简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBP/USD May See Deepened Loss

Abstract:GBP/USD created the deepest loss since March after experiencing a surge early this year and a slump in September.

WikiFX News (2 Oct.) - GBP/USD created the deepest loss since March after experiencing a surge early this year and a slump in September. The main theme for the pair this year lies in the Brexit and the outbreaks of COVID-19. In the last quarter of 2020, where will the British pound move to?

Technically speaking, GBP/USD dwindled straightly towards the 200-SMA (Simple Moving Average), a watershed between the upbeat and downbeat sentiment, after breaching the Rising Wedge support. The path of least resistance for the pair is expected to be lower as the RSI (Relative Strength Index) is approaching the oversold territory and the MACD indicator has fallen below the zero line.

Moreover, the negative slope of both the 21- and 50-DMA indicates a swelling bearish momentum, which could ultimately drive the price down to the confluent support crossed at the April high of 1.2648 and the uptrend extending from the May low of 1.2183 if the 200-DMA is unable to stifle selling pressure. On the contrary, a short-term recovery could be on the cards if price can climb back above the June high of 1.2813. Once there is a close above the August low of 1.2981 and the 50-DMA of 1.2960, the March high of 1.3200 may carve a path for a retest.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX

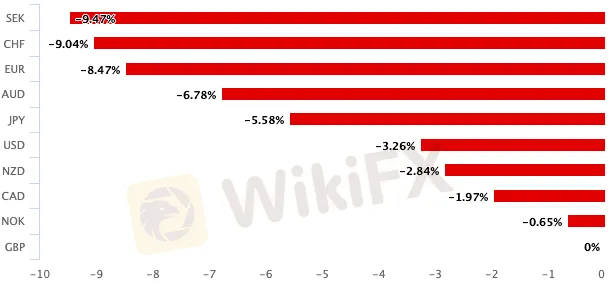

Chart: Comparison of Currencies; GBP is 2020's worst performing currency.

Chart: Trend of GBP/USD

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Myaccount Upgrade Announcement

We are pleased to announce that STARTRADER MyAccount is scheduled for system upgrade starting at 00:00 platform time (GMT+3) on July 6, 2024, and will be completed within the same day.

Trading Hours Adjustment of Cryptocurrency Products

Trading Hours Adjustment of Cryptocurrency Products

STARTRADER Secures 4 Awards at ProFX Awards Ceremony

In an honorable moment, STARTRADER has received 4 prestigious awards at the ProFX Awards ceremony held on 31 May 2024, Queen Elizabeth 2 Hotel in Dubai, UAE.

Today's analysis: USDJPY Set for Potential Increase Amid Intervention Risks and Bullish Trends

USD/JPY is near intervention levels with Japanese officials warning of potential forex actions. Despite a bullish trend, caution is advised due to possible government interference. The pair has risen past 158.25, aiming for 160.20, within a broader uptrend from 150.25. A break below 150.87 could signal a larger correction towards 146.47.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator