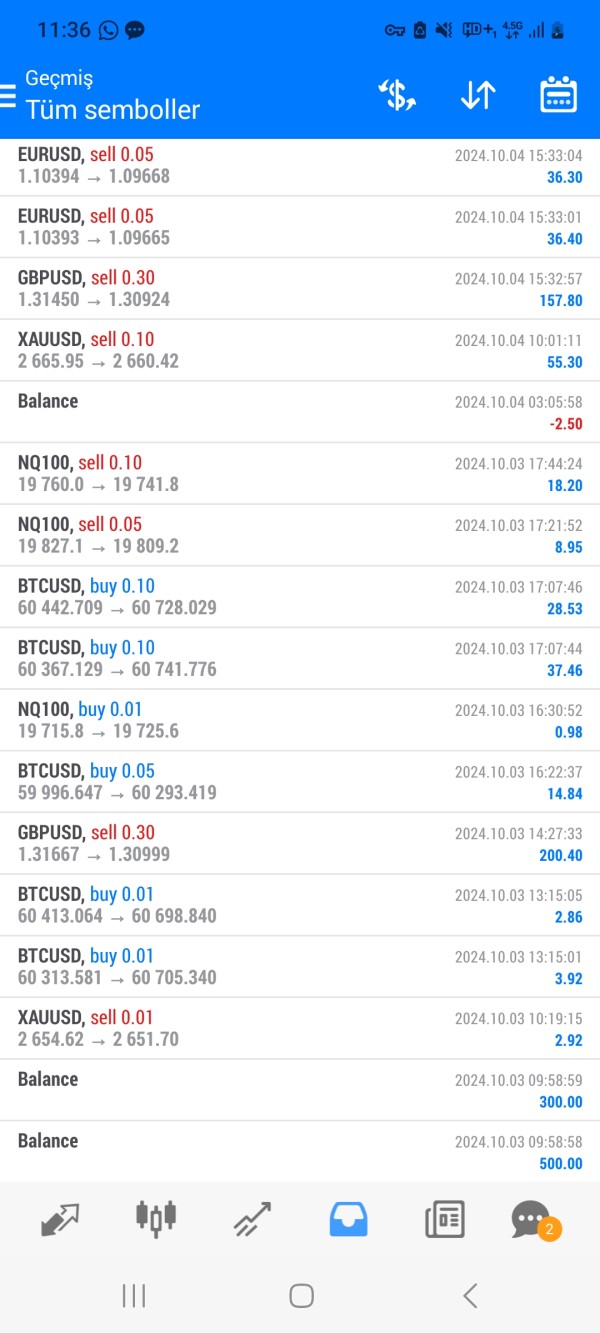

Market Instruments

Grand Capital offers investors access to popular currency pairs in the Forex market, stocks, cryptocurrencies, indices, metals, and energy commodities.

Minimum Deposit

To meet different investors' investment needs and trading experience, Grand Capital offers six different accounts: Standard (minimum deposit of $100), MT5 (minimum deposit of $100), ECN Premium (minimum deposit of $500), Micro (minimum deposit of $10), Crypto (minimum deposit of $100), Swap-Free Accounts (minimum deposit of $100).

Grand Capital Leverage

Trading leverage vary depending on various trading accounts. Standard, Micro, and Swap-free accounts offer leverage from 1:1 to 1:500. MT5 and ECN Premium accounts offer leverage from 1:1 to 1:100, and Crypto accounts can be used with a maximum leverage of 1:3.

Spreads & Commissions

Minimum spreads for the Grand Capital Standard account starts at 1 pip, no commission on Forex, $14 to $15 per contract on CFDs, 0.1% of total volume on USA Stocks CFDs, 0.1% on ETFs CFDs. Minimum spreads for MT5 accounts start at 0.4 pips, commissions on Forex, metals, indices, and energy are $5 to $10 per lot, 0.1% of trading volume for CFDs on USA and EU Stocks, 0.5% of trading volume for Russian & Asian stocks, 0.5% of trading volume for cryptocurrencies, and 0.1% of trading volume for CFDs on ETFs. The minimum spread for ECN accounts is 0.4 pips, and commissions for Forex, metal, energy is $5 per lot, indices $7 per lot, ETFs CFD 0.1%, USA and EU stocks 0.1%, CFDs on ETFs 0.1%. The minimum spread for micro accounts starts from 1 pip, and the commission is $0. The spread for cryptocurrencies starts from 0.4 pips, and the commission is 0.5%.

Trading Platforms

GrandCapital offers a variety of trading platforms for traders, namely Grand Trade, MT4, MT5, WebTrader.

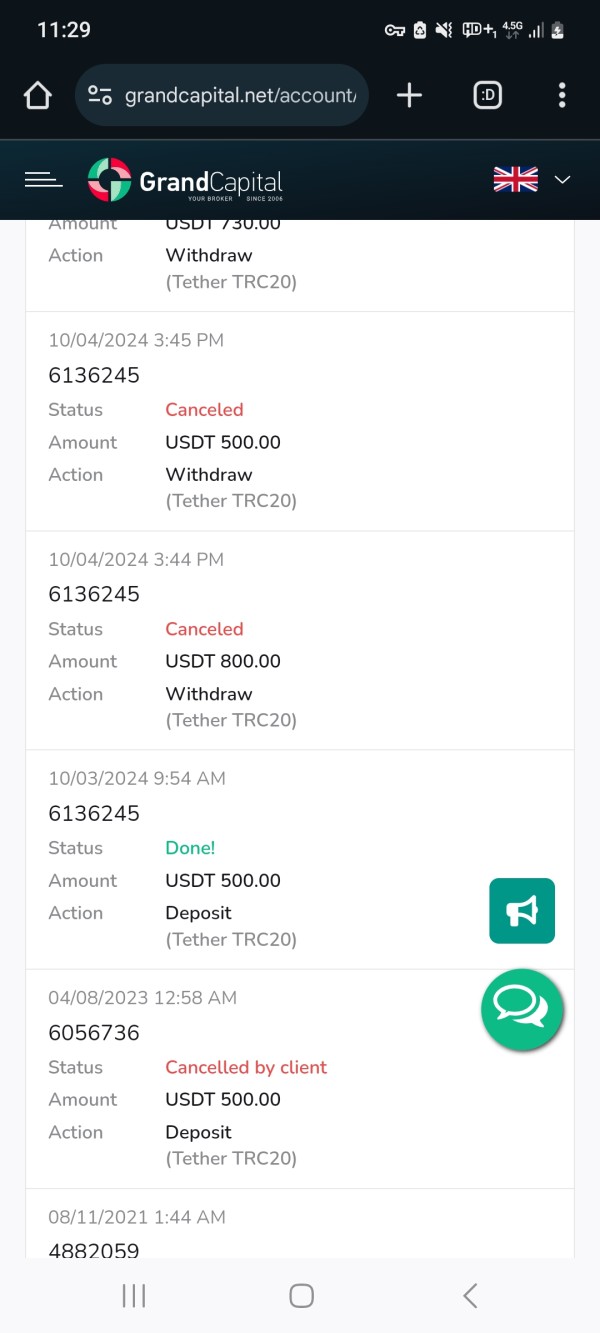

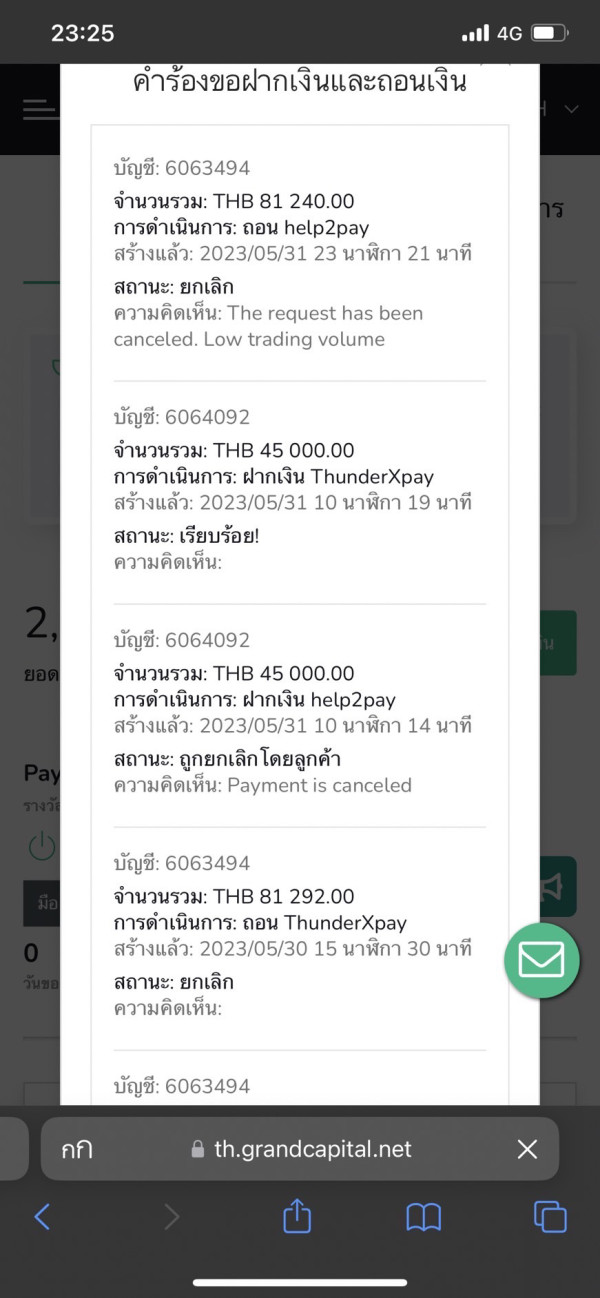

Deposit & Withdrawal

Grand Capital offers traders a range of convenient ways to deposit and withdraw funds, mainly bank transfers, cryptocurrency payments, FasaPay, Help2Pay, NETELLER, PayTrust, Perfect Money, Skrill, VLOAD, Tether, WebMoney, etc.

Keywords

- 5-10 years

- Suspicious Regulatory License

- MT4 Full License

- MT5 Full License

- Self-developed

- Regional Brokers

- High potential risk

Disclosure

Scam Alert: Grand Capital Ltd - Fraudulent company (the “fraudulent company”) and Unauthorized use of website (the “unlawful websites”)

Country/Region

SC FSA

Disclosure time

2024-07-01

Disclose broker

Blacklists of unauthorized companies and websites: Forex

Country/Region

FR AMF

Disclosure time

2021-01-18

Disclose broker

cmvm warns investors about the Grand Capital ltd

Country/Region

PT CMVM

Disclosure time

2020-12-18

Disclose broker

Blacklists of unauthorized companies and websites: Forex

Country/Region

FR AMF

Disclosure time

2019-07-23

Disclose broker

Review 13

Content you want to comment

Please enter...

Review 13

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX3203588779

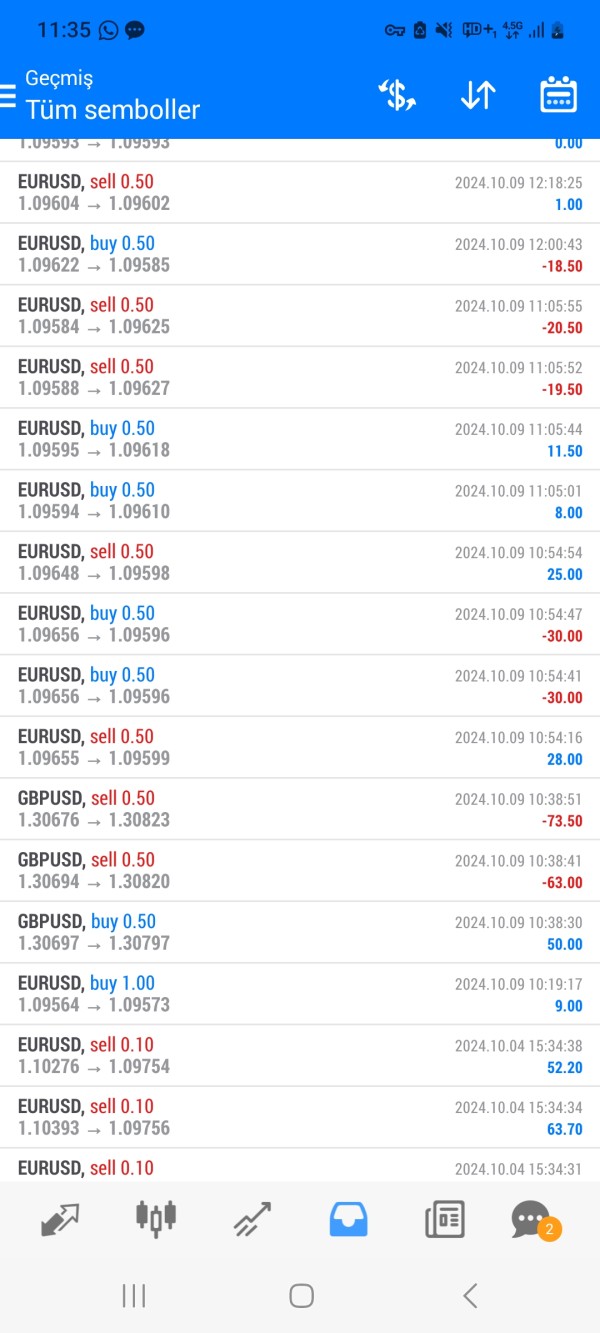

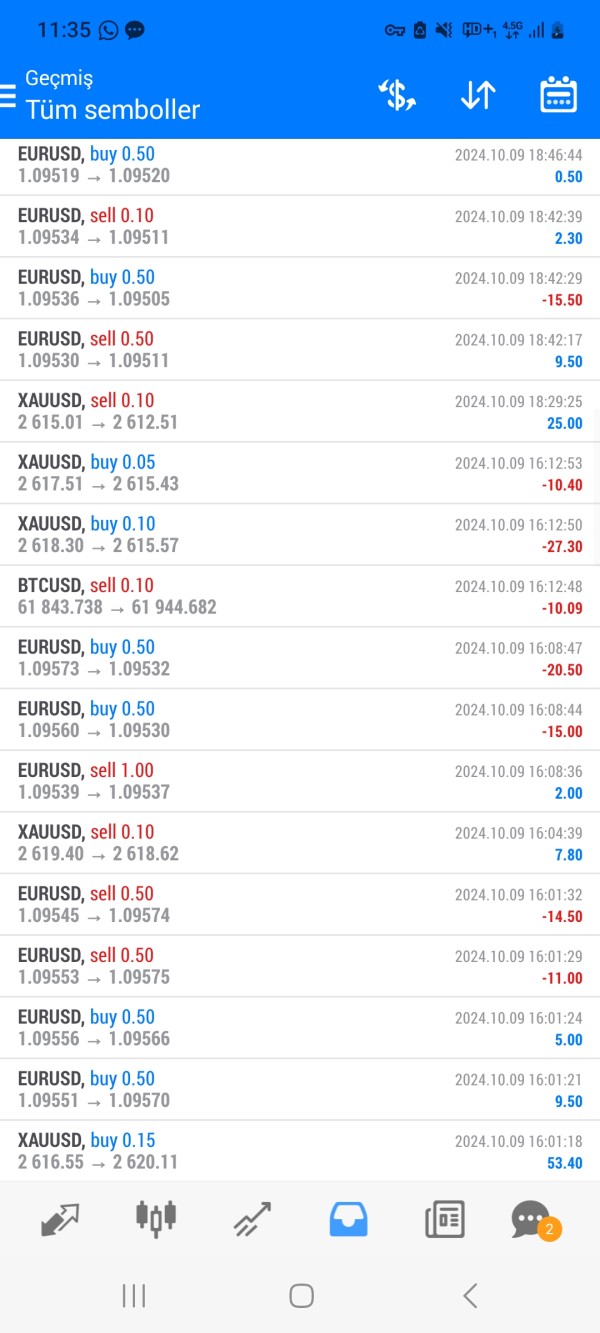

Turkey

I deposited 500 dollars and won 800 USD. When I wanted to withdraw money, they suggested the lot condition. They said 5 percent lots was a requirement, I made 25 lots, but they said make 9 more lots, I made 15 more lots, this time they used the processing time as an excuse. And they don't return my messages anymore, this company is a fraud, don't jump like a carp!!!!

Exposure

10-10

shrawan

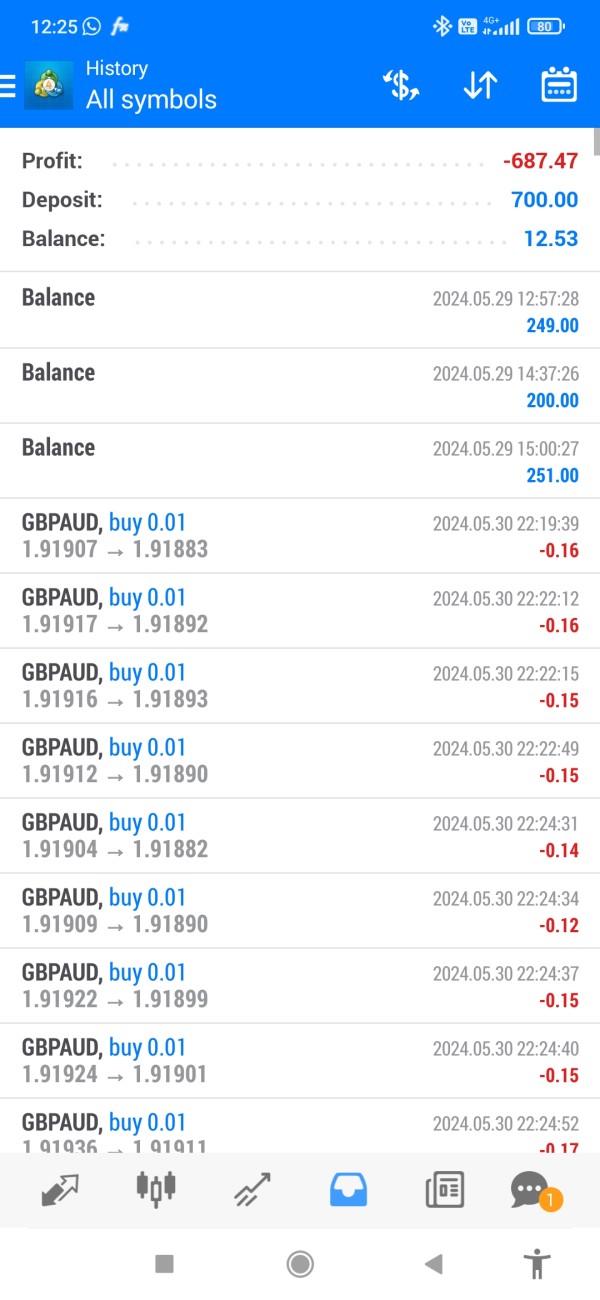

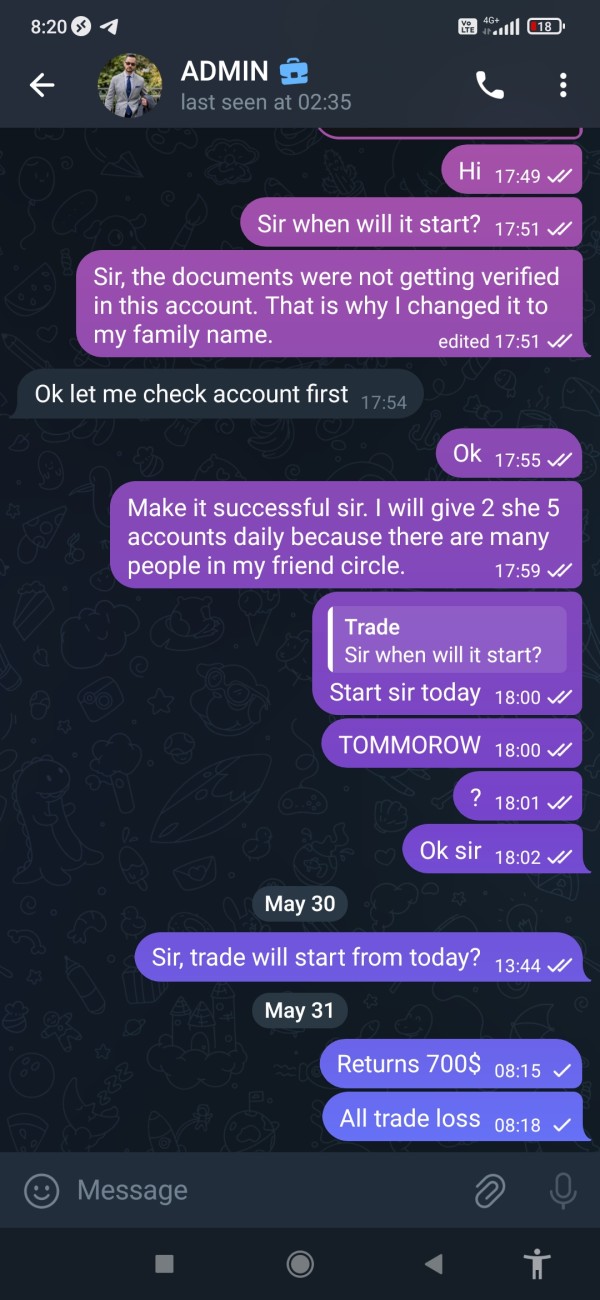

India

Grand Capital First of all, they have a guy who shows us the profit in the live account and tells us to open an account in Grand Capital. Then we opened the account. We had to deposit there. I deposited $700 and after that, that account was taken out of my account. None of you should create an account with this broker. This broker loots everyone's money.

Exposure

05-31

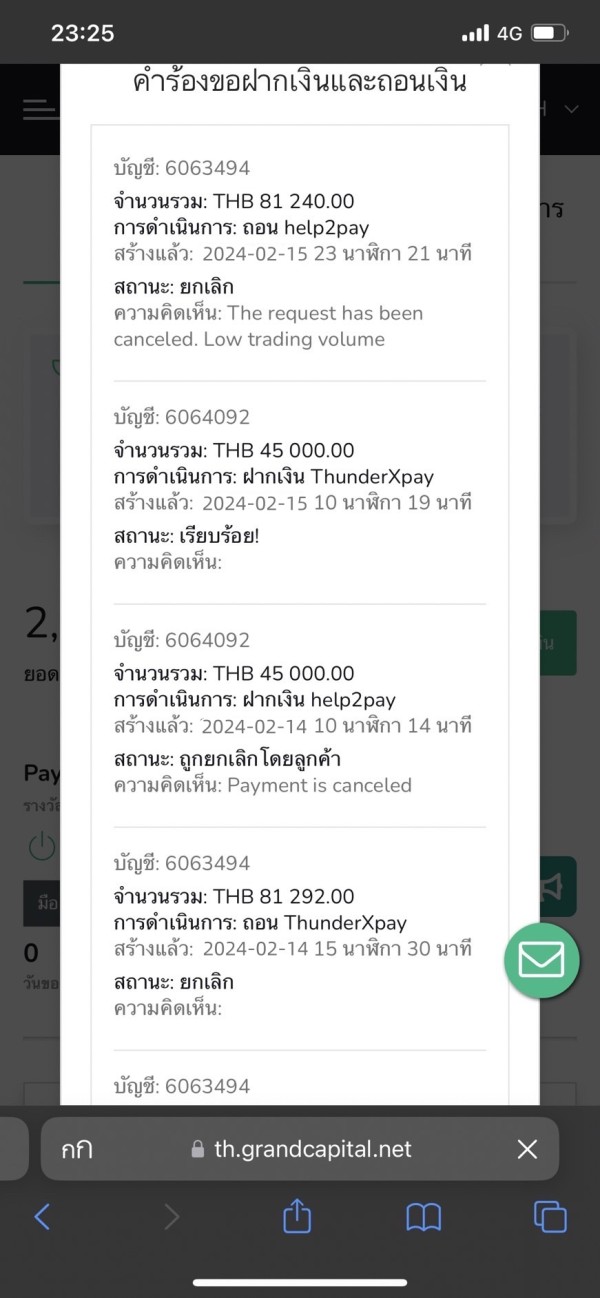

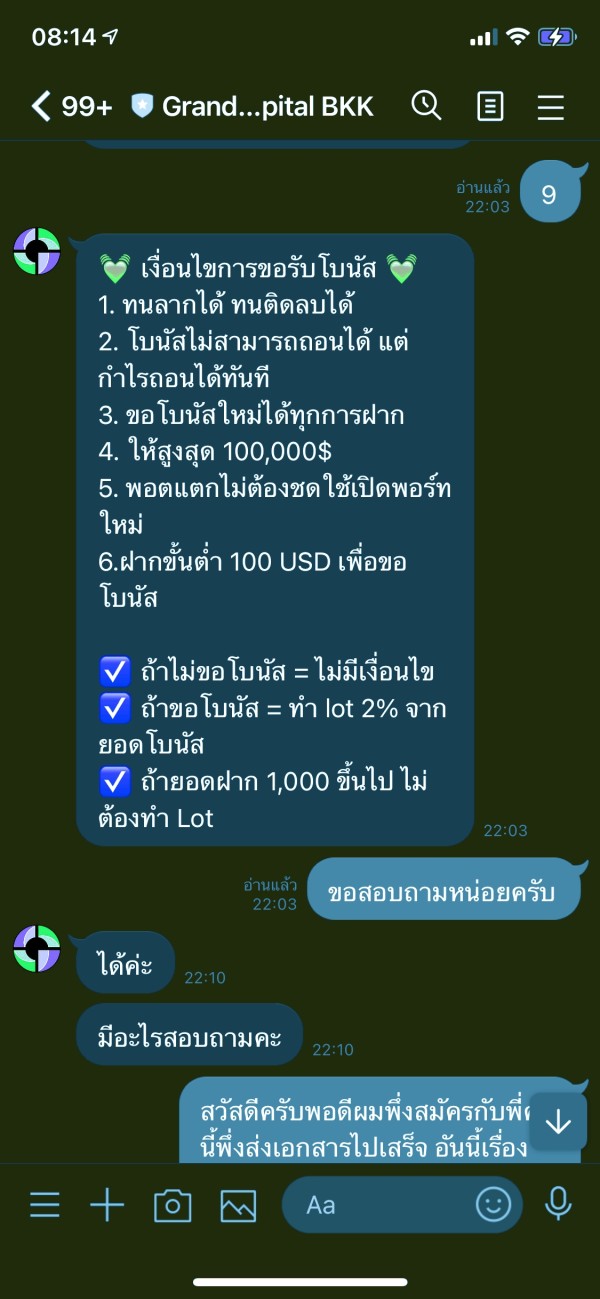

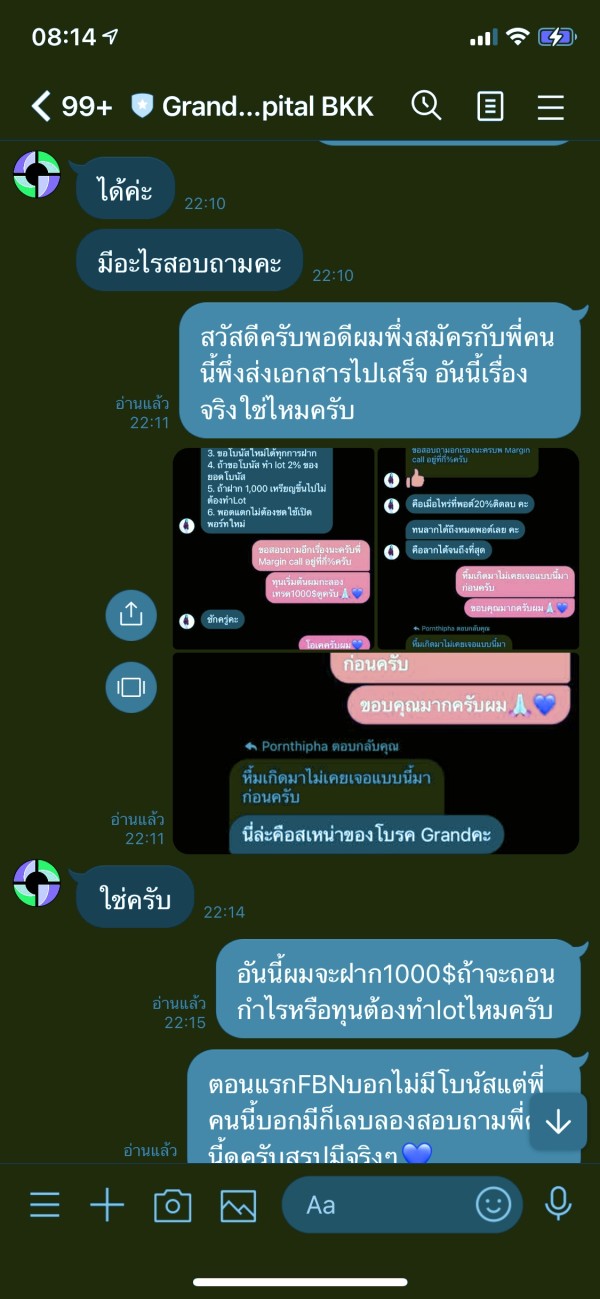

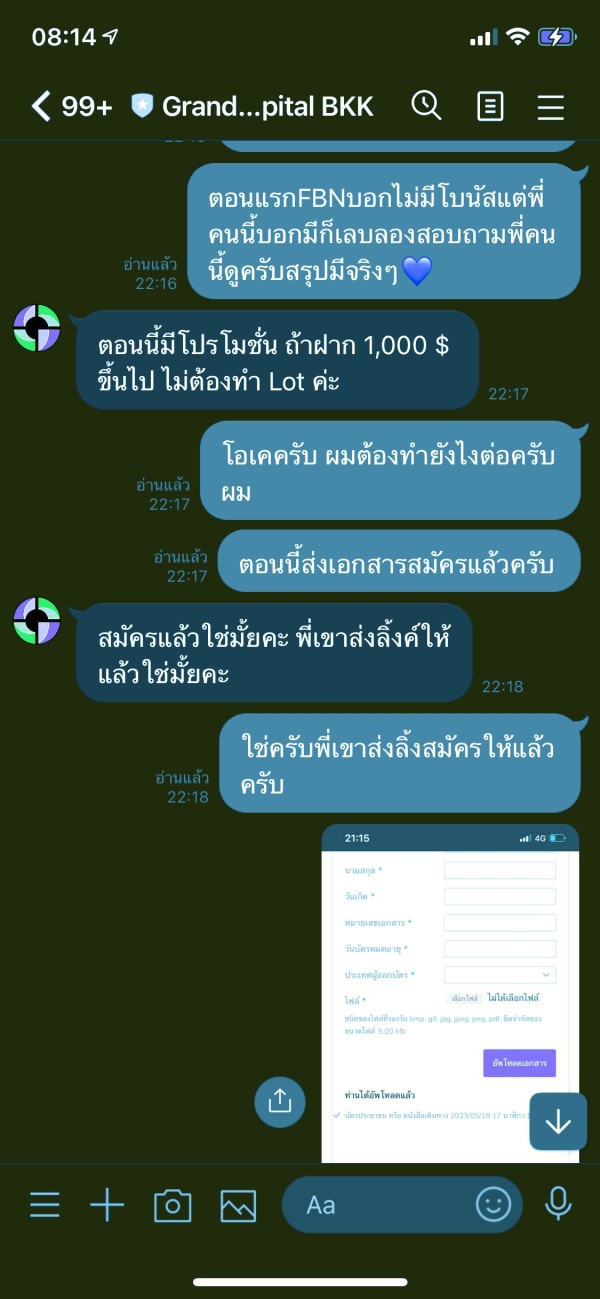

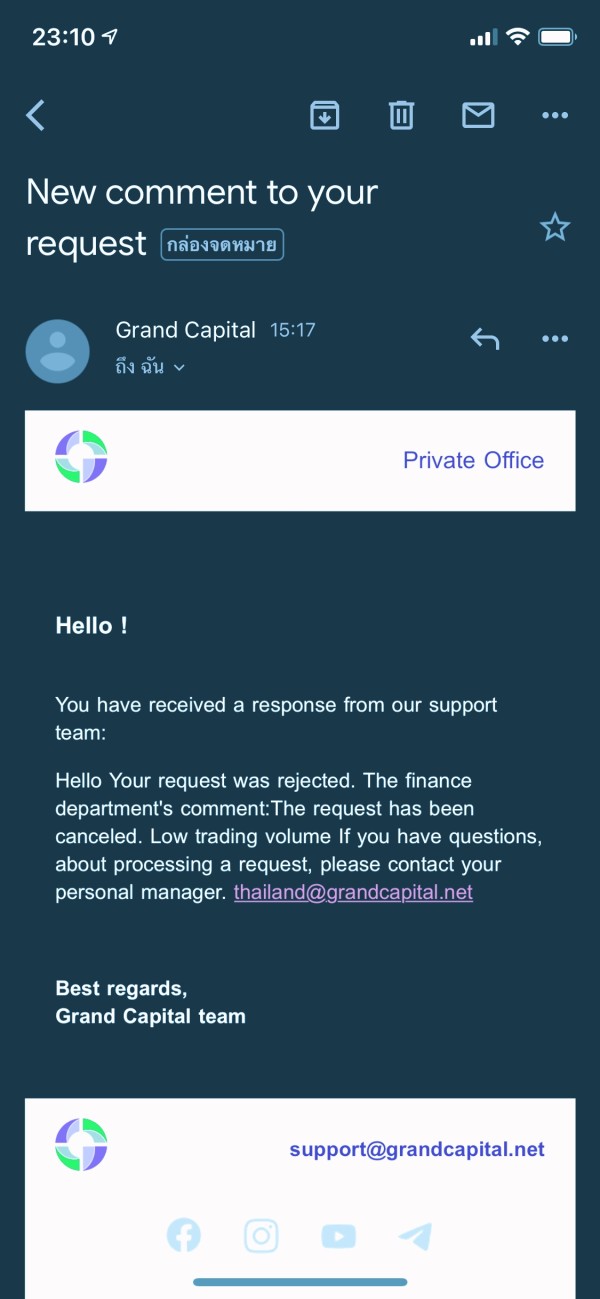

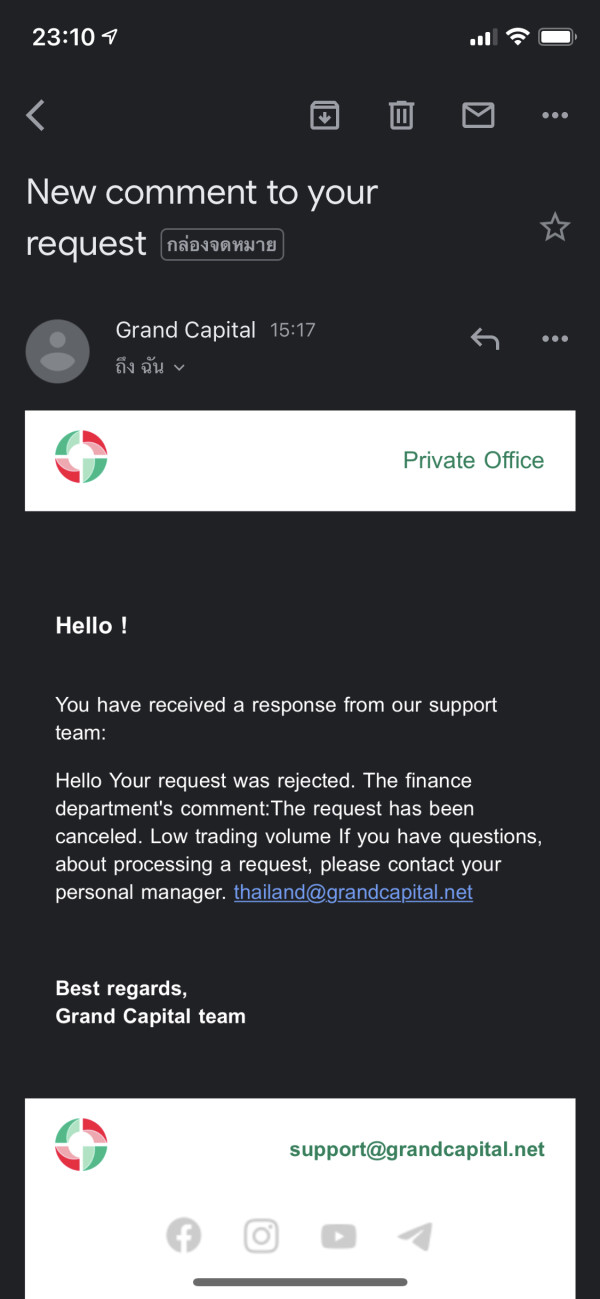

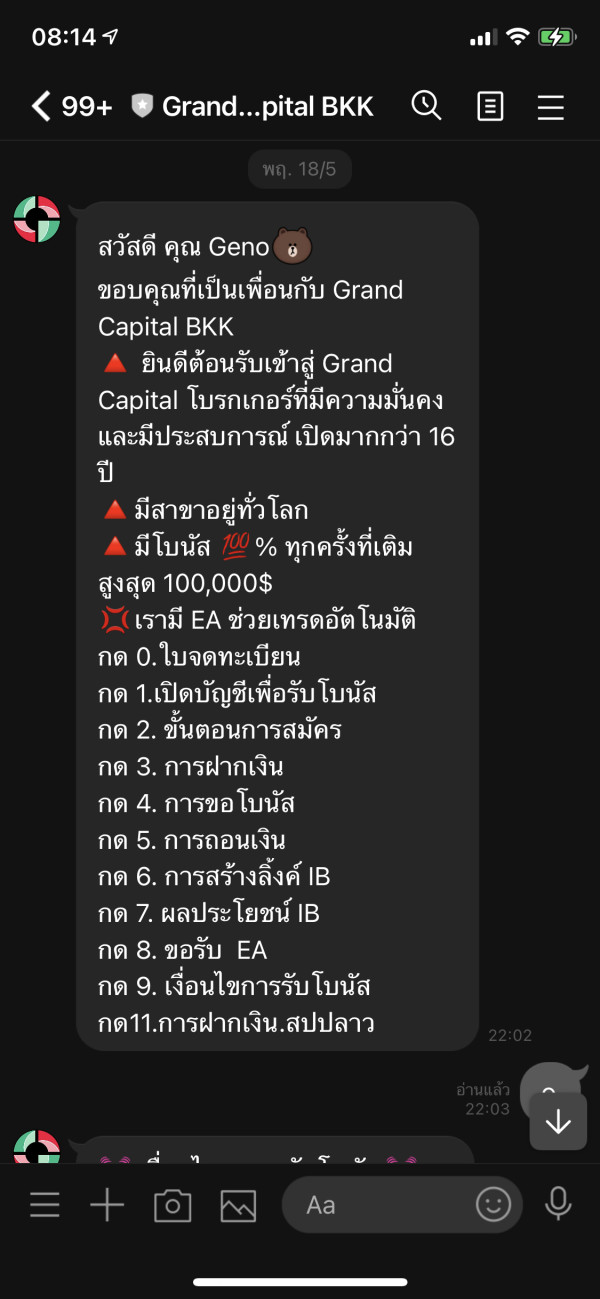

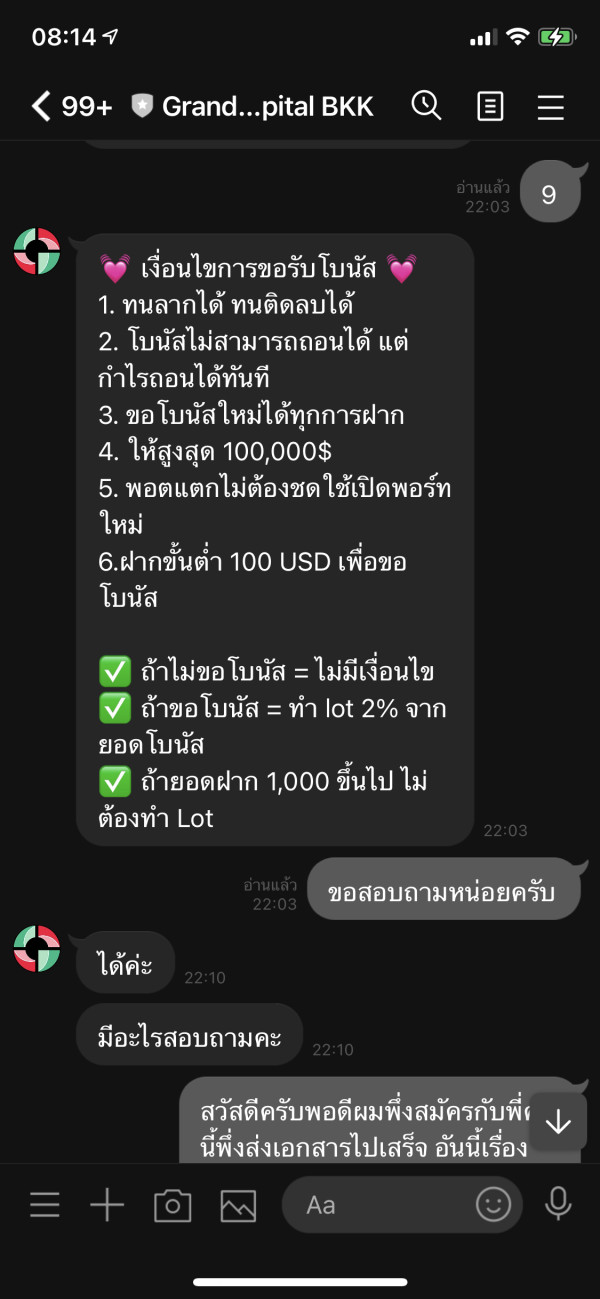

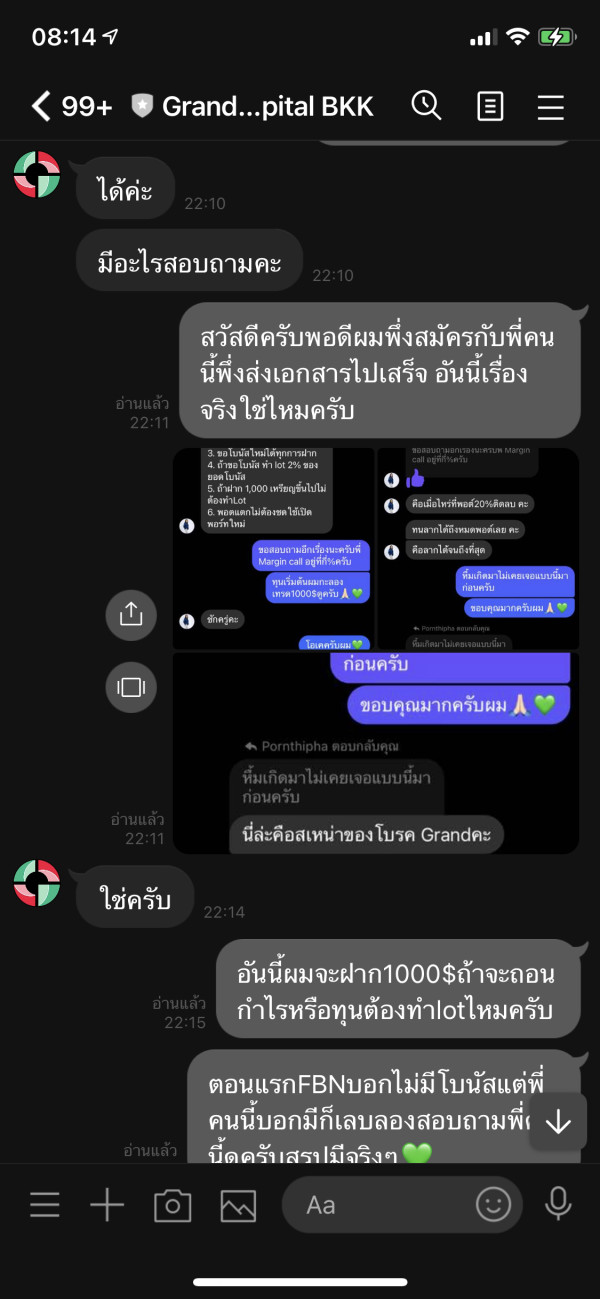

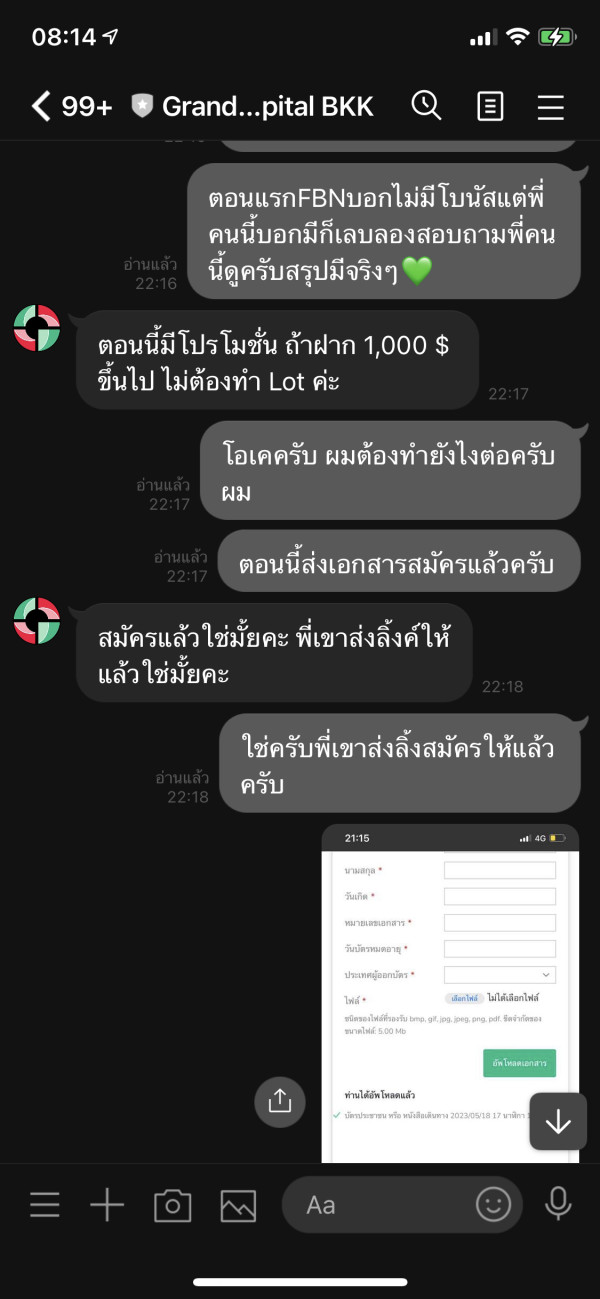

Noinong

Thailand

Ok, evidence added. Please approve. I made a withdrawal and then the broker contacted me saying I broke the rules. The person who brought the promotion to correct me was IB and the GrandcapitalBKK admin and told me the conditions. Just 6 points with a message that if you deposit 1000$ or more, you don't have to make a lot, and didn't tell me any rules other than that. I followed everything but today I made a withdrawal but it was rejected by the broker.

Exposure

03-20

Gero Roger

Thailand

I made a withdrawal, then the broker contacted me saying that I broke the rules. The GrandcapitalBKK admin previously told me only 6 conditions, saying that if you deposit 1000$ or more, you will make a profit. There was no other rules. I followed everything, but today when I made a withdrawal, it was rejected by the broker.

Exposure

2023-06-07

FX3694442902

Vietnam

It is simply a scam. The broker covets all ur profits.

Exposure

2020-07-14

Nhi Linh

Vietnam

Unable to withdraw

Exposure

2020-06-19

Docikstorm

Ukraine

I met all the qualifications for withdrawal, while Grand Capital refused and even deleted all my trading records, which is shameless. I used 100 times leverage to trade, and only profited $50. Who dares to trade in your platform? The customer service is out of contact.

Exposure

2020-03-26

Xvette

Pakistan

Trading experience is smooth, but the platform lacks some advanced market tools.

Neutral

08-01

JP

Hong Kong

Ah, Grand Capital! Way to keep things interesting. As smooth as butter when it comes to depositing money and the customer service is pretty on point. Having diverse account types and their bonus system is quite the catch! But then comes the passport verification hiccup, more like a head-scratching, mysterious twist. And Oleg... uh oh! That 2-minute account drain gave a whole new meaning to 'fast'. Guess, it's always quite the ride when you're trading with Grand Capital, huh? 😅

Neutral

04-19

JeepLee

United Kingdom

Hey there, trading enthusiasts! I've been exploring the vast trading universe with Grand Capital recently. The assortment of tradable assets made available was a pleasant surprise - there's something for every kind of trader out there. Navigating through their MetaTrader platforms felt like sailing through calm waters. Though, I’d be remiss to not mention - the lack of official regulation and the negative user feedback did cause some rough seas. Remember, it's not all about the thrill, safeguard your investments!

Neutral

2023-12-04

sicong

South Africa

I've recently dipped my toes in the trading waters of Grand Capital. What caught my eye? The diversity of trading options with assets you won't find just anywhere - I mean, Meat CFDs, who'd have thought? The MetaTrader 4 and 5 platforms were a treat too, made navigating the trading ocean a breeze. But I'd caution you to keep your sea legs about you - the platform does lack regulation, and there have been some less than favorable reviews. Stay sharp, my friends, and may your trades be profitable!

Neutral

2023-12-01

.79756

Mexico

Hello everyone, I would like to record my experience with grandcapital so far! I officially started trading with him a month ago, and currently my transactions and withdrawals are normal. But after seeing this site I was a little worried, afraid that my money was not safe, so I decided to gradually withdraw my remaining funds.

Neutral

2022-11-21

一个好运的人

Malaysia

The help was always given on time and worked very well. I like how easy it was to use the website. My dedicated broker is a nice person who tells me a lot. He makes it clear what choices are available.

Positive

2023-02-16