简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.K. Dividends Could Take Six Years to Recover From Pandemic

Abstract:Dividends paid by U.K. companies could take six years to recover from unprecedented cuts during the coronavirus pandemic.

Dividends paid by U.K. companies could take six years to recover from unprecedented cuts during the coronavirus pandemic.

Payouts this year could shrink by nearly half to 56.7 billion pounds ($71 billion) in the worst-case scenario, according to a report from financial data firm Link Group. While a rebound is expected next year, it could conceivably take until 2026 for dividends to reach the level seen in 2019.

The damage was done in the second quarter, when the government imposed a lockdown that left the U.K. headed into what could be its deepest recession in 300 years. A total of 176 companies canceled dividends and another 30 cut them, according to the report. That resulted in a far more drastic reduction in payouts than was seen in the aftermath of the last financial crisis.

“The second quarter was truly a record-breaker, not by a whisker, nor by a nose, but by a mile,” Link said in its U.K. Dividend Monitor. “As the Covid-19 pandemic sent the world into lockdown, U.K. companies slashed payouts with unprecedented speed and ferocity.”

The biggest shock came when Royal Dutch Shell Plc, which had been the biggest payer in the FTSE 100, cut its dividend for the first time since the Second World War. The decisions by Shell, the big U.K. banks and other major companies raised questions about the sustainability of the generous payouts that have long attracted investors to U.K. stocks.

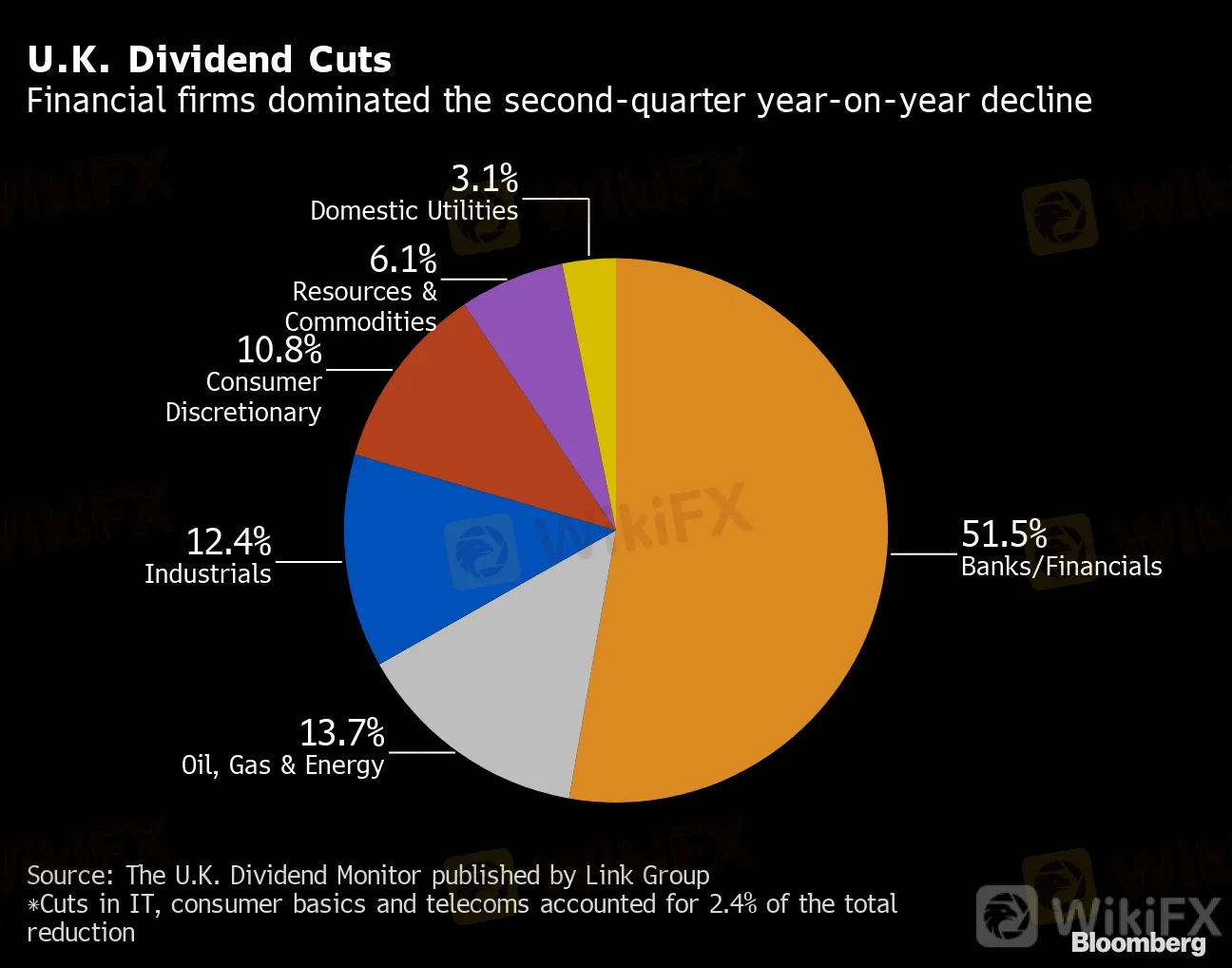

U.K. Dividend Cuts

Financial firms dominated the second-quarter year-on-year decline

Source: The U.K. Dividend Monitor published by Link Group

*Cuts in IT, consumer basics and telecoms accounted for 2.4% of the total reduction

The big banks such as HSBC Holdings Plc, as well as other financial firms, came under pressure from the Bank of England to curtail payouts. Most complied, and the sector accounted for more than half of all dividend cuts in the second quarter, according to the report.

One potential positive from the carnage of the second quarter is that many companies have taken the opportunity to reset their dividends at a lower, most sustainable level from which they can start to rebuild. U.K. equities are expected to yield 3.3% in the worst-case scenario over the next 12 months, according to the report.

Read more: Dividend Crisis Has U.K. Income Funds Fighting for Their Future

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator