Score

DotBig

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://dotbig.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesUsers who viewed DotBig also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

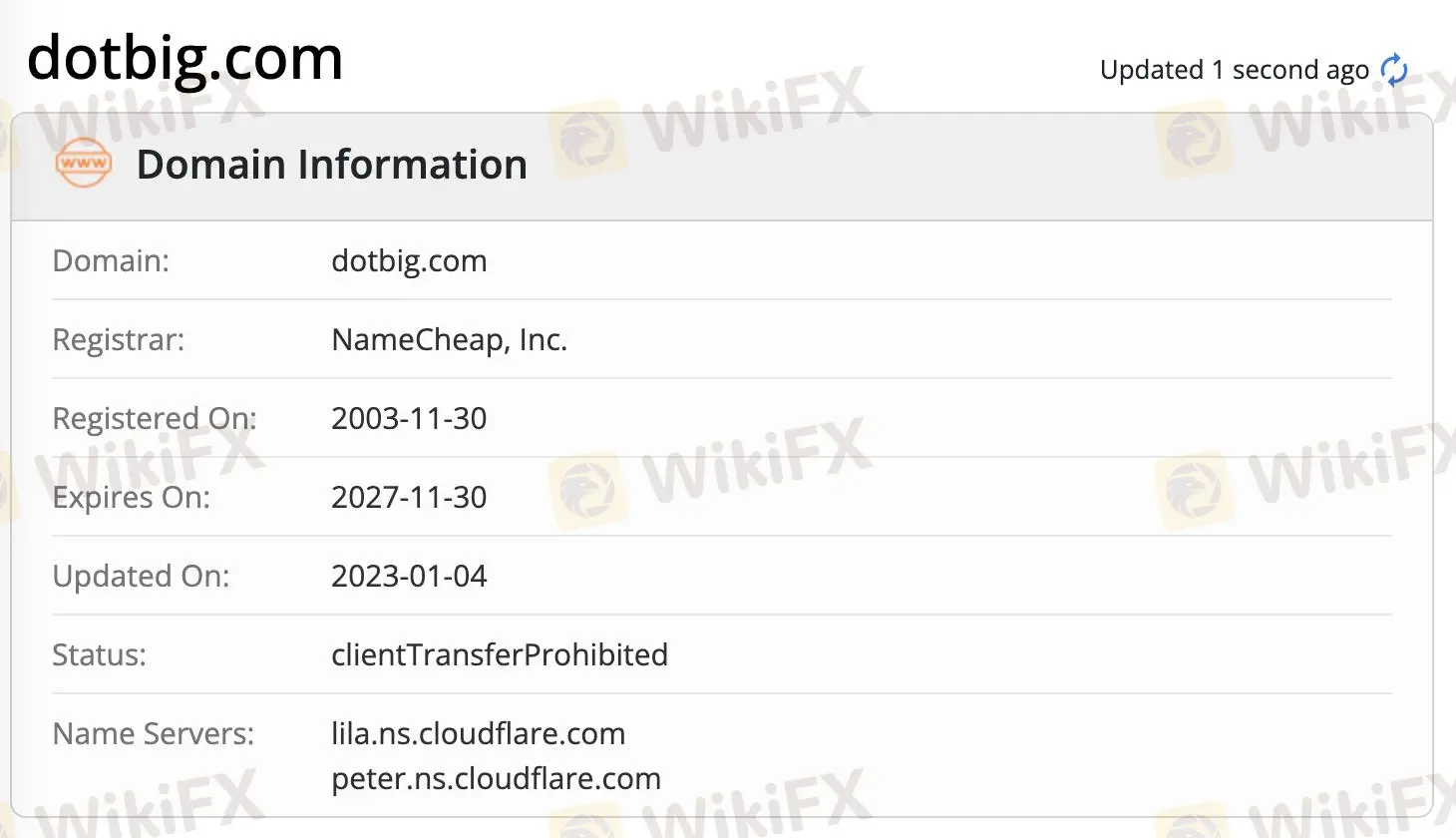

Website

dotbig.com

Server Location

United States

Website Domain Name

dotbig.com

Server IP

172.67.143.213

Company Summary

| DotBig Review Summary | |

| Founded | 2003 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No regulation |

| Market Instruments | Forex, Stocks, Indices, Cryptocurrencies, Commodities, CFDs, ETFs |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Min Deposit | $100 |

| Trading Platform | DotBig Web |

| Customer Support | 24/7 support |

| Contact form | |

| Tel: +44 8000465677 | |

| Email: contact@dotbig.support | |

| Facebook, Instagram, X, Linkedin | |

| Regional Restrictions | Canada, China, Russia, Indonesia, Australia, Japan, Singapore, the United States, jurisdictions on the FATF and EU/UN clients are not allowed |

DotBig Information

Founded in 2003, DotBig is an unregulated broker registered in Saint Vincent and the Grenadines, offering trading in forex, stocks, indices, cryptocurrencies, commodities, CFDs, and ETFs on DotBig Web trading platform. The minimum deposit requirement is $100.

Pros and Cons

| Pros | Cons |

| Various trading products | No regulation |

| Demo accounts | No MT4/MT5 platform |

| Popular payment options | Limited info on trading conditions |

| No deposit fees | Regional restrictions |

| 24/7 support |

Is DotBig Legit?

No. DotBig currently has no valid regulations. Please be aware of the risk!

What Can I Trade on DotBig?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Commodities | ✔ |

| CFDs | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

DotBig Fees

DotBig applies a commission to trading accounts that exhibit inactivity for a period exceeding one month. In terms of deposit fees, DotBig operates with a no-fee policy.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| DotBig Web | ✔ | Web, mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

