简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FX Week Ahead - Top 5 Events: Biden Stimulus Speech; China Manufacturing PMI; UK GDP; US Manufacturi

Abstract:FX Week Ahead - Top 5 Events: Biden Stimulus Speech; China Manufacturing PMI; UK GDP; US Manufacturing PMI; US NFP

FX WEEK AHEAD OVERVIEW:

The economic calendar has a distinct US-focus as the calendar turns from March to April, and from 1Q‘21 to 2Q’21 (US consumer confidence, President Biden speech on infrastructure stimulus, ISM Manufacturing & Markit Manufacturing PMI, and US nonfarm payrolls).

Signs of inflation heating up may be ignored (German and Euroarea inflation rates), while evidence that major economies have struggled may be overlooked (UK GDP).

On balance, recent changes in retail trader positioning suggest that the US Dollar has a bearish bias.

03/31 WEDNESDAY | 00:30 GMT | CNY NBS MANUFACTURING PMI (MAR)

Tensions between the US and China are heating up, with many indications suggesting that the Trump-inspired US-China trade war will continue with under the Biden administration – and perhaps intensify. Ahead of anything else intensifying, data releases are due to show that Chinas manufacturing sector is still growing, but barely. The March China NBS manufacturing PMI is expected to cross the wires with a reading of 51.2, according to a Bloomberg News survey, up from the 50.6 reading in February.

03/31 WEDNESDAY |06:00 GMT | GBP GROWTH RATE (4Q20)

Even as the UK remains among the best in the world in terms of vaccination rates, the outbreak of the B.1.1.7 mutation of COVID-19 still managed to slow things down at the end of last year. According to a Bloomberg News survey, the final UK growth rate update for 4Q20 is due to show a slight improvement, from -8.7% to -7.8% (y/y). Nevertheless, any issues seen in the final 4Q20 UK GDP data may be overlooked as markets continue to look forward to the UK regaining its pre-COVID economic potential.

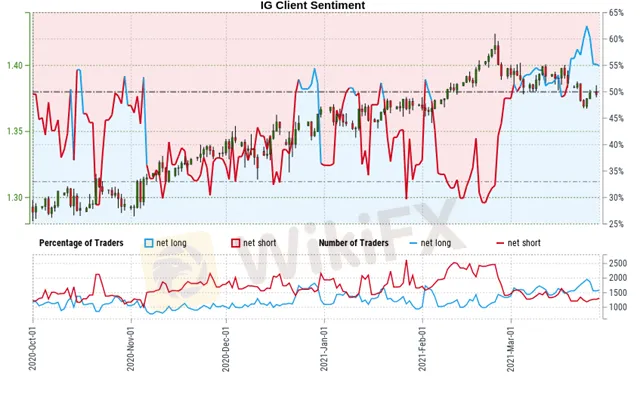

IG CLIENT SENTIMENT INDEX: GBP/USD RATE FORECAST (MARCH 29, 2021) (CHART 1)

GBP/USD: Retail trader data shows 51.55% of traders are net-long with the ratio of traders long to short at 1.06 to 1. The number of traders net-long is 1.03% lower than yesterday and 21.51% lower from last week, while the number of traders net-short is 14.46% higher than yesterday and 13.02% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

04/01 THURSDAY | 00:00 GMT | USD PRESIDENT BIDEN SPEECH ON RECOVERY PACKAGE

US President Joe Biden has already seen his $1.9 trillion stimulus program pass into law, but hes not done yet. Midweek, the American president will not only deliver remarks regarding the deployment of the first stimulus package and an update on COVID-19 vaccination efforts, but will also outline the framework for a sweeping infrastructure spending program, encompassing climate change and public education. While it remains to be seen whether or not the Biden administration prioritizes changes to the Senate filibuster is another story, but the markets may soon have a new carrot to chase.

04/01 THURSDAY | 13:45, 14:00 GMT | USD MARKIT MANUFACTURING PMI (MAR), USD ISM MANUFACTURING PMI (MAR)

The US economy is gaining steam, at least in the manufacturing sector, which accounts for around 12% of all US jobs. Both readings of the sector due out from Markit IHS and the Institute of Supply Managers (ISM) suggest that March was a stronger month than February. The Markit Manufacturing PMI survey is due in at 59 from 58.6, while the ISM Manufacturing PMI is expected at 61.3 from 60.8. Cumulatively, running at a pace near 60 suggests that US economic data momentum is improving as vaccination efforts accelerate, priming the US economy for a strong 2Q21.

04/02 FRIDAY | 12:30 GMT | USD NONFARM PAYROLLS & UNEMPLOYMENT RATE (MAR)

Following the surprisingly strong reading for February, the US labor market is looking to build on that momentum with a reading nearly twice as strong. Consensus surveys from Bloomberg News see the world‘s largest economy having added +675K jobs in March following the gain of +379K jobs in February. The unemployment rate (U3) is set to drop from 6.2% to 6%.At the end of the week, the US jobs report may serve as a key stepping stone to reinvigorating the US-centric ’reflation trade: higher yields, higher equities, and a higher US Dollar.

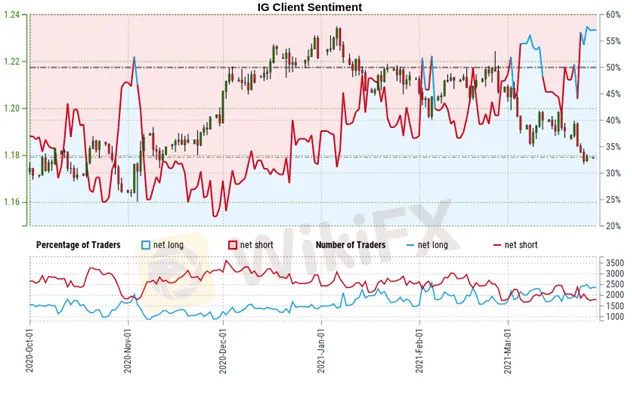

IG CLIENT SENTIMENT INDEX: EUR/USD RATE FORECAST (MARCH 29, 2021) (CHART 2)

EUR/USD: Retail trader data shows 53.71% of traders are net-long with the ratio of traders long to short at 1.16 to 1. The number of traders net-long is 5.91% higher than yesterday and 19.69% higher from last week, while the number of traders net-short is 20.68% higher than yesterday and 9.13% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiFX Review: Is PU Prime a decent broker?

Currency Calculator