简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DXY Remains in Wild Swings amid Legal Challenges to Election

Abstract:With the US election completely dominating the movements in the dollar, the DXY fluctuated around 93.50 on Thursday.

WikiFX News (5 Nov.) - With the US election completely dominating the movements in the dollar, the DXY fluctuated around 93.50 on Thursday. While Biden is six electoral votes away from the presidency, expectations are shifting away from a Trump victory.

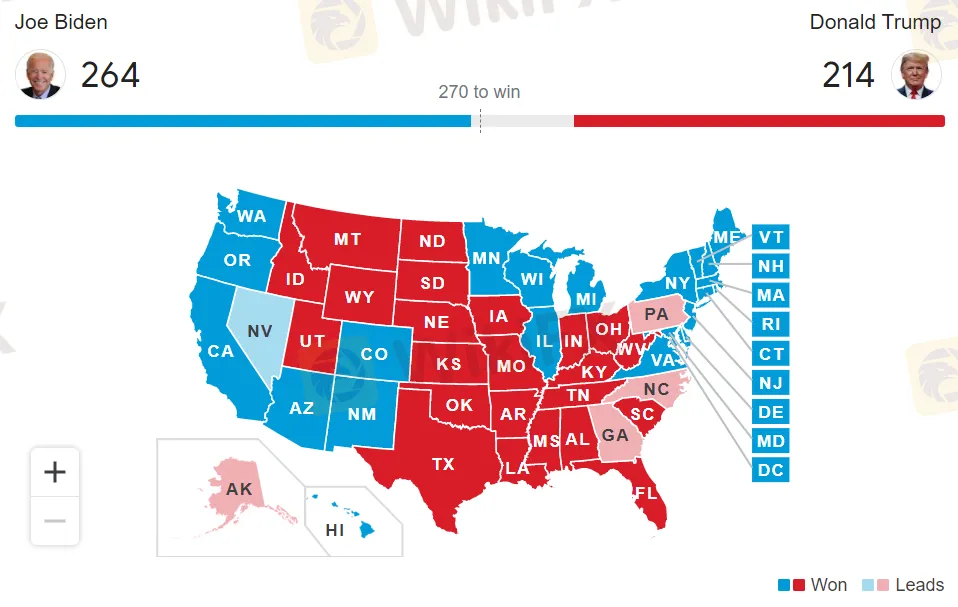

The latest data has put Biden at 264 electoral votes while Trump at 214. As it stands, Biden will clinch a victory as long as he wins any one of the five states which are still left uncalled. Among them, Nevada will continue counting votes, but results will not be updated until the morning of Nov. 5 (local time), said an official of Nevada elections.

Trump‘s campaign has filed lawsuits in Georgia after its path to victory narrowed, requesting a halt to the state’s vote counting. The campaign also threatened legal challenges in Pennsylvania and Michigan and sought a recount in Wisconsin. The election results are facing legal challenges.

Risk aversion will persist if this keeps going to the courts, said Edward Moya, senior market analyst. In this case, the US dollar may embrace more upsides.

However, the current situation signals uncertainties in the election results, implying the DXY will see wild swings enduring in the short term.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/wikifxIN

Chart: Latest election data

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

DXY Rebounds amid Surging Covid-19 Cases in Europe & UK

A coronavirus variant spread in Britain when the public was upbeat on the vaccine inoculation.

Sluggish US Economic Recovery Hampers DXY’s Rally

Recently, obstacles in the DXY rally have brought about wild swings.

Two Concerns Non-Negligible After Thanksgiving

It is reported that the US Food and Drug Administration has scheduled a meeting of its Vaccines and Related Biological Products Advisory Committee on Dec. 10 to discuss the request for emergency use authorization of a Covid-19 vaccine from Pfizer.

US Dollar Outlook Hinges on Fed Rate Decision & Forward Guidance

The Federal Reserve meeting is likely to influence the near-term outlook for the US Dollar as the central bank is widely expected to deliver another 25bp rate cut.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator