简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Lonely Oil Tankers Signal Ongoing Drop in Asia-Europe Fuel Trade

Abstract:Shipments of diesel and jet fuel from East Asia to Europe are set to stay low for a while yet, potentially aiding hard-pressed European refiners.

Shipments of diesel and jet fuel from East Asia to Europe are set to stay low for a while yet, potentially aiding hard-pressed European refiners.

Only two ships hauling about 160,000 tons of fuel have sailed the route so far this month and just one, the Navig8 Pride LHJ, is currently booked to make the voyage in the coming weeks, according to fixture lists and tanker-tracking data compiled by Bloomberg. Thats a sharp contrast with the May-June period, when in excess of two million tons arrived in Europe from East Asia, more than the combined arrivals for the whole of January-April.

“We might not see more loadings from East for Europe until next month,” said Sandra Octavia, an oil products analyst at Energy Aspects Ltd. China is likely to boost exports in August, which could push down prices in East Asia to a level that would make it profitable to ship fuel to Europe, she said.

Europe usually doesn‘t make enough jet and diesel-type fuels and imports significant volumes, while Asia is structurally oversupplied with both and regularly exports to Europe, a pattern that was reinforced as the Covid-19 pandemic raged. This month’s slowdown in diesel and jet fuel shipments to Europe reflects Asia‘s economic recovery, as well as the impact of maintenance work at the region’s refineries.

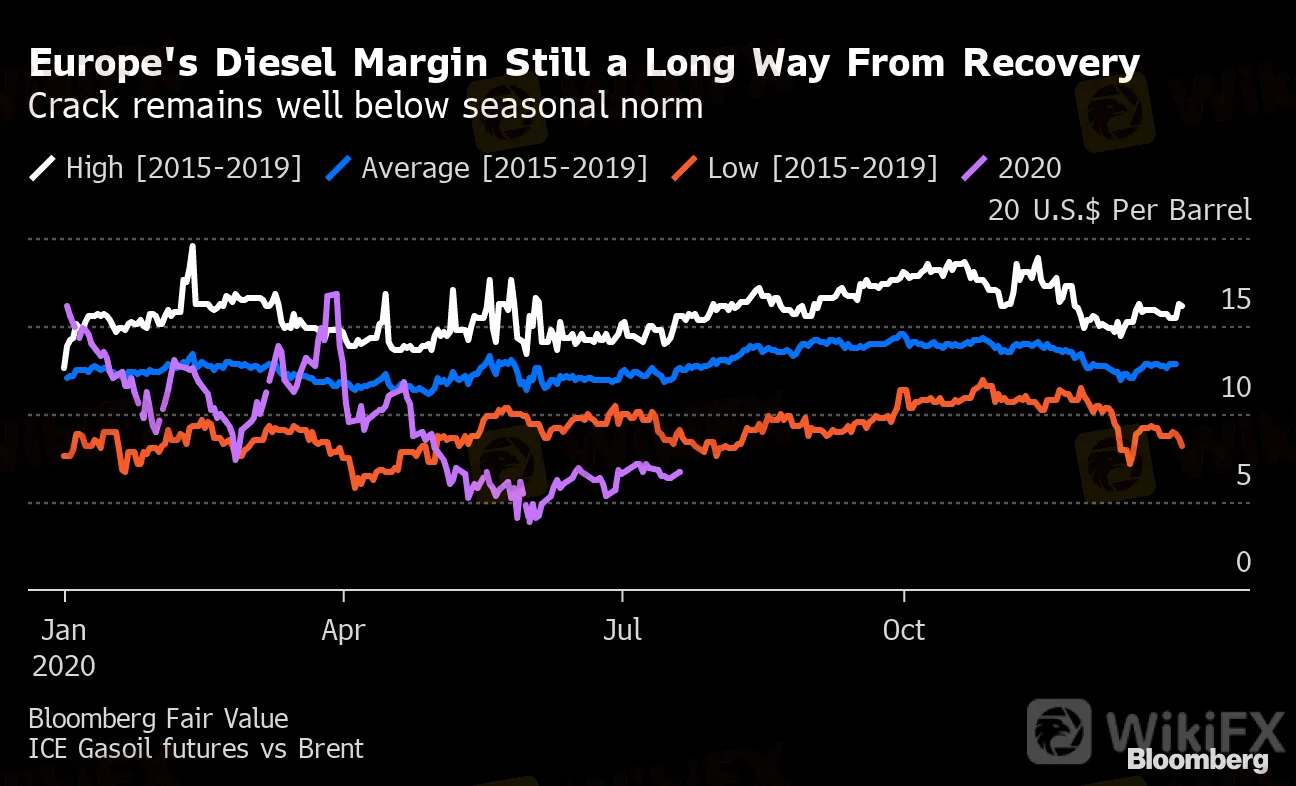

Europe's Diesel Margin Still a Long Way From Recovery

Crack remains well below seasonal norm

Bloomberg Fair Value

ICE Gasoil futures vs Brent

For Europe‘s beleaguered refiners, who have been hit by cratering demand because of the pandemic and face a continent awash with fuel, fewer arrivals are likely to be welcome. Some of May-June’s deluge is still floating aboard ships off the coast of northwest Europe, diesel and jet fuel margins are well below seasonal norms and both are still in a contango structure, where prompt contracts are cheaper than those for sale at a later date.

Its too early to say for sure whether the drop in exports to Europe will be mirrored in shipments from other key fuel suppliers to the region such as the Middle East and the U.S.; with shorter voyage times, bookings may still emerge for ships from these regions that would arrive before the end of August. But the most recent tracking for both regions shows little sign of a rebound next month, after likely declines in July.

{777}

— With assistance by Prejula Prem

{777}

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator