简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Inflation Binds Czechs After Fast Rate Cuts

Abstract:While the coronavirus continues to crush consumer demand and prompt central bankers to vow more action to help their economies, policy makers in a country bordering the euro area see their anti-pandemic work as essentially done for now.

LISTEN TO ARTICLE

2:21

SHARE THIS ARTICLE

Share

Tweet

Post

A pedestrian wearing a protective face mask walks past the headquarters of the Czech central bank in Prague, Czech Republic, on March 18.

Photographer: Milan Jaros/Bloomberg

Photographer: Milan Jaros/Bloomberg

While the coronavirus continues to crush consumer demand and prompt central bankers to vow more action to help their economies, policy makers in a country bordering the euro area see their anti-pandemic work as essentially done for now.

{13}

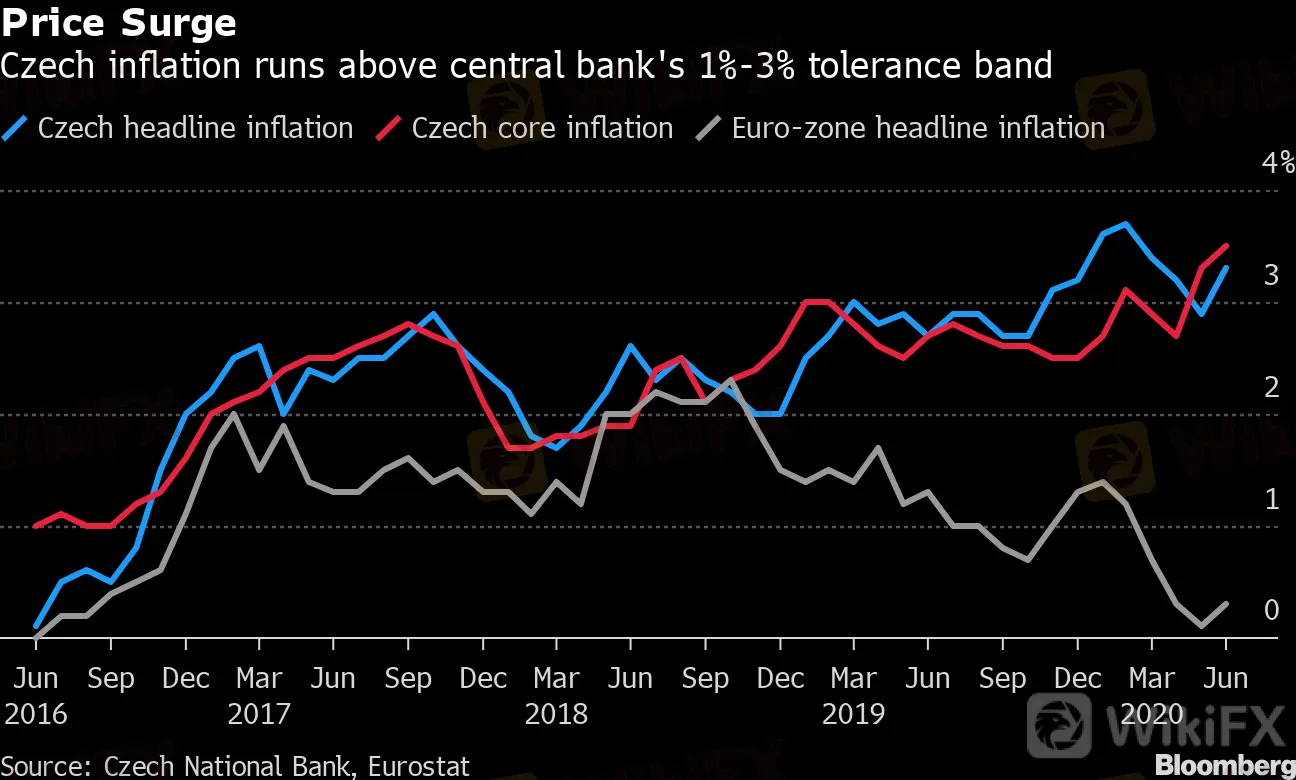

After cutting interest rates by a cumulative 2 percentage points from March to May -- the fastest pace in the European Union -- the Czech Republic is facing a rare spike in price growth thats coinciding with the virus-induced recession.

{13}

The combination is allowing the central bank to take a break, possibly for a year or more. Economists expect it to leave the benchmark unchanged at 0.25% at a meeting on Thursday.

Price Surge

Czech inflation runs above central bank's 1%-3% tolerance band

Source: Czech National Bank, Eurostat

{777}

Despite a 10.7% drop in second-quarter output from a year earlier, government support is helping keep inflation above target and keeping the lid on unemployment, which remains one of the lowest in Europe. Investors have removed bets on further monetary easing.

{777}

“Our baseline forecast scenario is for interest rates to remain stable at current levels until end-2021,” said Martin Gurtler, an analyst at Komercni Banka AS. “Inflation is likely to slow significantly in the coming months.”

Read more:

Record Economic Hit Is Better Than The Tragedy Czechs Braced For

Czech Rates to Stay Low as Stagflation Is Temporary, Holub Says

A $400 Billion Fund Bets Czech Rate Hikes Will Return Next Year

Virus Helps Czech Billionaire Leader Go on a Spending Spree

Worse-than-expected retail sales for June, the first month the economy almost fully emerged from a virus lockdown, show households remain uncertain about the recovery. The country still has more job vacancies than unemployed, largely thanks to temporary government subsidies for workers salaries and state guarantees for cheap business loans.

After inflation unexpected jumped to 3.3% in June, central bank board member Tomas Holub said the “stagflationary trend” is temporary and no rate hikes will probably be needed for at least a year.

The seven-member board is scheduled to announce its decision at 2:30 p.m. in Prague, followed by a press briefing with Governor Jiri Rusnok and the highlights of fresh quarterly forecasts at 3:45 p.m.

“Markets shouldnt look for rate hikes signals,” said economist Mai Doan at Bank of America Corp. in London. “We remove our rate-cut expectations for 2020 and see rates on hold at 0.25% through 2021.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Currency Calculator