简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

3 Mistakes Investors Make During Election Years

Abstract:The US Presidential Election 2020 is near and often this causes anxiety for many retail investors. And we all know when our emotions are in play, we tend to make many stupid and unnecessary mistakes.

The US Presidential Election 2020 is near and often this causes anxiety for many retail investors. And we all know when our emotions are in play, we tend to make many stupid and unnecessary mistakes.

Today let's touch on the 3 Mistakes Investors Make During Election Years in hopes that you will be aware of them, and more importantly not fall for them.

#1 - Overanalyzing which party will win

It's interesting to follow and dip our toes into forecasting who's gonna win this coming election - Biden or Trump. And you might even have your personal preference on who you favour as the upcoming US President.

But while we can do all the analysis and prediction, as traders and investors, we always follow the mantra that “the market is always right”.

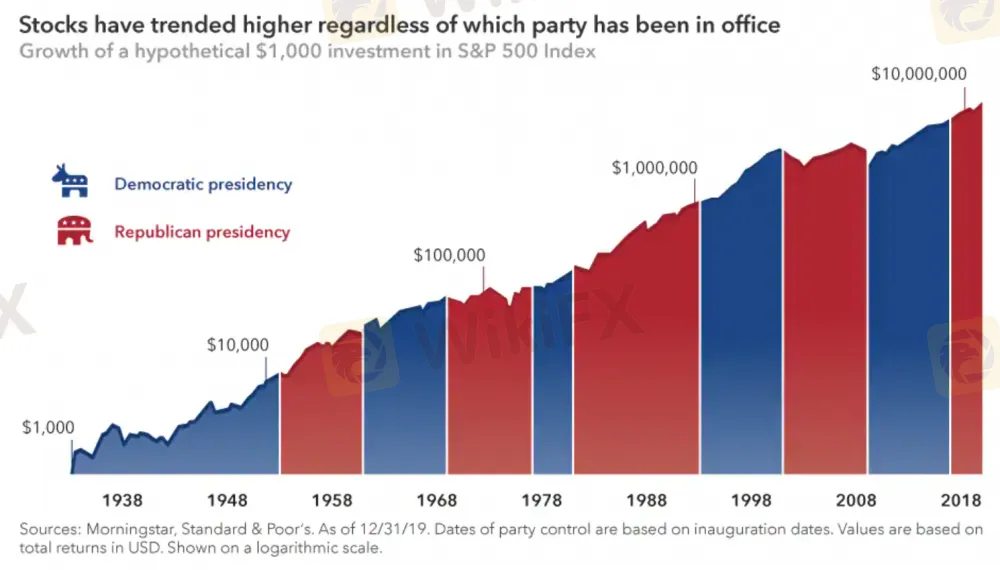

If we were to look all the way back to 1933 when Franklin D. Roosevelt took the presidential office to date, the stock market (S&P 500) has trended higher regardless of which party has been in office.

So while some of us gonna have our own side bet on who's gonna win this election, don't forget to also keep your bet on the stock market

#2 - Too worried about volatility

Markets hate uncertainty, and that causes volatility. There will certainly be higher volatility in the market this coming election, and it's definitely very important that as traders and investors, we are aware of such volatile seasons and take precautionary measures.

But at the same time, it is also because of such volatility, opportunities arise in the market.

“When everyone is worried that new government policy is going to come along and destroy a sector, that concern is usually overblown,” Lovelace says. “Companies with good drugs that are really helping people will be able to get into the market, and they will get paid for it.”

The key here is to seek out these opportunities and manage our risk accordingly.

#3 - Trying to time the market

According to Morningstar, since 1992, investors have poured assets into money market funds much more often leading up to elections. By contrast, equity funds have seen the highest net inflows in the year immediately after an election.

This suggests that investors may prefer to minimize risk during election years and wait until after uncertainty has subsided to revisit riskier assets like stocks.

However, the results haven't been favourable to them. According to historical statistics, these investors tend to underperform when they try to time their investment around the elections.

To capitalize on this, look to position yourself ahead of the herd. And when these retail investors re-invest back into the equities market, they will be providing the demand force that pushes price higher.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

These Are How Millionaire Forex Traders Think and Act

It's no secret that in the world of trading, the most difficult thing is realization. Everyone can expect to be a successful trader, a trader who wins a lot of money, to a millionaire trader. But all this could be a dream if they didn't try to chase it.

How to Register Forex Trading, 5 Easy Steps to Follow

Foreign exchange has been developed and turned into something big in all of society. Not just office employees, but also students, kids in school, housewives, and even the unemployed.

Pip In Forex Trading, The Relation to Profitability

Pip or price interest point or percentage in point is a measurement tool associated with the smallest price movement any exchange rate makes. Usually, there is four decimal places used to quote currencies.

Euro Drops to 2-Decade Low on Recession Fears

Worries about how the European Central Bank will react also undermined sentiment after Germany's Bundesbank chairman Joachim Nagel lashed out at the ECB's plans to try and protect heavily indebted countries from sharp increases in lending rates.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Currency Calculator