简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Overview of the EUR/USD pair

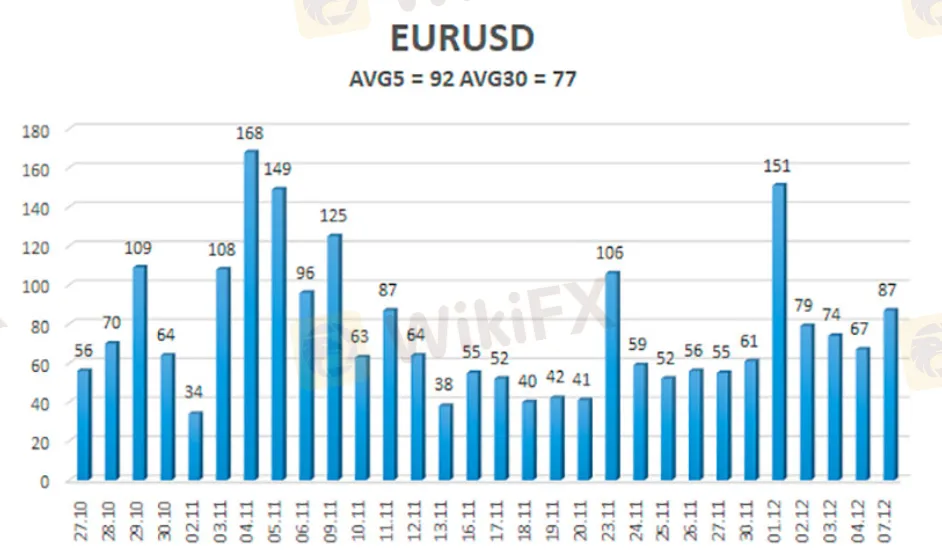

Abstract:The volatility of the euro/dollar currency pair as of December 7 is 92 points and is characterized as "high".

The volatility of the euro/dollar currency pair as of December 7 is 92 points and is characterized as “high”. Thus, we expect the pair to move today between the levels of 1.2020 and 1.2214. A reversal of the Heiken Ashi indicator downwards signals a new round of corrective movement.

Nearest support levels:

S1 – 1.2085

S2 – 1.2024

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading recommendations:

The EUR/USD pair started to adjust. Thus, today it is recommended to open new buy orders with a target of 1.2207 and 1.2214 if the Heiken Ashi indicator turns up again. It is recommended to consider sell orders if the pair is fixed below the moving average with targets of 1.2020 and 1.1963.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

One article to understand the policy differences between Trump and Harris

M2FXMarkets Review 2024: Read Before You Trade

How can the forex fix be manipulated?

CMC Markets and ASB Bank Form Strategic Partnership

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Currency Calculator