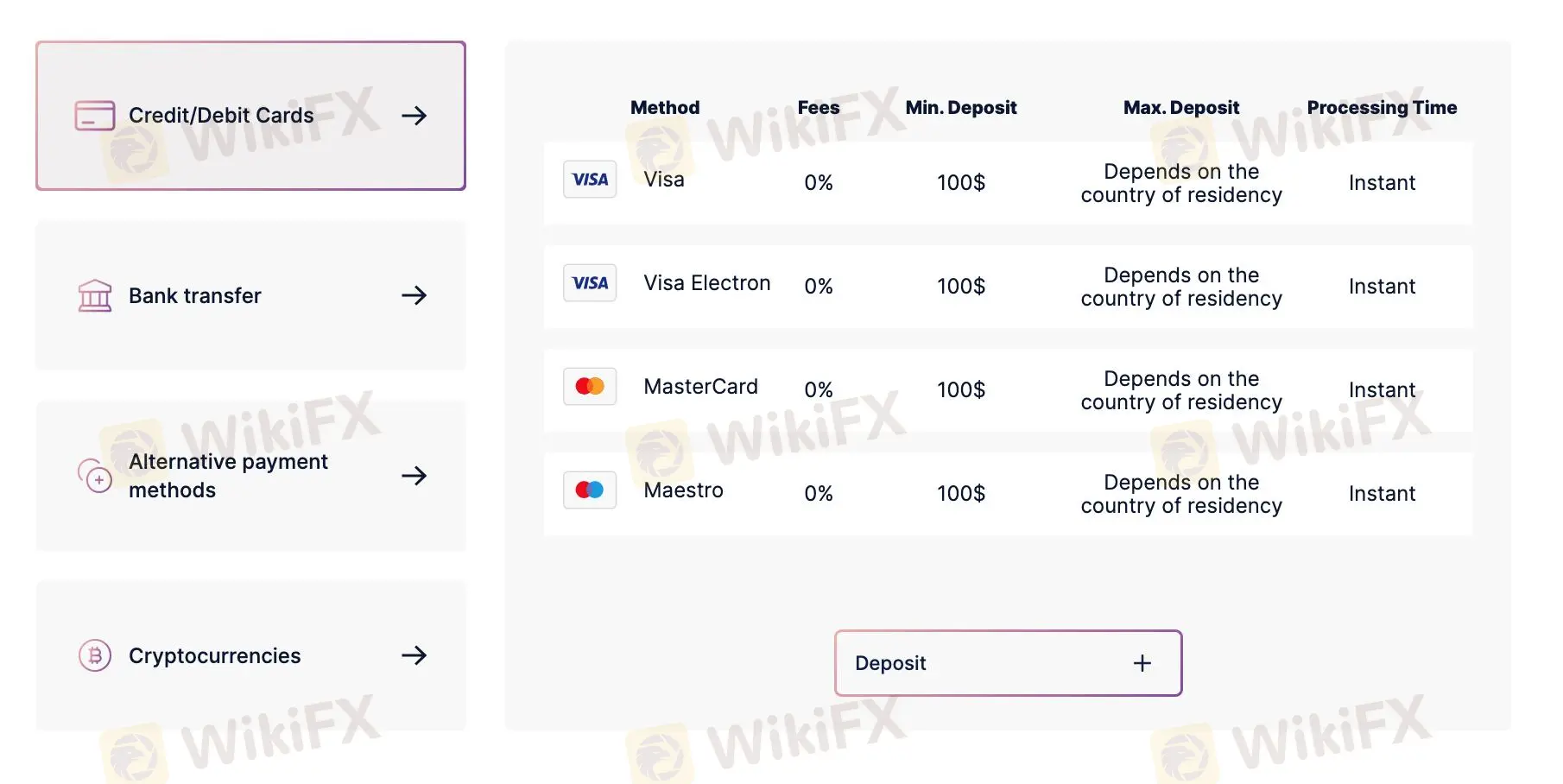

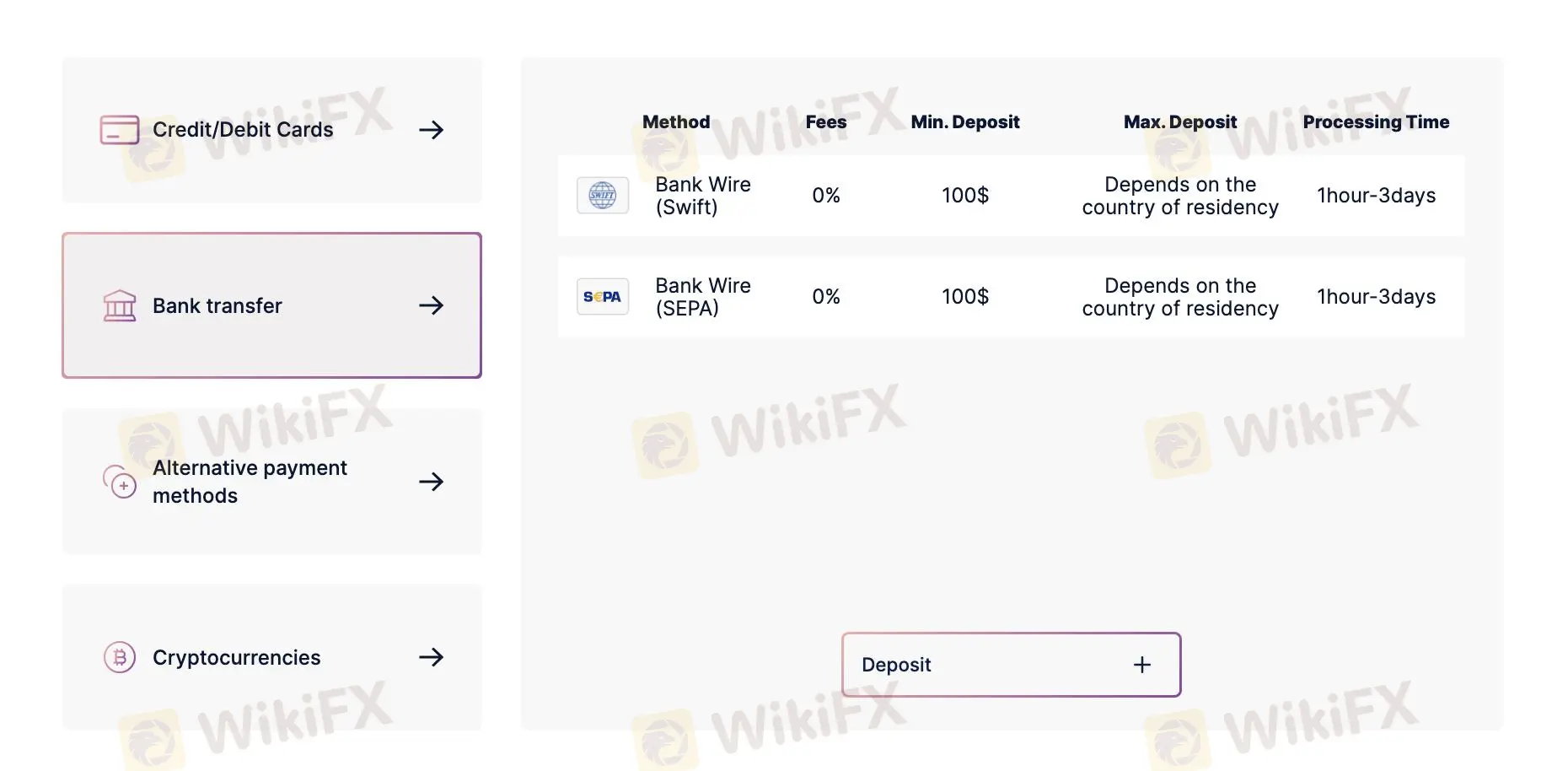

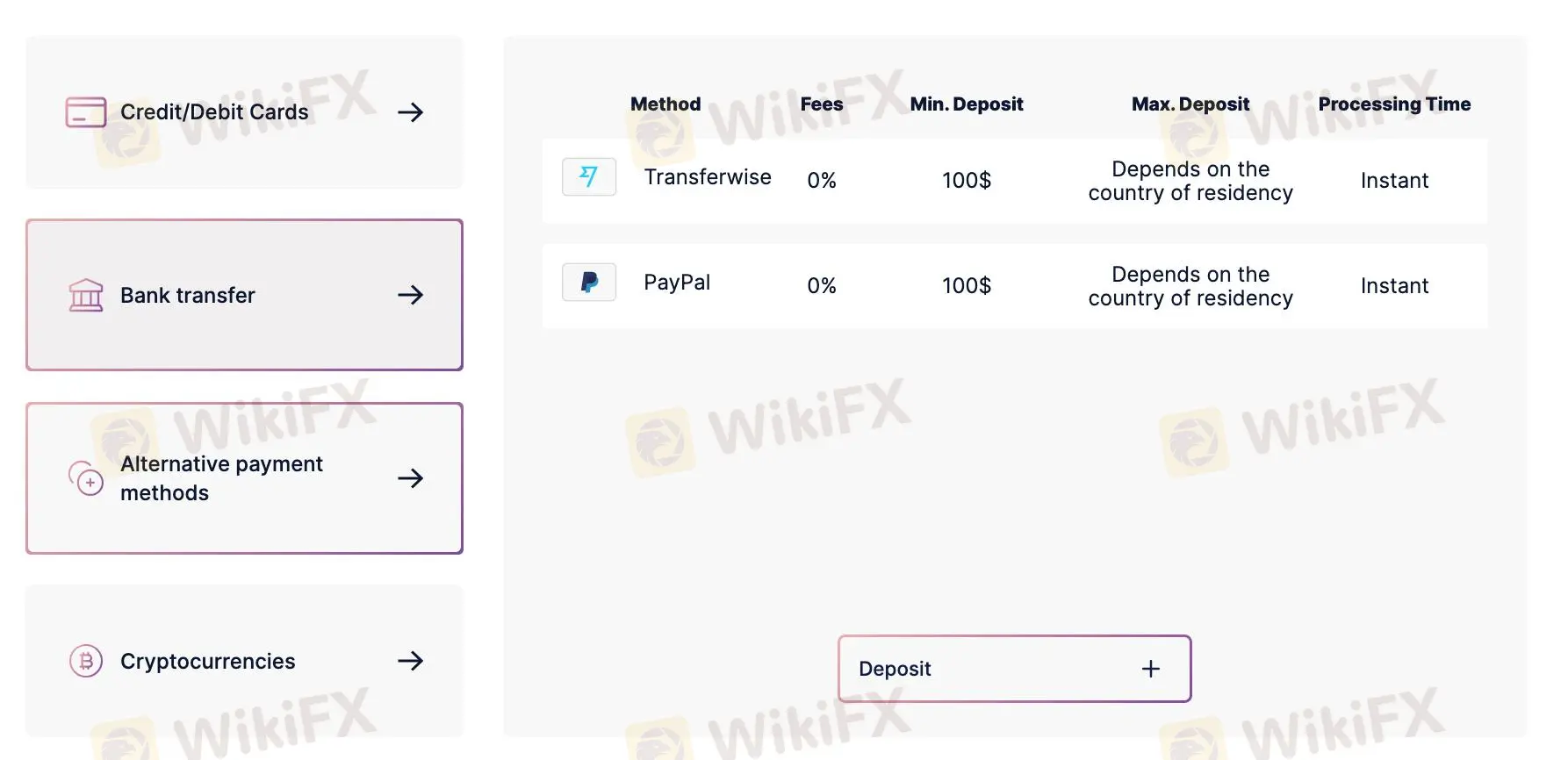

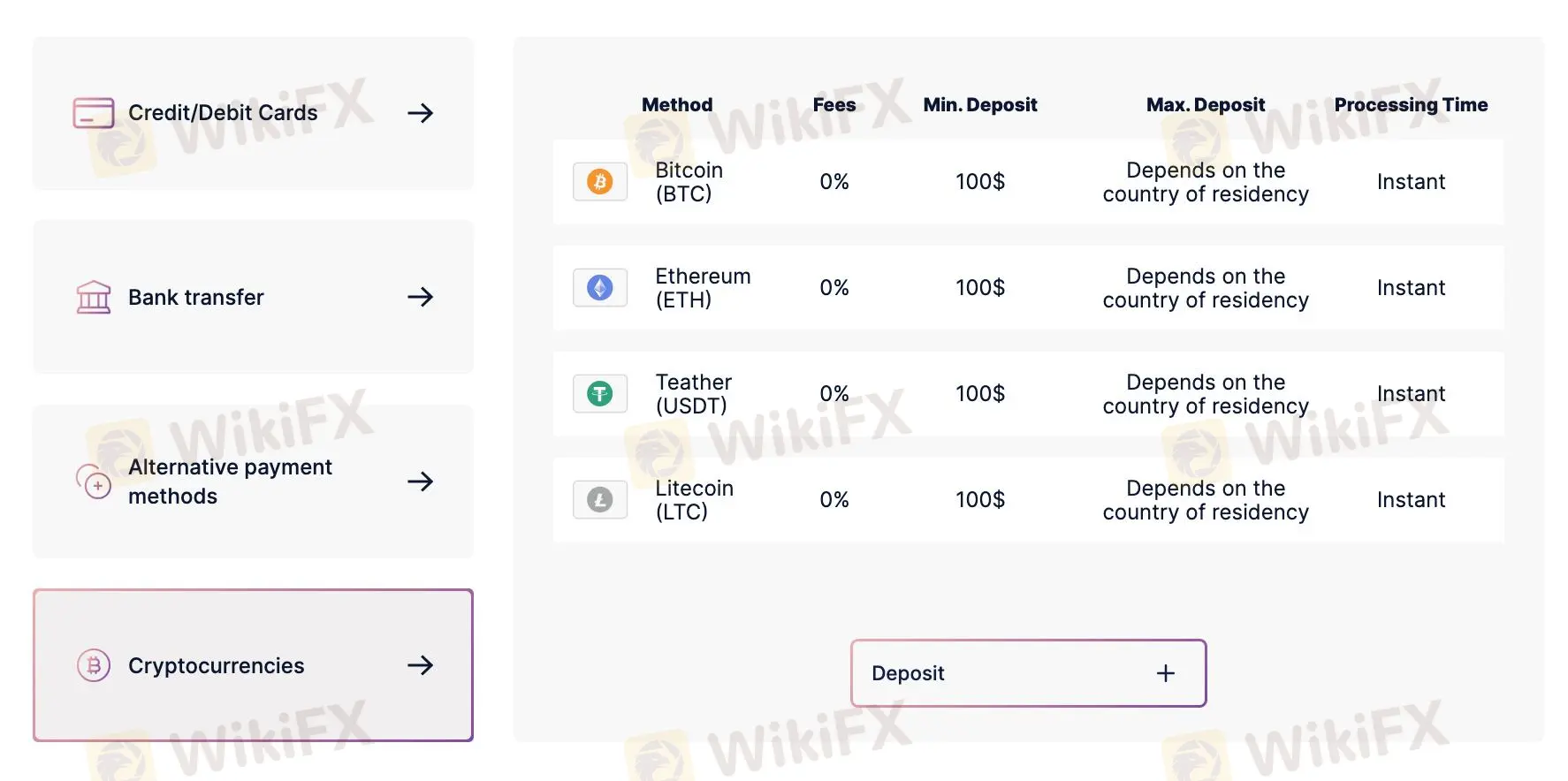

The broker accepts payments via credit, debit cards, bank wire, Transferwise, PayPal and cryptocurrencies.

| Deposit Option | Min Deposit | Fees | Processing Time |

| Credit/debit cards | $100 | ❌ | Instant |

| Bank transfer | 1 hour - 3 days | ||

| Transferwise | Instant | ||

| PayPal | |||

| Cryptocurrencies |

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 7

Content you want to comment

Please enter...

Review 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Đinh Hoàng Gia

India

In the past, I had a bad impression of them. It was based primarily on a misunderstanding on my part! I have been using DotBig for 3 months now... have made many withdrawals and always the service is exceptional.

Neutral

2023-02-28

Holli_Next

United States

I definitely realized for myself that if you start with a small deposit, a bonus program and low spreads, trading here becomes very profitable. And knowing that state-of-the-art encryption technology is protecting my funds adds an extra layer of confidence. Now I’m testing their different tools and I really like them all!

Positive

2023-12-27

David11

United States

I am always looking for new platforms to realize my trading goals, and as soon as I realized DotBig was unwaveringly committed to security, I immediately created several portfolios with them, although the differences with other platforms were minimal. But I also liked the experience of using their Stop Loss and Take Profit options, because I believe this is an effective way of managing risks that can help you navigate volatile markets with more confidence. Although in general, if you look, I didn’t find any big advantages or differences from others.

Positive

2023-12-19

Namaari

Canada

When I started trading, there was minimal information everywhere on all platforms on how to make such a process profitable and safer, but now there is a lot of it on every platform. But the knowledge and efficiency of the support service at DotBig added one plus for me to the ability to sometimes use them in currency and crypto trading, which are my main areas. Their commitment to helping clients resolve any technical or sales issues is truly commendable.

Positive

2023-12-13

David11

United States

At first, when I was just getting into the swing of things in trading, there wasn’t enough information for me to fully understand all the risks and the picture in order to work, but it was on DotBig that the information section turned out to be a real treasure trove for me to hone my trading skills. Their provided materials and tools will definitely serve as a valuable resource for anyone, whether a beginner, which I was at one time, or an experienced trader.

Positive

2023-12-05

Advio

Canada

I was forced to close my account with my previous broker. I won’t even give them negative advertising here! I decided to switch to the more well-known broker dotbig, although I had almost no faith left, but this broker is reliable and has a good reputation among experienced traders. Pros: spreads are as low as possible. You can transfer funds from your other brokerage accounts. There are many tutorials for beginners. No hidden fees when depositing or withdrawing funds.

Positive

2023-11-28

Matther3

United States

Although I saw different reviews about DotBig, I decided to try this platform on my own, especially since I have experience and I immediately understand where there could be fraud, but their transparent trading conditions speak for themselves, and definitely, in my opinion, It's worth partnering with them because the absence of hidden fees and taxes ensures that you get what you see, which promotes trust between the platform and traders. Now I have their currency trading section at the top and I’m doing a good job.

Positive

2023-11-21