简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

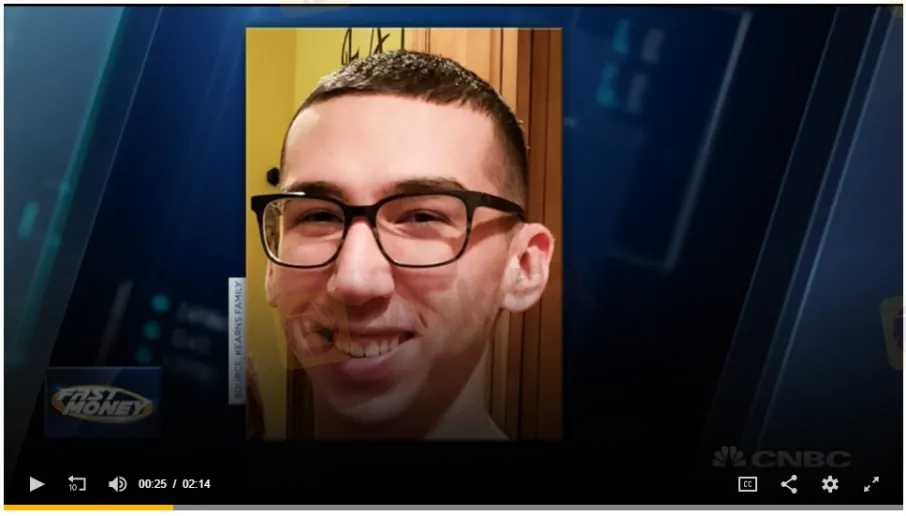

Three Lessons We Can Learn from Robinhood Trader, Alexander Kearns

Abstract:“20-year-old Robinhood trader, Alexander Kearns dies by suicide after seeing a $730,000 negative balance.”

Twenty-year-old commits suicide after seeing what he believed were major losses on Robinhood

“20-year-old Robinhood trader, Alexander Kearns dies by suicide after seeing a $730,000 negative balance.”

In the past week, youve probably come across similar headlines on social media.

This tragic incident happened amid the recent increase in account opening and trading volume from retail traders and investors.

Robinhood was reported adding more than 3 million users in 2020 as of May 4, and close to 50% of these new users were first-time investors. As of early June, Robinhood‘s desktop and mobile weekly visitors were up 332% from the year before, according to a research from SimilarWeb. That's more than twice the rate of growth as Robinhood’s next-closest competitor in the wealth management space.

While this is good news for the brokerage firm, it is concerning news to both the retail trading industry and educators like ourselves.

What happened to Alexander Kearns (and hopefully there wont be any more similar cases from the recent increase of “Robinhood Traders”) is a good reminder to all retail traders and investors.

Here are 3 lessons we can all learn from Robinhood trader, Alexander Kearns -

1.Know your trading instrumentThere were different perspectives on Kearns suicide case.

According to his cousin-in-law, Bill Brewster was saying Robinhood should be responsible for his suicide -

“It doesn't make any sense to me. I would think that a tech company that is focused on financial transactions would have the sense to understand that they should display the number to people in a way they can decipher,” he tells PEOPLE. “The fact of the matter is this kid died over nothing. Nothing. He didn't owe a penny... This is finance, this is people's lives.”

“I would argue that if you are playing with people's finances, and it is true that you are driving people to use options... you have got a duty to make sure that people do not sign on and see a number like [$730,165],” says Brewster. “Because you know right now most of those people unsophisticated.”

And there was also the perspective where Kearns wasnt well equipped with the proper knowledge of trading. Before his suicide, Kearns allegedly wrote -

“The puts I bought/sold should have canceled out, too, but I also have no clue what I was doing now in hindsight. There was no intention to be assigned this much and take this much risk, and I only thought that I was risking the money that I actually owned. If you check the app, the margin investing option isn‘t even ’turned on for me. A painful lesson. F— Robinhood.”

While we can respect and understand the differing opinions of who is or should be responsible for this tragic incident, allow me to direct the attention to the following statement written by Kearns -

“...but I also have no clue what I was doing now in hindsight.”

This indicated that he wasnt well equipped with the necessary knowledge of the trading instrument that he was trading with. According to the articles published, Kearns was likely trading on options.

If youre not familiar with options, this is the one trading instrument (the other is the futures market) that I always encourage traders to avoid, especially if you are very new to trading and investing.

Trading is already challenging in having to get your direction and timing right to profit from the market. In options trading, you need to get the direction, timing, AND the market volatility right to profit from the market.

If getting both factors are difficult already, what makes you think adding a third factor to trading will make it easier?

Generally, options trading can be wildly lucrative, but it is also highly complex and comes with greater risk. Unlike trading stocks or the currency market, in which it is very rare to lose more money than you initially deposit, in certain situations options trading can expose you to losing a theoretically infinite amount of money.

So heres the #1 lesson:Whatever instrument or market you decide to trade and/or invest. The most important thing is to first equip yourself with the right and proper knowledge.

As Warren Buffett said, “Risk comes from not knowing what you're doing.” Get informed. Educate yourself. You can mitigate at least some risk by simply learning more about what you want to do.

All of us traders and investors started off not knowing what we were doing too. But as we are learning and working on our skills, it is important to always ensure we are well protected and we have stringent risk management in place too. Which brings us to the next lesson -

2.Risk management is an integral part of tradingIf you are coming into the market to trade and invest and think that you can get rich quickly, you are gonna be so wrong! Trading and investing is a journey. It is a process and requires hard work, dedication, and a certain level of commitment to succeed.

It is worth it then? Absolutely!

Quoting Ray Barros from one of the conversations we had with him, “Where do you get 90% of the population putting money in your pocket? Only in trading.”

Heres a snippet of the conversation we had with Ray Barros sharing on the importance of risk management on 14th April 2020.

The key is to master the ability to trade profitably. And the only way we can trade profitably is when we are able to master our risk and psychology.

While Im not really a fan of Jim Cramer, I fully agreed with what he mentioned on his “Mad Money” show recently, “It got too easy, and now we all have to suffer as the get-rich-quick crowd gets blown out,” describing the current environment as one of “rampant speculation.”

We understand that desperate time calls for desperate measures. But there are consequences that you need to be prepared to take if youre seeking for a massive amount of profits and returns in a very short period of time.

There is a clear distinction between trading and gambling. And risk management is one of the elements that draw the line.

Always remember that the higher the reward youre seeking to obtain, the higher the risk you need to take.

And that brings us to the third lesson -

3.Understand leverage, and never over-leveragedKearns left a note on his computer, asking, “How was a 20 year old with no income able to get assigned almost a million dollars worth of leverage?”

This is one of the most commonly misunderstood concepts in trading and investing. Leverage has a different context and application in finance, stocks trading, futures trading, options trading, currency trading, and investing. And it gets even more confusing when we bring in the term “margin trading”. But lets not go into a whole topic on definitions here.

Keeping it simple to understand, we shall just loosely define leverage and margin trading as a system that allows the trader to open positions much larger than his own capital.

The apparent advantage of using leverage is that you can make a considerable amount of money with only a limited amount of capital. But the problem is that you can also lose a considerable amount of money trading with leverage. It all depends on how wisely you use it and how conservative your risk management is.

You might be thinking that the higher the leverage, the higher the risk, and in return the higher the profit too. Thats not entirely accurate. Because the other function of risk is where you cut your positions or cut your losses.

Then again, every instrument in the financial market is different in the usage of leverage and hence bringing us back to the #1 lesson - always equip yourself with the right and proper knowledge.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Trading Style Best Suits Your Personality?

Trading style often correlates with the personality of the trader. It is important to reflect internally on personality and lifestyle before choosing a trading strategy and creating a trading plan.

Ten Forex Trading Skills for Beginners! Part I

WikiFX has elaborately concluded ten trading tips in the forex industry for beginners.

Priceless Methods of Trading!

Keeping learning can make you survive in forex trading because of the ever-changing market.

How to Protect Yourself and Gain Profits in Turbulent Market?

Market is unpredictable and changeable all the time. How to handle this kind of situation and control risks in a proper manner are explained and analyzed herein based on examples in real life.

WikiFX Broker

Latest News

eToro Expands Nationwide Access with New York Launch

Webull Partners with Coinbase to Offer Crypto Futures

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator