Score

Apolo Trading

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://apolotrade.website/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesUsers who viewed Apolo Trading also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

apolotrade.website

Server Location

France

Website Domain Name

apolotrade.website

Server IP

92.205.13.119

Company Summary

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2020 |

| Company Name | Apolo Trading |

| Regulation | Unregulated |

| Minimum Deposit | $100 for Basic Account, higher for others |

| Maximum Leverage | Up to 1:500 |

| Spreads | Information not available |

| Trading Platforms | Web trader |

| Tradable Assets | Stock market indices and commodities |

| Account Types | Basic, Standard, Professional |

| Demo Account | available |

| Customer Support | Limited contact options; unclear quality |

| Payment Methods | Credit cards, bank wire, cryptocurrencies |

| Educational Tools | Limited educational resources |

| Website Status | Reported as down and potentially a scam |

Overview

Apolo Trading, an unregulated broker established in 2020 and registered in Saint Vincent and the Grenadines, presents a worrisome picture. The absence of regulation raises significant concerns about investor protection. While offering a variety of account types and a demo account, the lack of transparency regarding spreads, coupled with limited educational resources, hinders traders' ability to make informed decisions. Moreover, reports of the website being down and suspicions of being involved in fraudulent activities cast a shadow on the broker's credibility. Combined with unclear customer support, potential investors and traders should approach Apolo Trading with extreme caution.

Regulation

Apolo Trading is an unregulated broker, a classification that should immediately raise concerns for potential investors and traders. Unregulated brokers operate without oversight from financial regulatory authorities, leaving clients vulnerable to various risks. These risks may include fraudulent activities, lack of transparency, and inadequate security measures to protect clients' funds. Unregulated brokers often operate in jurisdictions with lax financial regulations, making it difficult for clients to seek legal recourse in case of disputes or financial losses. It is crucial for individuals interested in trading or investing to prioritize their safety and financial security by choosing brokers that are regulated by reputable authorities to ensure a higher level of accountability and protection for their investments.

Pros and Cons

Apolo Trading presents a mixed picture for potential investors and traders. On the positive side, it offers a range of market instruments, including popular stock market indices and commodities, allowing for diversification of investment portfolios. The broker also provides various account types to cater to different trading needs and risk appetites. However, significant concerns arise due to its unregulated status, which exposes clients to potential risks, including lack of oversight and security. Additionally, the lack of clear information regarding spreads and commissions, coupled with limited educational resources, can be detrimental to traders looking to make informed decisions and improve their trading skills.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

Market Instruments

Apolo Trading offers a range of market instruments that encompass both stock market indices and commodities, providing its clients with opportunities to diversify their investment portfolios and participate in various financial markets.

Stock Market Indices:

S&P 500: The S&P 500 is a prominent stock market index in the United States, representing 500 of the largest publicly traded companies. It offers traders exposure to the performance of a broad cross-section of the U.S. equity market.

Dow Jones Industrial Average (Dow Jones): The Dow Jones is another major stock market index in the United States, comprising 30 of the largest and most established companies. It serves as a benchmark for the overall health of the U.S. stock market.

DAX 30: The DAX 30 is the primary stock market index in Germany, consisting of the 30 largest and most liquid companies traded on the Frankfurt Stock Exchange. It allows investors to track the performance of the German economy and stock market.

Commodities:

Gold: Gold is a precious metal and a popular investment choice for its ability to hedge against inflation and economic uncertainty. It is widely traded as a store of value and a safe-haven asset.

Crude Oil: Crude oil is a vital global commodity used extensively in the energy sector. Trading crude oil allows investors to speculate on oil price movements, which can be influenced by geopolitical events, supply and demand dynamics, and OPEC decisions.

Natural Gas: Natural gas is another important energy commodity. It is used for heating, electricity generation, and industrial processes. Trading natural gas enables investors to take advantage of price fluctuations influenced by factors like weather patterns, production levels, and consumption trends.

Account Types

Apolo Trading offers three account types to suit different trading needs:

Basic Account ($100): Ideal for beginners with a low minimum deposit, providing basic trading features and educational resources.

Standard Account ($500): Designed for traders with some experience, offering a wider range of tools, research materials, and potentially more competitive spreads.

Professional Account ($5,000): Geared towards experienced traders with higher capital, providing advanced tools, comprehensive research, and premium services like dedicated account managers.

Leverage

Apolo Trading offers a maximum trading leverage of 1:500 to its clients. This leverage ratio allows traders to control a larger position size with a relatively smaller amount of capital. While high leverage can amplify potential profits, it also significantly increases the risk of substantial losses. Traders should exercise caution and have a solid risk management strategy in place when using high leverage, as it can lead to both rapid gains and losses in the volatile world of financial markets.

Spreads and Commissions

Apolo Trading's specific details regarding spreads and commissions are currently unclear. To gain a comprehensive understanding of the costs associated with trading on their platform, potential clients are advised to visit Apolo Trading's official website or reach out to their customer support team for precise and up-to-date information. Spreads and commissions can vary widely among brokers, impacting a trader's overall trading costs. Therefore, it is essential for individuals considering Apolo Trading as their broker to thoroughly review their fee structures and assess how they align with their trading strategies and financial goals. Making an informed decision requires a clear understanding of the broker's pricing model, and this information can be obtained directly from Apolo Trading.

Deposit & Withdrawl

Apolo Trading offers multiple methods for both depositing and withdrawing funds, catering to the diverse preferences of its clients:

Deposit Methods:

Credit Card: Clients can fund their trading accounts using credit cards such as Visa, MasterCard, or other major credit card providers. This method is convenient and offers quick access to funds for trading.

Bank Wire: Bank wire transfers allow clients to transfer funds directly from their bank accounts to their trading accounts with Apolo Trading. While this method may take longer to process compared to credit cards, it is a secure way to deposit larger sums of money.

Cryptocurrency: Apolo Trading accepts cryptocurrency deposits, which can include popular cryptocurrencies like Bitcoin, Ethereum, or others. Crypto deposits are often processed quickly and provide an extra layer of privacy and security.

Withdrawal Methods:

Credit Card: Clients may be able to withdraw funds to their credit cards, especially if the initial deposit was made using this method. However, not all brokers support withdrawals to credit cards, and there may be limitations on the amount that can be withdrawn in this way.

Bank Wire: Bank wire transfers are commonly used for withdrawals, especially for larger amounts. This method ensures that funds are transferred directly to the client's bank account.

Cryptocurrency: For clients who deposited funds using cryptocurrencies, withdrawals can often be made in the same cryptocurrency used for the deposit. This can provide a quick and efficient way to access your funds.

The availability of specific deposit and withdrawal methods, as well as any associated fees or processing times, may vary depending on Apolo Trading's policies and the client's location. Traders should refer to Apolo Trading's official website or contact their customer support for precise information on deposit and withdrawal methods, as well as any associated costs and processing times. Additionally, clients should be aware of potential regulatory and tax implications when using certain methods, especially cryptocurrencies.

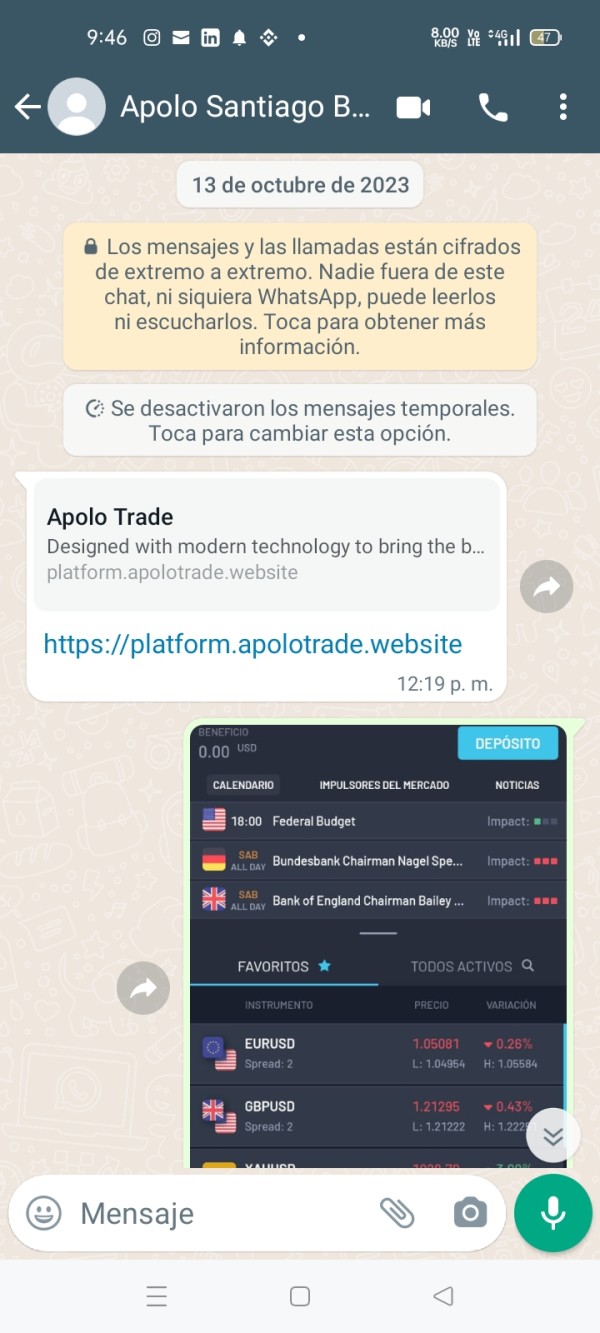

Trading Platforms

Apolo Trading's web trader platform appears to be a rudimentary and limited online trading interface. It offers only basic trading tools, lacks advanced features, and often comes across as clunky and unintuitive. Traders using this platform may find it frustrating to navigate and may be at a disadvantage compared to those using more sophisticated trading platforms with advanced charting capabilities, research tools, and customizability. While it allows for basic order execution, it falls short in providing a comprehensive and competitive trading experience, which could hinder traders' ability to make informed decisions and efficiently manage their investments.

Customer Support

Apolo Trading's customer support appears to be lacking in terms of accessibility and reliability. The presence of only a phone number and a web contact form, coupled with a physical address in the British Virgin Islands that coincides with another brand, raises suspicions about the broker's commitment to providing effective customer service. The use of social media icons that do not lead to actual social media profiles or engagement with clients further reinforces concerns regarding the broker's transparency and credibility. Consequently, potential clients should be cautious and prepared for the possibility of encountering subpar customer support, which could hinder their ability to seek assistance or resolve issues effectively when trading with Apolo Trading.

Summary

Apolo Trading presents several concerning aspects for potential investors and traders. Firstly, the broker operates without regulatory oversight, posing significant risks such as potential fraudulent activities, lack of transparency, and inadequate fund protection. Additionally, the availability of educational resources is limited, hindering traders' ability to enhance their skills and make informed decisions. The trading platform appears rudimentary and lacking in advanced features, potentially disadvantaging users. Customer support is also questionable, with limited contact options and suspicious elements, including an ambiguous physical address. Furthermore, the broker's website being down and reported as a scam raises serious doubts about its credibility and reliability. Overall, Apolo Trading's negative attributes and lack of transparency make it a risky choice for traders and investors.

FAQs

Q1: How can I deposit funds into my Apolo Trading account?

A1: Apolo Trading offers multiple deposit methods, including credit cards, bank wire transfers, and cryptocurrencies. You can choose the method that suits you best.

Q2: Is my money safe with Apolo Trading as an unregulated broker?

A2: Trading with an unregulated broker like Apolo Trading involves higher risks, as there is no regulatory authority overseeing their operations. It's crucial to exercise caution and consider the associated risks when trading with such brokers.

Q3: What is the minimum deposit requirement for opening an Apolo Trading account?

A3: Apolo Trading offers three types of accounts, with the Basic Account having a minimum deposit requirement of $100, the Standard Account requiring $500, and the Professional Account needing a minimum of $5,000.

Q4: Does Apolo Trading provide educational resources for traders?

A4: Apolo Trading appears to have limited educational resources available. Traders may need to seek external educational materials to supplement their knowledge.

Q5: What is the maximum trading leverage Apolo Trading offers?

A5: Apolo Trading offers a maximum trading leverage of 1:500, allowing traders to control larger positions with a relatively smaller amount of capital. However, high leverage also comes with increased risk and potential for significant losses.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 6

Content you want to comment

Please enter...

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Ing3918

Colombia

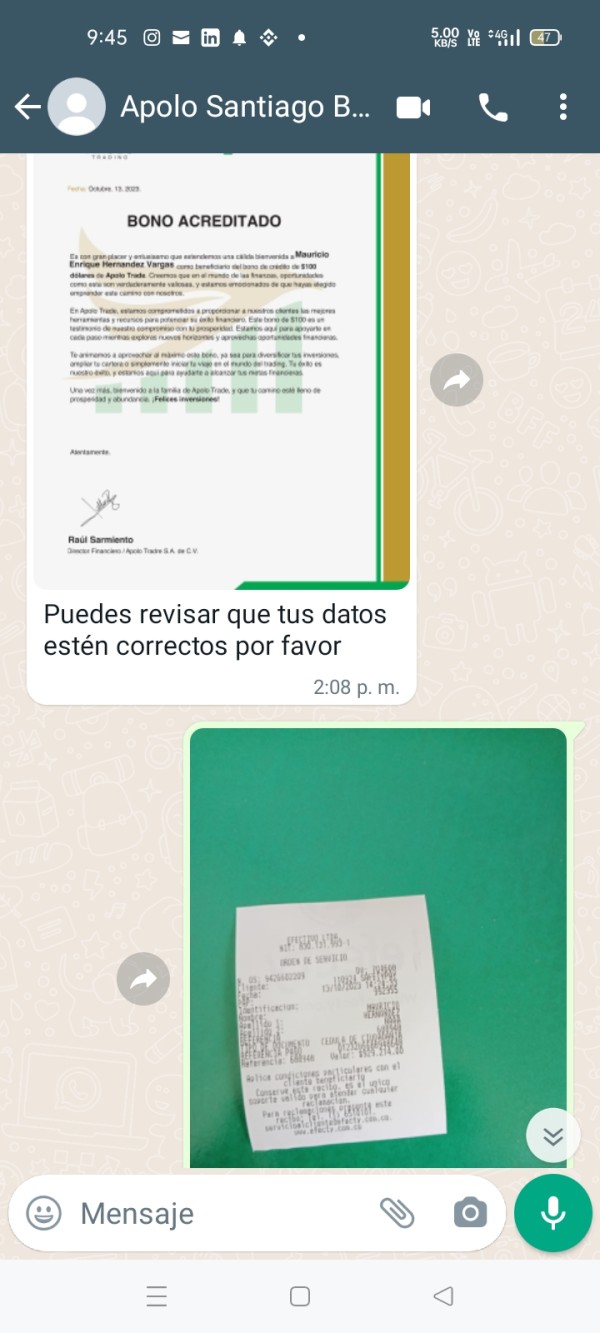

I present this to this community and hope this is the correct channel to broadcast this information and prevent more from continuing to fall into these types of events. They start with the greatest kindness to let me invest 200 USD. They contact you with 4 people with different positions to give credibility, the first opening actions are correct and generate confidence in their analysis, but once no more deposits are generated, increasing the capital that they insist on, they begin with the opening of offers in a manner contrary to the market trend and since they do not allow risk control parameters to be set (stop loss), the account is allowed to go negative until it is burned. They also send statements stating that due to the market change, they have to close the accounts. The supports remain here and I hope it does not happen to more people, who allow themselves to be persuaded by the interest of having greater capital in a short time than what we possess.

Exposure

01-13

mso435

Colombia

They are scammers, they make you invest and if you don't invest more they disconnect and close the platform. Thus they lose customers.

Exposure

01-10

wallace854

Peru

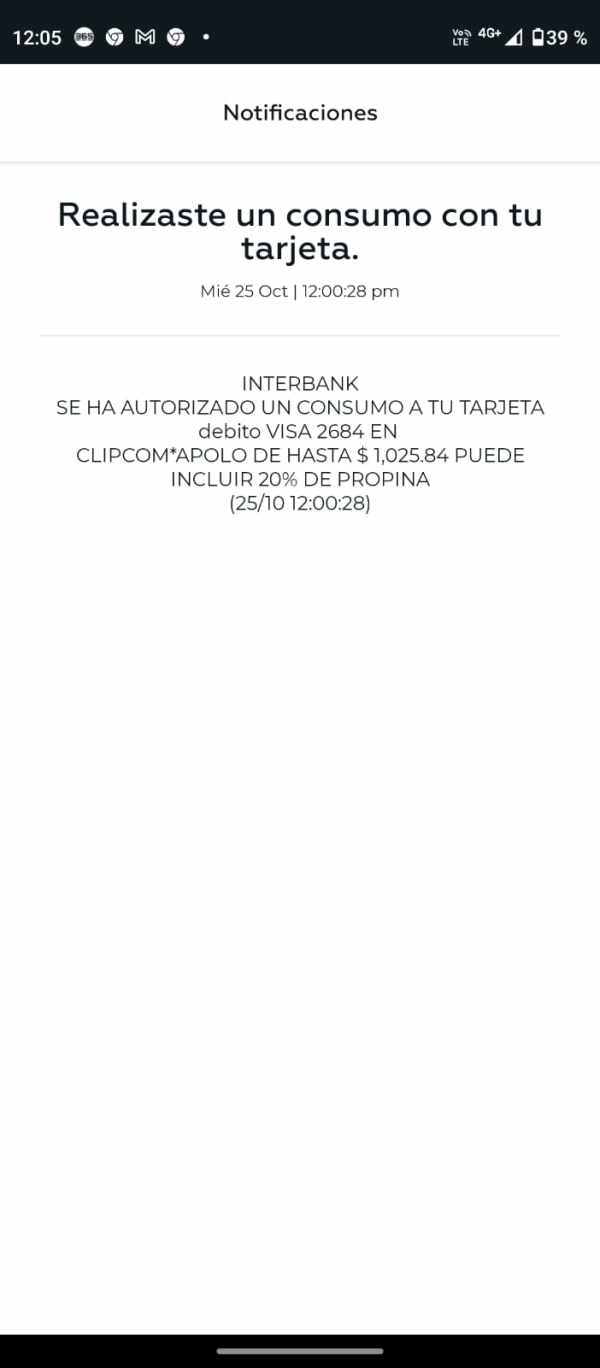

GOOD AFTERNOON I HAVE SUFFERED A SCAM FROM APOLO TRADER FOR AN AMOUNT MORE than 5,000 USD, I STARTED WITH INVESTING 200 USD AS VAT WINNING EACH OPERATION AND IT REQUIRED ME TO INVEST MORE AND MORE TO MAKE A BIG PROFIT IN THE OPERATION WHEN THE TIME ARRIVED TO WITHDRAW, ONE DAY LEFT BEFORE TO WITHDRAW THE MONEY THEY MADE ME TRADE AGAINST THE TREND WHICH I LOST MORE THAN THE PROFIT AND TO NOT LOSE THE MONEY THEY ASKED ME FOR 2000 USD TO PUT INSURANCE AND NOT LOSE THE MONEY.

Exposure

2023-11-21

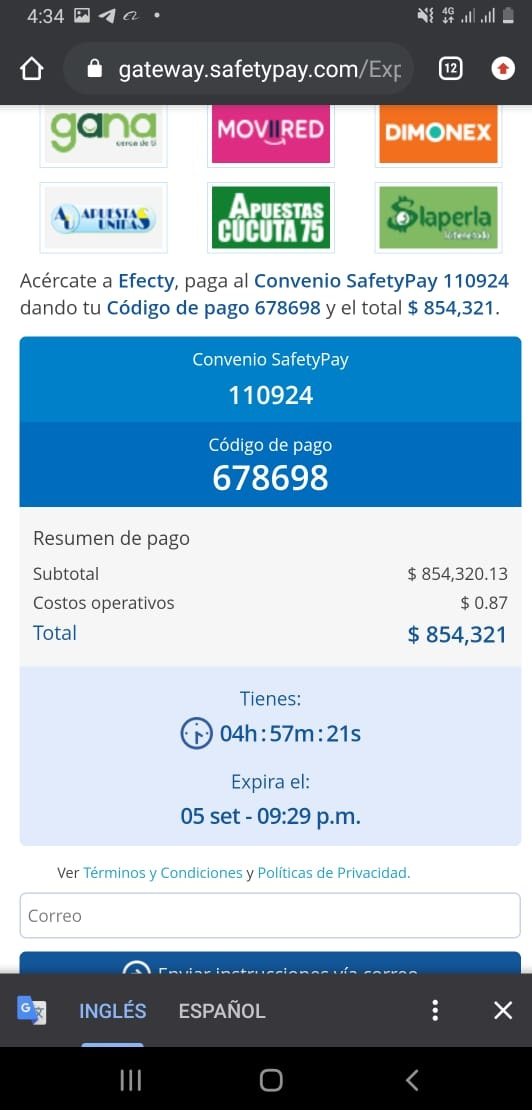

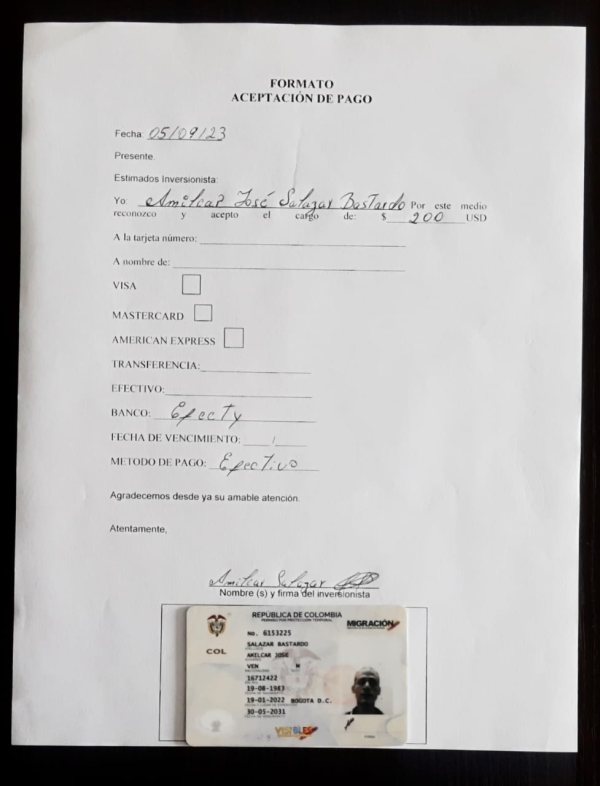

Amilcar

Colombia

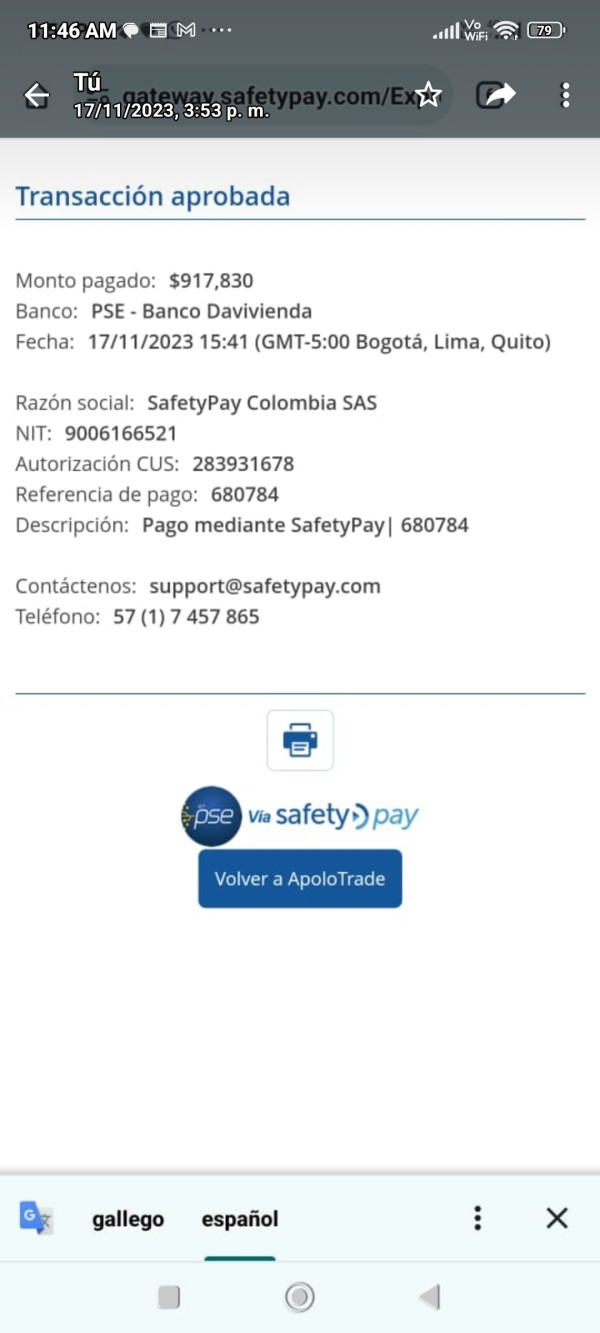

Good evening, have a treat, almost a month ago I opened an account at Brokers Apolo Trading, which had constant calls from them, I agreed to invest since they promised me certain percentages of profits and advice all day, first It took a long time for the money to be reflected on the platform, the truth is I was worried, then my money was reflected, then I spoke with the advisor and he told me to invest more because he advised people who invested a lot of money, then he started with the crazy I had the idea that I should invest a million dollars, then he insisted on depositing at least a thousand dollars, in the end, he just told me that he could help me with something, which seemed unfair to me because they told me that no matter what I invested, it was always my duty to help me. On the other hand, another person asked me for papers papers and did not verify me, he wrote to me every three to five days just so that I would send him more papers, I told him that the advisor treated me very badly and that he did not call me or write to me and to please give me my money back, and she told me to talk to the advisor, which he didn't even attend to me, so time passed, I verified my account but still, they didn't assist me, nor did they let me withdraw my money, the advisor It doesn't help me and I have looked for a way to recover my money, the investment was 200 dollars, 854 thousand Colombian pesos, I deposited them in cash and I still keep the invoice from that day.

Exposure

2023-09-20

A+

Cambodia

Having been using Apolo Trading for about two months now and I haven't had any major issues with the platform - no slippage, no withdrawal problems, nothing like that. I'm actually thinking about upgrading to their standard account because the spreads are even lower and I'd be able to use their auto-trading features.

Neutral

2023-03-29

fengyunwaihui168

Singapore

I have been trading in the demo account of Apolo Trading for nearly a month, but now I am hesitant to really invest, because I see that this company has no regulatory license. Should I deposit money here?

Positive

2023-03-09