简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

World Economy Faces New Fiscal Cliffs Amid Pressure for Spending

Abstract:SHARE THIS ARTICLE ShareTweetPostEmailThe world‘s major economies poured money into the fight again

The world‘s major economies poured money into the fight against the coronavirus slump, and now they’re edging toward what may be a more complex policy choice: when and how to turn off the spigots.

Governments have pledged some $12 trillion in spending this year, the International Monetary Fund estimates. While the fund says its too early to cut off the support, it warns record debt levels will eventually pose a challenge for policy makers.

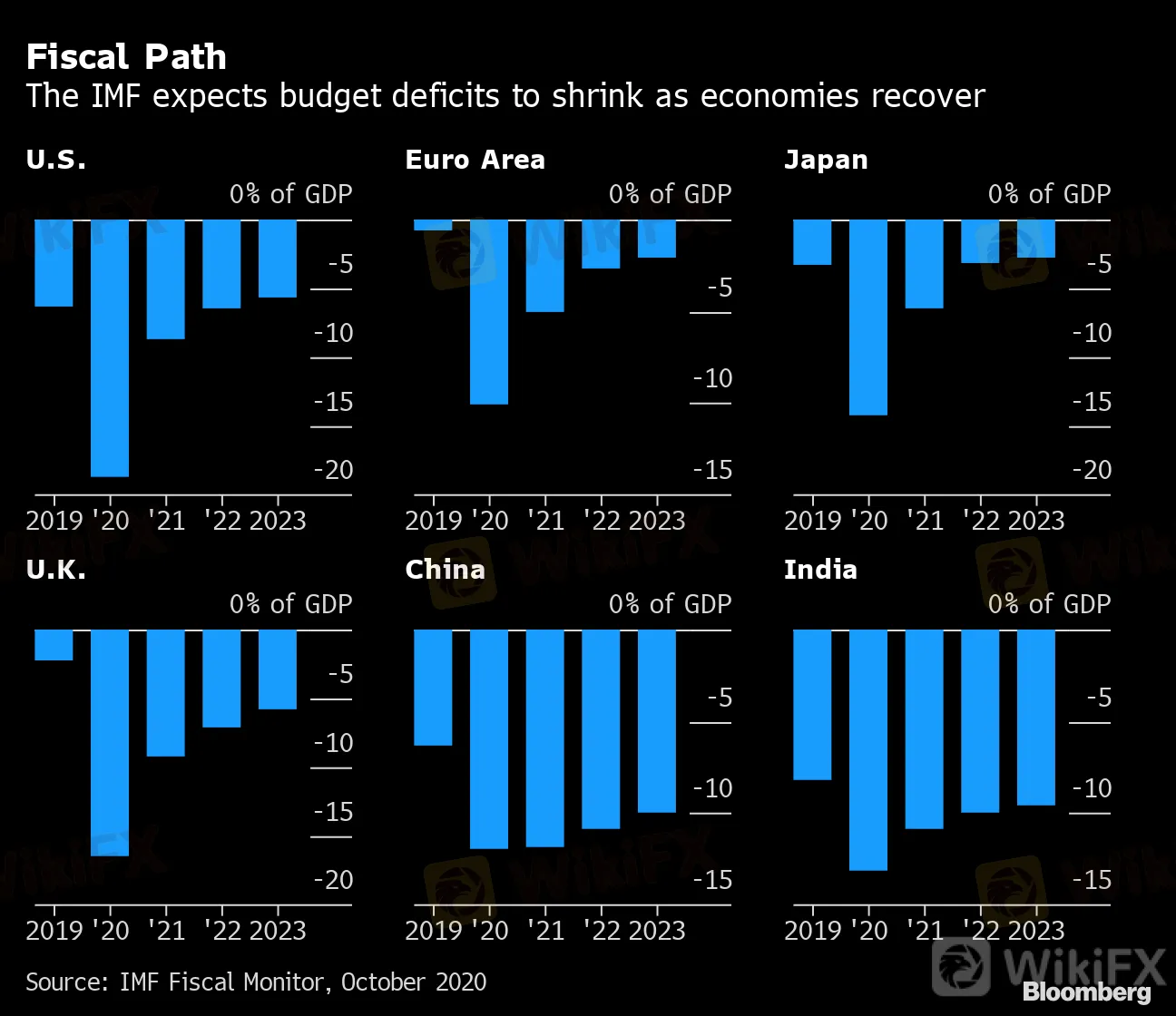

Fiscal Path

The IMF expects budget deficits to shrink as economies recover

Source: IMF Fiscal Monitor, October 2020

The biggest economies are generally still in the spending camp, though budget deficits are forecast to start narrowing in 2021. Financial markets show no signs of balking, with borrowing costs at record lows almost everywhere. Yet, from some U.S. Republicans to sound-money advocates in Germany, debt concerns are starting to get voiced.

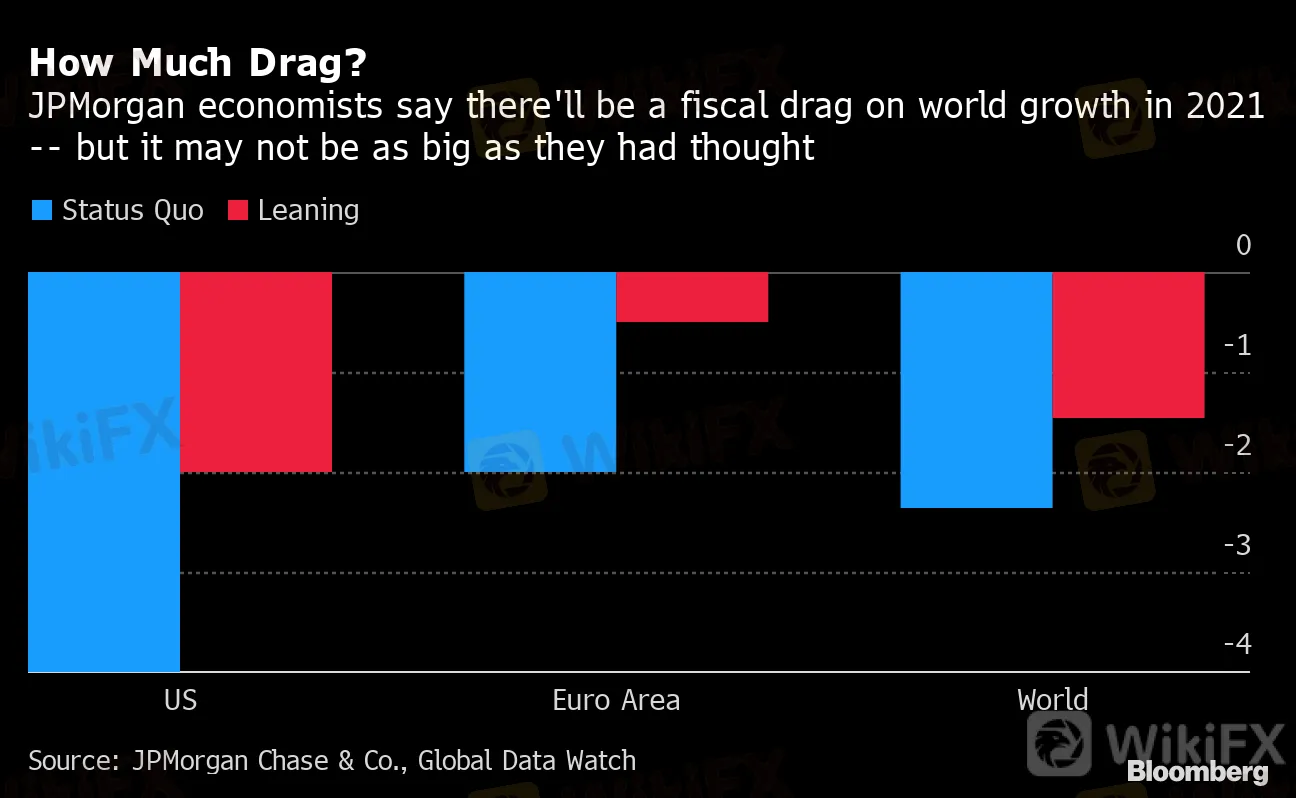

Some retrenchment looks inevitable. JPMorgan Chase & Co. says therell be a fiscal drag on the world economy next year -– but it may be less severe than expected, as momentum in the U.S. and Europe shifts toward extending aid.

How Much Drag?

来源:摩根大通,全球数据观看

下面在世界比格的财政前景的SA综述牛逼的经济体。

{} 21 美国 {21} {} 22 财政部长史蒂芬Mnuchin所有,但所谓的时间周三在几个月 - 长尝试11月3日总统大选前获得国会通过一个经济刺激法案。为失业,小企业和地方当局这意味着更多的支持可能将不得不等待,直到新一届国会于1月就位。 {22} {} 777 但预期财政刺激在2021年已与民主党挑战者乔·拜登民调领先总裁唐纳德·特朗普,以及民主党可能横扫过国会的可能性日益一起。 {777} {} 24 在那种情况下,分析师说大流行的措施至少价值$ 2.2万亿 - 量民主党一直在推动 - 通过立法将可能速度。随着划分国会像现在一个,选后的刺激将面临更强硬的路线谁就赢得白宫。 {24} 欧元区

{26} 在欧洲,悬崖边还有一段路要走 - 与管道更多的预算支持。各国政府已经延长早期流行的方案,其中提供了慷慨的贷款,信用担保和工资的支持,和欧洲的联合援助几乎18000亿欧元($ 2.1万亿美元),为集团的突破口,仍然在等待发放。 {} 26 {} 28 财长被告知要保持政策的扩张性2021,并逐步取代长期措施紧急援助,这将有助于促进低碳,数字经济。与此同时,最近的债务危机并没有被遗忘,而南欧国家,甚至在流行病高失业率和债务,知道他们会受到来自投资者特别审查。 {28} {29 } 日本 {29}{15}

JPMorgan economists say there'll be a fiscal drag on world growth in 2021 -- but it may not be as big as they had thought

{15}

{17}

Source: JPMorgan Chase & Co., Global Data Watch

{17}

{20}

Here‘s a roundup of the fiscal outlook in the world’s biggest economies.

{20}{21}

U.S.

{21}{22}

Treasury Secretary Steven Mnuchin all but called time Wednesday on the months-long attempt to get a stimulus bill through Congress before the Nov. 3 presidential election. That means more support for the unemployed, small business and local authorities will likely have to wait until a new Congress is seated in January.

{22}{777}

But expectations for a fiscal boost in 2021 have been growing along with Democratic challenger Joe Bidens poll lead over President Donald Trump, and the likelihood that Democrats could sweep Congress too.

{777}{24}

In that scenario, analysts say pandemic measures worth at least $2.2 trillion –- the amount Democrats have been pushing for -- would likely speed through the legislature. With a divided Congress like the present one, post-election stimulus will face a tougher path whoever wins the White House.

{24}{25}

Euro Area

{25}{26}

In Europe, the cliff-edge is still some way off -– with more budget support in the pipeline. National governments have extended early-pandemic programs, which offered generous loans, credit guarantees and wage support, and almost 1.8 trillion euros ($2.1 trillion) of joint European aid, a breakthrough for the bloc, is still waiting for disbursement.

{26}

{28}

Finance ministers have been told to keep policy expansionary in 2021, and to gradually replace emergency aid with longer-term measures that will help foster a low-carbon, digital economy. At the same time, a recent debt crisis hasn‘t been forgotten, and Southern European countries, with high unemployment and debt even before the pandemic, know they’ll be under particular scrutiny from investors.

{28}{29}

Japan

{29}{30}

Japan‘s government debt is on track to reach 266% of GDP this year, according to the IMF. But it hasn’t caused obvious problems for the economy, and new Prime Minister Yoshihide Suga says theres no hard limit to how much he can borrow.

{30}

For now, Suga still has several trillion yen from a second extra budget to help support the pandemic economy. If the third-quarter rebound proves weaker than expected, speculation of another top-up will likely mushroom.

Before Suga took over, the government had already pushed back the cliff edge for its furlough program by three months, to the end of the year.

{34}

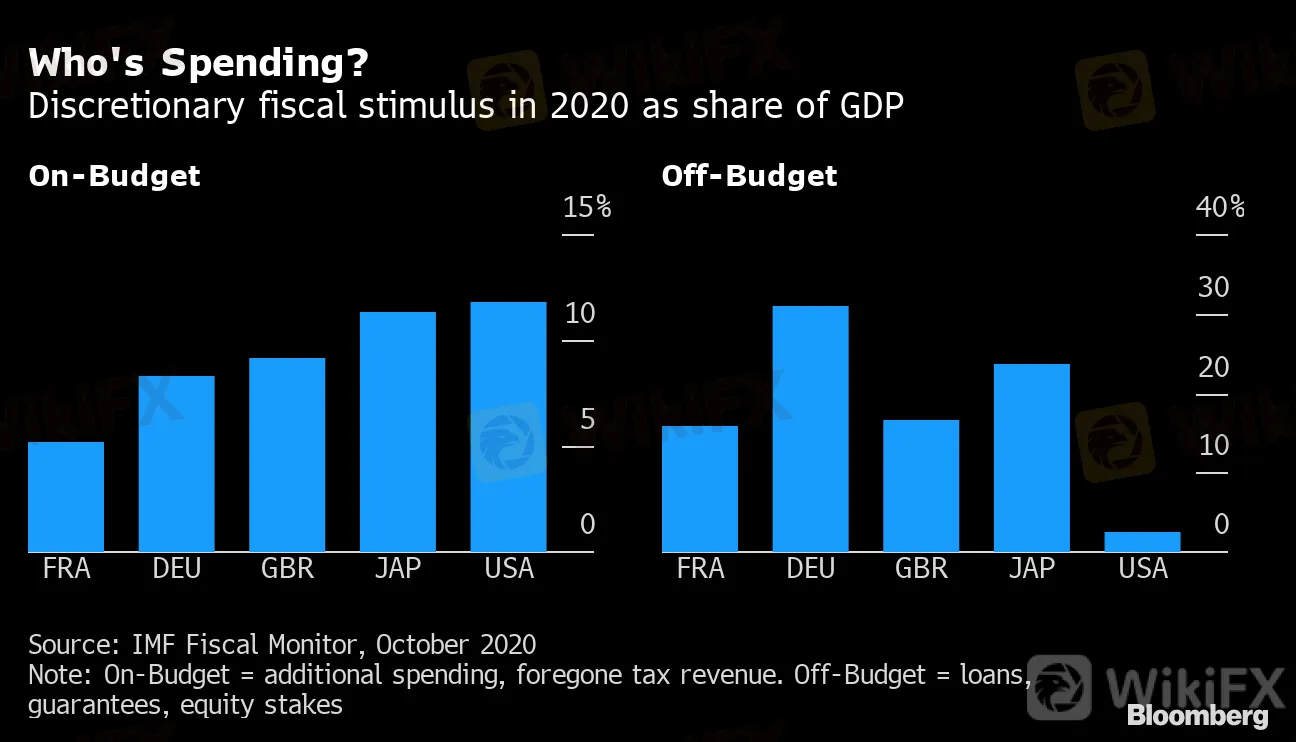

Who's Spending?

{34}

Discretionary fiscal stimulus in 2020 as share of GDP

Source: IMF Fiscal Monitor, October 2020

{38}

Note: On-Budget = additional spending, foregone tax revenue. Off-Budget = loans, guarantees, equity stakes

{38}

U.K.

The U.K. is already trying to scale back stimulus -– and finding it‘s hard going, especially in the middle of a menacing new wave of coronavirus cases. Chancellor of the Exchequer Rishi Sunak has said early-pandemic spending levels aren’t sustainable, suggesting tax increases in the medium term.

The government said last month it would replace an across-the-board furlough program -– which supported more than 9 million jobs, at a cost of almost 40 billion pounds ($52 billion). The new, more targeted plan was expected to trigger a jump in unemployment.

Since then, Sunak has had to backpedal –- announcing additional wage support for workers at companies that are forced to shut down under new lockdown rules. The government has also deferred a deadline for businesses to apply for government-backed loans, and eased the terms for paying sales taxes.

China

Far from facing a fiscal cliff, Chinas government is finding it hard to spend the trillions of yuan in fiscal firepower that it has set aside to bolster what is already a steady economic recovery. The IMF expects China to keep more of its fiscal stimulus in place over the next few years, compared with developed economies.

{48}

The government is selling a record amount of bonds this year to pay for stimulus. Much of that is at the local level, with 3.75 trillion yuan ($558 billion) earmarked to help regional authorities develop infrastructure.

{48}

India

Like China, India is forecast by the IMF to run relatively large budget deficits through 2023.

{52}

With its economy set to shrink by more than major emerging-market peers this year, the government is rolling out additional fiscal stimulus, more recently targeted at consumers, the bedrock of the economy. However, much of the support so far has fallen short of expectations and hasnt given the economy the immediate boost it needs.

{52}

Fiscal room is also shrinking following a plunge in government revenue, forcing authorities to borrow a record amount this year. That surge in debt has pushed Indias credit rating closer to junk.

— With assistance by Yuko Takeo, Yoshiaki Nohara, and David Goodman

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

WikiFX Review: Is IQ Option trustworthy?

5 Questions to Ask Yourself Before Taking a Trade

Quadcode Markets: Trustworthy or Risky?

Avoid Fake Websites of CPT Markets

Webull Canada Expands Options Trading to TFSAs and RRSPs

Currency Calculator