简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

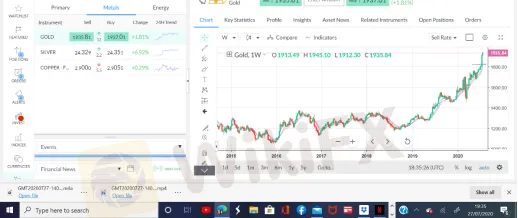

Gold hits a record high in 9 years | KOL Forex Analysis•Bola Akinya

Abstract:Gold prices hit a record high on Monday, as a weakening dollar injected new momentum into a rally driven by uncertainty about the world economy. Investors are rushing to Gold more than other precious metals as a result in the rising concerns of a second wave of the dreaded pandemic, COVID-19

Gold prices hit a record high on Monday, as a weakening dollar injected new momentum into a rally driven by uncertainty about the world economy.

Investors are rushing to Gold more than other precious metals as a result in the rising concerns of a second wave of the dreaded pandemic, COVID-19

Futures contracts for delivering gold in August shot up as much as 2.2% to $1,940.10 a troy ounce, topping the previous intraday peak of $1,923.70 from September 2011.

They ended the day up 1.8% at $1,931, a second consecutive closing record.

Gold hit an all time closing high for the first time in nearly nine years Friday, but remained short of the intraday record.

Monday‘s record marked a milestone in gold’s bull run, which many traders rank alongside those of 2008-11 and the late 1970s. The gloomy outlook for the world economy, a decline in interest rates, rising tensions between the U.S. and China, and the dollars depreciation have fueled the surge as investors have bought assets they perceive to be havens.

“There are still a lot of things to be worried about, which is why gold is attracting all this attention and all this money,”

Youre seeing money slipping out of the stock market or out of other assets and just eking into gold.

Gold, as a small market, is moving a long way as a result.

The advance marked gold‘s seventh consecutive daily advance, the metal’s longest winning streak since February.

Gold prices have gained nearly 9% over the past month and about 27% this year, making the metal one of the strongest-performing major assets in 2020.

The price of silver, seen as a store of value by investors as well as having widespread industrial uses, rose even more sharply than gold Monday. Futures for September delivery, the most widely owned contracts, jumped 7.2% to $24.501 an ounce, the highest level in almost seven years.

Adding impetus to gold and silver Monday was a weakening in the dollar, which made the precious metals more attractive to investors overseas. The ICE U.S. Dollar Index, which tracks the dollar against the currencies of six trading partners, fell Monday, extending a recent slide that has it on track for its worst month in nearly a decade.

Golds traditional inverse relationship with the dollar had frayed this year, as both assets benefited from haven buying during the pandemic.

It is now reasserting itself, a factor that will boost gold in the coming months if the dollar continues to slide, said Joni Teves, precious-metal strategist at UBS Group.

Still, the move in gold this year has really been driven by rising strategic interest,

Investors who were previously uninterested in the precious metal are now buying it, a trend that could lift prices above $2,000 an ounce within six months, s

Gold prices have leapt in London, the main hub for buying and selling gold bars, as well as in New York‘s futures market. In Friday’s auction, prices topped $1,900 for the first time since the Bank of England and N.M. Rothschild & Sons Ltd., now investment bank Rothschild & Co., founded the daily price in 1919.

One factor that distinguishes the current surge in gold prices from the bull run during and after the last global financial crisis is the fragile state of demand for physical metal. Lockdowns and economic uncertainty have crimped jewelry purchases in India and China, normally two huge bullion markets.

So far, a burst of buying by investors has more than offset the dearth of jewelry demand. But if financial demand dries up, prices could fall without physical consumption to act as a cushion for prices.

Investors who wouldnt normally be active in the market until European and U.S. hours bought gold in thin Asian trading Monday, exaggerating the rise, and London sessions this morning is still reeling from the effects.

Weekly Analysis and Projections

Considering the current global downturn and potential for a global depression, GOLD seems like it is about to blow its top.

If a clear rejection is seen from its all-time highs, there is a potential for a CUP and HANDLE pattern to form which is very bullish for the commodity.

