简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How The VIX Reacts to US Presidential Elections?

Abstract:It’s normal for the VIX (the volatility index) to be high surrounding a presidential election. It’s like test anxiety. You study and you’re like, ‘The test is going to be horrible’ and then the test is over and the test anxiety goes away. It’s the same with elections. The election occurs on defined dates. You know who the person in power will be.

It‘s normal for the VIX (the volatility index) to be high surrounding a presidential election. It’s like test anxiety. You study and you‘re like, “The test is going to be horrible” and then the test is over and the test anxiety goes away. It’s the same with elections. The election occurs on defined dates. You know who the person in power will be.

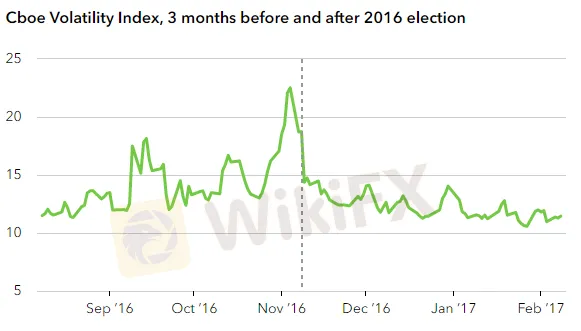

If you look at the VIX right before and after an election, youll see that the VIX tends to go a bit wild and then flatten out. Here are one of the most controversial elections in recent memory: Donald Trump in 2016. The VIX calmed down a few months after the election.

Here‘s a chart showing the VIX three months before and three months after the Trump’s surprise 2016 victory.

Source: YCHARTS

If the VIX is really high it means markets are likely to be lower in the near future, its a good time to buy and a good time to rebalance your portfolio. A high VIX signifies that“markets are really far away from their normal trading levels,” meaning that investors can find bargains during times of high volatility.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Currency Calculator