简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Hedge Fund Looks for Bottom in Turkish Lira

Abstract:Hedge fund manager Peter Kisler is looking to this weeks Turkish central-bank meeting for a signal to start buying lira.

An employee hands 200 Turkish lira banknotes to a customer on the counter inside a foreign currency exchange bureau in the Beyoglu district of of Istanbul, Turkey, on Tuesday, Aug. 11, 2020. A day after the latest call from President Recep Tayyip Erdogan for lower borrowing costs to boost economic growth, the central bank reduced the cheaper liquidity it provides to primary dealers as part of its open market operations to zero from Aug. 12, according to a statement on Tuesday.

Hedge fund manager Peter Kisler is looking to this weeks Turkish central-bank meeting for a signal to start buying lira.

The question is whether Turkey will let its currency weaken further or hike rates to defend it, said North Asset Management‘s Kisler. The London-based investor sold all its Turkish assets before capital outflows started accelerating in March, fueling the lira’s decline to a record against the dollar.

The lira one-month deposit rates of 16.25% is the highest in emerging markets, and lucrative compared with peers such as Russia at 4.35% and South Africa at 4.25%. But those returns would dissipate if the lira continues weakening and inflation remains in double digits. So far, policy makers have resisted raising borrowing costs even as the currency slumped, and theyre expected to leave the benchmark rate unchanged at 8.25% on Thursday.

“If the central bank meaningfully hikes rates and says they are willing to hike further, that would definitely make Turkish assets more attractive,” Kisler said. “If they do hike, the first step would be to see the market reaction and how the government outside the central bank would react, but I would at least start looking for buying options on the lira.”

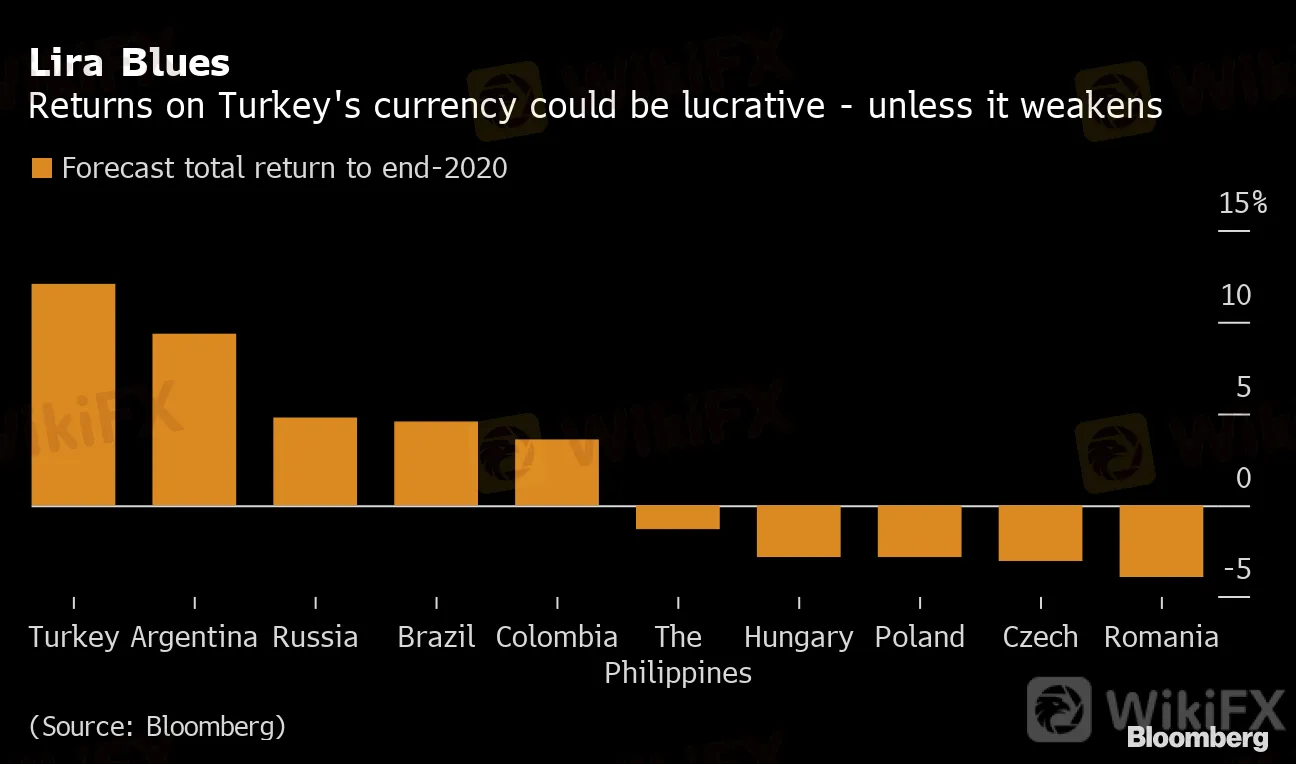

Lira Blues

Returns on Turkey's currency could be lucrative - unless it weakens

(Source: Bloomberg)

Kislers North Emerging Markets Fund returned 51% in the first six months of this year by shorting emerging-market debt before the selloff, according to a monthly report seen by Bloomberg. Similar macro funds are up an average of 2.7% this year.

{22}

The easiest way to profit from lira appreciation is just to buy the currency cash, Kisler said, because of scarce liquidity in the debt market, a result of restrictions on the flow of capital to stifle foreign investors‘ ability to bet against the lira. Kisler said he wasn’t targeting any specific exchange-rate level to buy, and would look out for measures aimed at stabilizing the lira.

{22}

{24}

The lira gained on Tuesday for the first time in five days as the central bank took further steps to tighten liquidity in the banking sector. The currency has declined 19% this year, hitting a record of 7.4084 per dollar last week. Before its most recent bout of weakness, the currency was held in a tight range below 7 per dollar for more than two months through dollar sales by state banks.

{24}

“I suspect they are going to try to re-peg again at a new, higher rate, but is that rate 7.5 or is it 8?,” Kisler said. “If they have actually taken the decision to let it go, you could see it weaken to 8, if not more, and all the carry will be gone. There is a lot of uncertainty.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Japan to Take Action to Stabilize the Yen

Ringgit Remains Flat Amid Holidays, US Debt Concerns Loom

Taurex: Is it Safe to Invest?

WikiEXPO Global Expert Interview: Loretta Joseph——Unlock the forefront of digital finance

Vietnamese Police Bust $1.2 Million Crypto Fraud Case

XTB Receives Licenses to Operate in Indonesia & UAE

SEBI Bans Big "Finfluencers for Misleading Investors"

WikiFX New Year Bash: Chance to Win 70 USDT

Malaysia’s Securities Commission Enforces Ban on Bybit & Its CEO

WikiFX Review: Is HYCM still reliable in 2024?

Currency Calculator