简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/JPY refreshes one-year high above 110.00 as US dollar stays firm

Abstract:USD/JPY refreshes one-year high above 110.00 as US dollar stays firm

USD/JPY stays bid while rising to the fresh high since March 26, 2020.

US infrastructure plan headlines seem to favor sentiment off-late.

Beijing versus the West and covid woes seem to favor the US Treasury and dollar bulls.

Japan‘s Industrial Production recovered in February but traders await US President Biden’s speech and mostly ignored data.

USD/JPY takes the bids around 110.62, the highest level in one year, amid the initial hour of Tokyo open on Wednesday. The risk barometer recently gained amid upbeat forecasts over US President Joe Bidens upcoming infrastructure plans. Also favoring the bulls could be the broad US dollar strength, backed by the US Treasury yields rally to early 2020 peak.

The chatters suggesting no major tax hikes in US President Biden‘s infrastructure spending proposal recently crossed wires and favored the risks. Additionally, Biden’s push for faster US vaccines and American readiness to re-discuss the nuclear deal with Iran also brighten the sentiment.

It should be noted, however, that the UK‘s push to get tough on China and the United Nations (UN) inaction on North Korea’s missile test weigh on the mood. Additionally, allegations over stealing thousands of the US State Departments' data on Russia join American dislike for Beijings play in Hong Kong politics and delay in elections to heavy the sentiment.

Amid these plays, US 10-year Treasury yield wobbles around January 2020 high whereas S&P 500 Futures print 0.17% intraday gains even as Wall Street closed on the mildly negative side the previous day.

Talking about the data, preliminary readings for Japan‘s February month Industrial Production recovered from -5.2% YoY prints to -2.6%. It’s worth mentioning that the US CB Consumer Confidence rose to a years high the previous day and favored the US dollar index (DXY) to poke the late November 2020 top.

Moving on, US ADP Employment Change for March, expected 500K versus 117K, can offer intermediate directions to the USD/JPY prices ahead of US President Bidens speech around 16:20. Also important will be the headlines affecting the risk, mainly concerning the coronavirus (COVID-19) in Europe and Australia as well as China-linked news.

Technical analysis

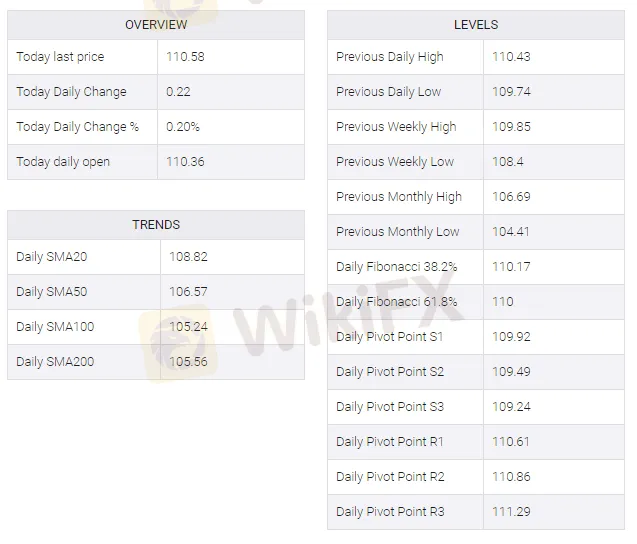

A clear break above the downward sloping trend line from October 2018, around 110.35 by the press time, favor USD/JPY bulls to aim for the 111.00 threshold during the further rise.

ADDITIONAL IMPORTANT LEVELS

----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Japanese Yen Outlook: USD/JPY, EUR/JPY & GBP/JPY

The yen weakens further as Fed Chair Powell's cautious remarks influence market sentiment. USD/JPY remains around 161, with resistance at 162, driven by Powell's comments and upcoming US CPI data. June's lower-than-expected PPI in Japan adds pressure on the yen. The sentiment is bullish for USD/JPY, supported by strong US economic indicators. Key influences include Federal Reserve signals, US economic data, and Japan's PPI. Potential movement for USD/JPY could see it testing 162 resistance.

Today's analysis: Gold Prices Maintain Strength Amid Mixed Economic Signals

The U.S. ISM Manufacturing PMI dropped to 48.5 in June, below expectations, but the dollar rebounded after a Supreme Court ruling in favor of Trump. Investors await U.S. job data for hints on potential Federal Reserve rate cuts. Despite rising U.S. bond yields, gold remains strong near $2300. If it breaks above the 50-day moving average of $2337, it could reach $2390-$2400, but faces resistance at $2339.21. A drop below $2323.29 would weaken the bullish signal; watch for a breakout in the $2291.

Japanese Yen Outlook: USD/JPY, EUR/JPY & GBP/JPY

The yen continues to weaken against major currencies, with USD/JPY potentially climbing above 165. Japan's officials express concerns, hinting at potential intervention. Stable domestic indicators fail to support the yen amid robust USD performance.

USDJPY Predicted to Rise on Yen Depreciation

The USD/JPY pair is predicted to increase based on both fundamental and technical analyses. Fundamental factors include a potential easing of aggressive bond buying by the Bank of Japan (BoJ), which could lead to yen depreciation. Technical indicators suggest a continuing uptrend, with the possibility of a correction once the price reaches the 157.7 to 160 range.

WikiFX Broker

Latest News

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Why is there so much exposure against PrimeX Capital?

Two Californians Indicted for $22 Million Crypto and NFT Fraud

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Malaysia Pioneers Zakat Payments with Cryptocurrencies

FCA's Warning to Brokers: Don't Ignore!

Currency Calculator