BULLISH for Gold ; however very BEARISH for the World's economy.

[About The Author]

Bola Akinya is a Forex trader and consultant with more than 20

years of immense experience in Forex Indices, Commodities and

Currencies.

Prior to becoming a professional Trader, she held positions as a

Head of Sales/Business Developer with Credit Registry and Operations

Manager with Peak Merchant Bank both in Nigeria before moving to UK

where she worked with great companies like AIG and The Wealth Training

Company as Course Instructor and Speaker for over 15 years on the FX and

Stock Markets before she set up her own Forex training school – The

Learn and Earn Forex Training Company 5 years ago.

Company as Course Instructor and Speaker for over 15 years on the FX and Stock Markets before she started (my own) company

Through using of Fundamental and Technical analysis, with highlight

of trader psychology, she has derived successful trading strategy in

short and medium term.

As the top Forex coach and mentor, she has trained individual traders/investors with her formidable strategies.

ng Guanyi Online Finance Channel - Fund and Commercial Bond

-Columnist of Wealthub Finance and Investment Smart Platform of Enrich Culture

-Guest presenter of Weekly Investment in the World of Enrich Culture

Flash

Event! Download WikiFX App now and sign up, youre gonna get a 6-month

WikiFX VIP membership worth of US$9 and the latest WikiFX global

e-Magazine for free. Contact support@wikifx.com with title [For

Download Rewards+ your wikifx ID]. We will reply you within 3 days.

WikiFX, a third-party forex broker inquiry platform, has collected

the information of 19,000+ forex brokers, 30 regulators, and helped

victims recover over 300,000,000.00 USD. WikiFX App provides functions

like forex brokers inquiry, calender, forex news express, calculator and

other trading tools to help you get trading done with ease.

Forex brokers inquiry: in order to create a safe forex trading

environment, WikiFX offers you two methods of checking the compliance of

forex brokers, online checking and offline investigation report. WikiFX

has an independent inspection team, conducting on-spot visit to brokers

offices to identify they are trustworthy or not.

Forex calender: the financial events which may affect forex trading

Forex news express: providing you the latest info anytime and anywhere

Forex forum: tons of posts by WikiFX users, containing technical

analysis, industry discussion, fraud brokers exposure; Users can

exchange their thoughts here freely.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX| Daily F.X. Analysis, August 28 |Arslan Ali Butt-KOL

WikiFX| Daily F.X. Analysis, August 28 |Arslan Ali Butt-KOL

EurAud – A Possible Third Retest of the Support Zone|KOL Analysis• Jasper Njuguna

The last three months has been a state of dull to especially swing traders who were riding the bearish trend as there now caught up in a range zone for the stated trading duration period. Earlier in the year, we saw a significant strong bullish move that started right about 1.61034 price handle and as per now it is still holding fort as a credible support level with four retest to the upside. It may not lost on market participants that that level still holds some very worthwhile long limit orders or buys orders from large players and position traders.

GBP/USD Remains An Attractive Buy!|KOL Analysis•Olimpiu Tuns

GBP/USD edges higher and it’s almost to hit 1.3285 yesterday’s high as the greenback is punished by USDX’s sell-off. The pair has confirmed again that the bullish bias remains intact on the Daily chart. Another higher high, a bullish closure above 1.3285 brings in new long opportunities. USD takes a hit from the US Dollar Index which failed once again to take out a dynamic resistance. USDX is traded at 92.61, right above 92.55 critical support. A valid breakdown validates a deeper drop and EUR/USD bullish run.

USD/CAD - Could A Short Term Reversal Be on the works?|KOL Analysis• Jasper Njuguna

Even though my sentiment for this pair is still bearish, as one looks at a text book perfect descending channel and where the upper trend line really being respected as strong support line having being tested four times. Nevertheless, it seems currently as we near close of monthly trading session, either sellers may be giving up ground, facing some bearish trend exhaustion or purely taking out some of the profits if at all not taking out their positions.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Standard Chartered Secures EU Crypto License in Luxembourg

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator