简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bailey Says BOE Hasnt Yet Reached a Judgment on Negative Rates

Abstract:SHARE THIS ARTICLE ShareTweetPostEmailBank of England Governor Andrew Bailey pushed back against sp

Bank of England Governor Andrew Bailey pushed back against speculation that central bank would cut interest rates below zero anytime soon, saying policy makers havent reached any judgment on whether to introduce negative interest rates.

The central bank is examining the operational implications of taking rates below zero, such as whether computer systems are able to handle negative figures. However, officials have other tools available and will use them actively as necessary, Bailey said on a webinar Tuesday hosted by Queens University Belfast.

“I just say to people, with all this speculation about whether we are or we aren‘t, we aren’t there at the moment,” Bailey said. “What we are doing is all the groundwork that we need to do to have another tool in the box and have it effectively in the box.”

Money markets briefly pared bets on BOE easing after his comments, pushing back the next 10 basis point rate cut to 0% to June from May before quickly reverting.

Speculation that the BOE will take rates into negative territory has grown in recent weeks as a resurgence of the coronavirus, rising unemployment and the potential for a messy Brexit reinforced downside risks to the U.K. economy. The BOE also stepped up its study of the policy, though it subsequently said this didnt mean action was imminent.

{12}

Policy makers have already expanded asset purchases and slashed rates to a record 0.1% since the virus hit the U.K. They are widely expected to increase the quantitative easing target again, and have said that they will begin structured talks with banks on the viability of sub-zero rates in the coming quarter. Bailey said there was no end date for the review.

{12}

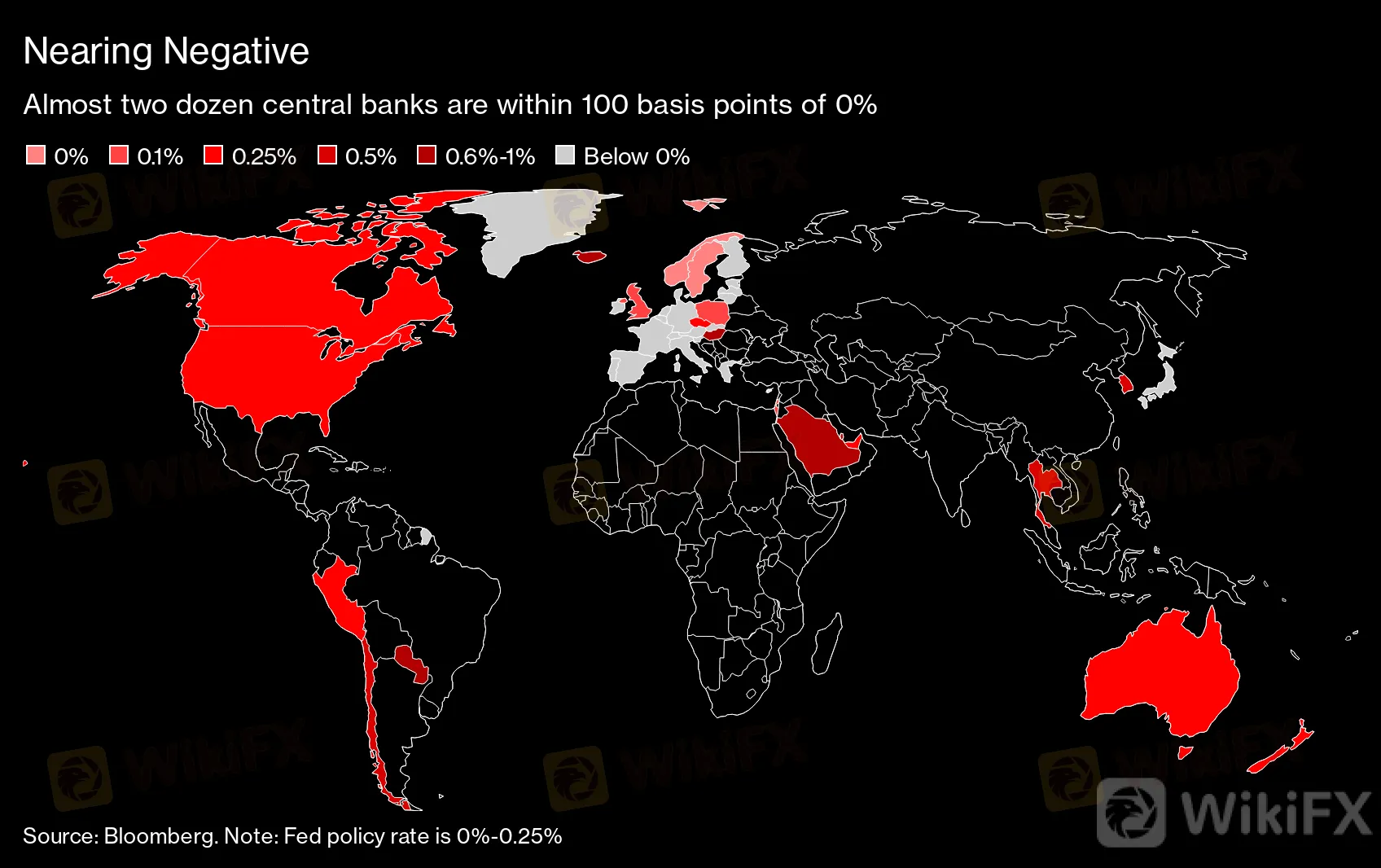

Nearing Negative

Almost two dozen central banks are within 100 basis points of 0%

Source: Bloomberg. Note: Fed policy rate is 0%-0.25%

Deputy Governor Dave Ramsden also played down the speculation. In an interview released on Monday, he said that he regards the current 0.1% level as the so-called effective lower bound for rates. However, Monetary Policy Committee member Silvana Tenreyro told the Telegraph newspaper at the weekend that she sees “encouraging” evidence on the policy.

Separately, Bailey said the U.K. housing market is unlikely to see any sharp downward movement. Home purchases have been buoyed in recent months by a temporary tax reduction thats set to expire in March.

| Read More: |

|---|

|

— With assistance by David Goodman, Eileen Gbagbo, and James Hirai

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator