Score

KuFin

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.kufinlimited.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed KuFin also viewed..

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

kufinlimited.com

Server Location

United States

Website Domain Name

kufinlimited.com

Server IP

45.133.239.29

Company Summary

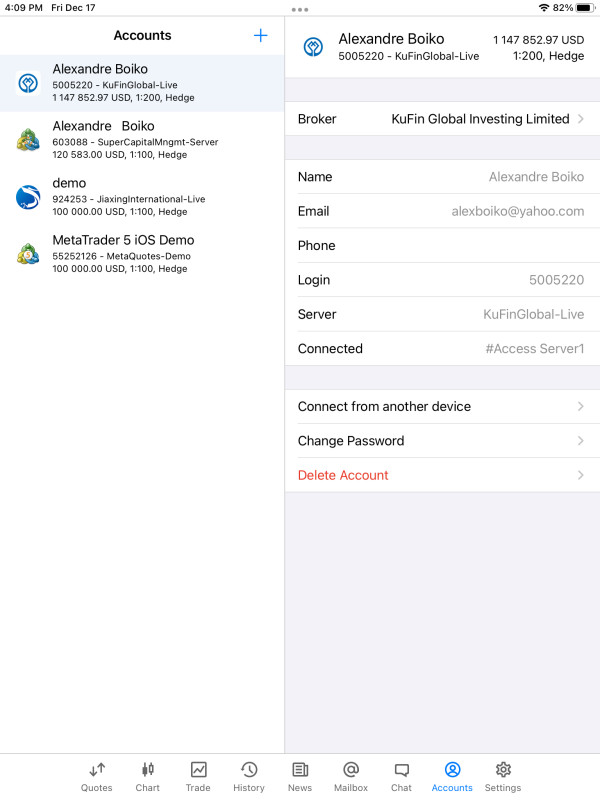

| KuFin | Basic Information |

| Company Name | KuFin |

| Founded | 2021 |

| Headquarters | United Kingdom |

| Regulations | Not regulated |

| Tradable Assets | Stocks, ETFs, Futures, Options, Forex, CFDs |

| Account Types | Basic, Premium, Professional, Managed, Islamic |

| Minimum Deposit | $100 (Varies by account type and funding method) |

| Maximum Leverage | Up to 500:1 (Varies by asset class and regulation) |

| Spreads | Variable (Depends on asset class and market conditions) |

| Commission | Varies by account type and asset (e.g., stock trades may incur $0.01 per share) |

| Deposit Methods | Bank transfers, Credit/Debit cards, Electronic payments, Cryptocurrencies |

| Trading Platforms | MetaTrader 5 (MT5) |

| Customer Support | Email: support@kufinlimited.com |

| Education Resources | Knowledge base, Webinars, Workshops, Market Analysis, Video Tutorials, Demo Account |

| Bonus Offerings | None |

Overview of KuFin

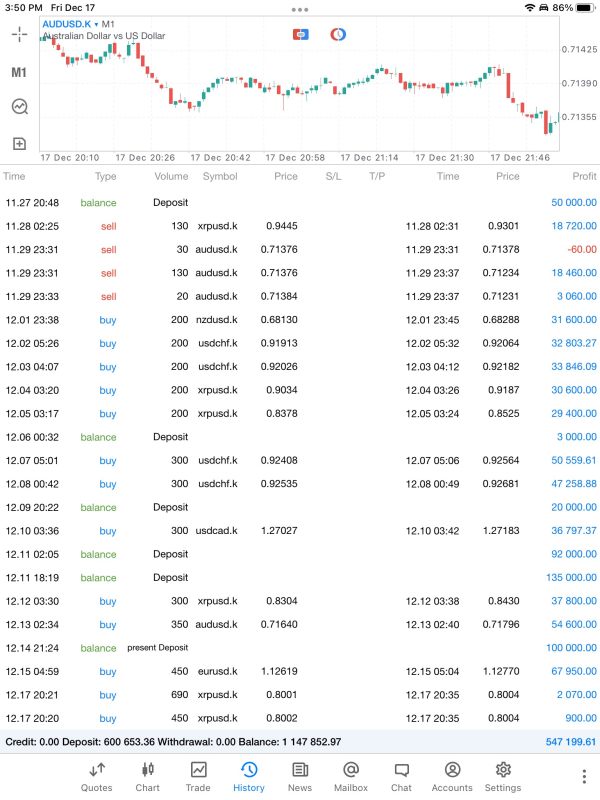

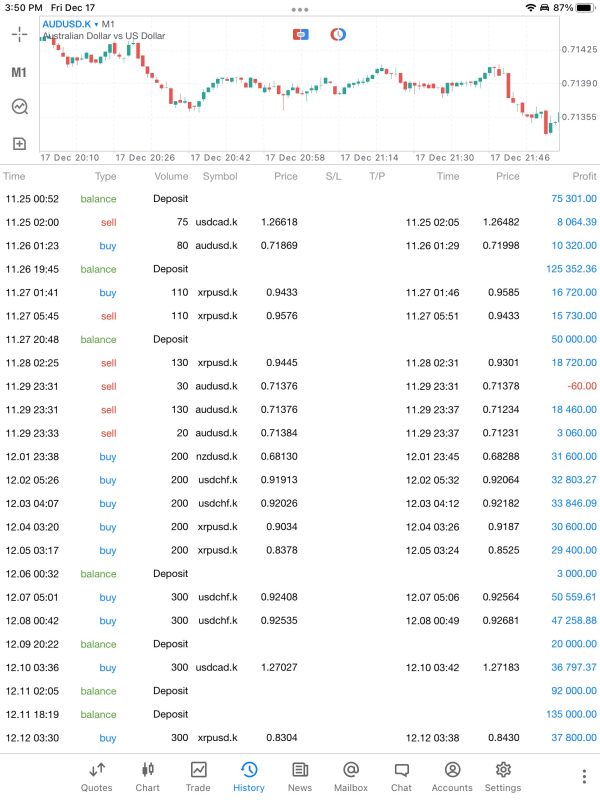

KuFin, established in 2021 and headquartered in the United Kingdom, is a trading platform designed to accommodate a diverse range of financial instruments and trading strategies. Offering a comprehensive selection of tradable assets, including stocks, ETFs, futures, options, Forex, and CFDs, KuFin aims to cater to the varied needs and preferences of traders. The platform provides multiple account types, such as Basic, Premium, Professional, Managed, and Islamic, offering tailored features and benefits to different levels of traders, from beginners to seasoned professionals.

Despite the platform's commitment to user education through resources like webinars, workshops, and a demo account, it's essential to note that KuFin operates without regulatory oversight. This lack of regulation raises concerns about the safety and security of user funds, as well as the transparency of the broker's operations. Traders considering KuFin should carefully evaluate the potential risks associated with an unregulated status and weigh them against the platform's offerings, such as flexible leverage options and the utilization of the MetaTrader 5 platform. Overall, KuFin provides a platform for a diverse range of traders, but caution is advised due to the absence of regulatory scrutiny.

Is KuFin Legit?

KuFin is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Trading with an unregulated broker like KuFin carries inherent risks. Without regulatory supervision, there may be limited avenues for dispute resolution, and traders may face challenges in seeking recourse in case of any issues or disputes. Additionally, unregulated brokers may not be subject to stringent financial and operational standards, potentially leading to inadequate client fund protection and unfair trading practices.

Pros and Cons

KuFin presents a range of strengths and weaknesses that traders should consider. On the positive side, the platform offers diverse account types, catering to various trading preferences, and a wide array of tradable assets, allowing for a comprehensive and dynamic portfolio. The flexibility in leverage options provides traders with the ability to customize their market exposure, and the use of the MetaTrader 5 platform enhances the trading experience with advanced features and accessibility. However, it's crucial to acknowledge the potential drawbacks, notably the lack of regulatory oversight, which raises concerns about fund safety and transparency. The absence of a regulated framework may lead to limited dispute resolution mechanisms and potentially exposes traders to higher risks due to the unregulated status. Additionally, there may be concerns regarding the platform's adherence to stringent financial standards.

| Pros | Cons |

|

|

|

|

|

|

|

|

Trading Instruments

KuFin offers a diverse range of trading instruments on its platform. These include:

1. Stocks: Representing ownership in listed companies, stocks allow users to buy and sell for potential profit.

2. Exchange-Traded Funds (ETFs): These funds track specific indices or sectors, providing diversification and cost benefits compared to individual stock purchases.

3. Futures Contracts: Agreements to buy or sell assets at predetermined prices in the future, used for risk hedging or speculation.

4. Options Contracts: Providing the right to buy or sell assets at specific prices within set time frames, options serve various purposes like income generation, risk management, or speculation.

5. Forex (Foreign Exchange): Involves trading currencies against each other, offering profit opportunities with significant associated risks.

6. Contracts for Difference (CFDs): Agreements to exchange price differences in assets without ownership, allowing speculation on various markets.

KuFin's platform caters to a wide range of trading strategies, from traditional stock investments to sophisticated derivatives trading.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | KuFin | RoboForex | FxPro | IC Markets |

| Forex | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | Yes |

| Options | Yes | No | Yes | No |

Account Types

KuFin provides a variety of account types to meet the diverse needs of its users, offering tailored features and benefits based on individual preferences and trading styles.

1. Basic Accounts: Designed for beginners and casual investors, Basic Accounts on KuFin provide a user-friendly entry point into the platform. Users can access essential trading features and educational resources to build their understanding of the financial markets.

2. Premium Accounts: Geared towards more experienced traders, Premium Accounts offer enhanced features and tools for in-depth market analysis. These accounts may provide advanced charting options, real-time market data, and additional research materials to assist traders in making informed decisions.

3. Professional Accounts: Tailored for professional and institutional traders, Professional Accounts on KuFin come with a comprehensive set of advanced tools and services. These accounts may offer priority customer support, exclusive research reports, and access to sophisticated trading algorithms, catering to the needs of high-volume and experienced market participants.

4. Managed Accounts: For users seeking a hands-off approach to investing, KuFin offers Managed Accounts where experienced portfolio managers handle investment decisions on behalf of the account holder. This option is suitable for individuals who prefer professional management of their investment portfolios.

5. Islamic Accounts: KuFin recognizes the diverse needs of its user base and offers Islamic Accounts that adhere to Sharia principles. These accounts operate without interest, ensuring compliance with Islamic financial regulations.

Each account type on KuFin is structured to provide a seamless and customized trading experience, empowering users to choose the level of sophistication and control that aligns with their investment goals and expertise.

Leverage

KuFin offers a flexible leverage feature, allowing traders to magnify their market exposure with specified leverage ratios. For instance, in the case of Forex trading, users might have access to leverage ratios ranging from 50:1 to 500:1, depending on the currency pair and regulatory considerations. This means that with a relatively small amount of capital, traders can control positions in the market that are 50 to 500 times the size of their initial investment.

Similarly, when trading stocks or commodities, KuFin may provide leverage ratios such as 2:1, 5:1, or higher, enabling traders to amplify their market participation beyond their deposited funds.

It's important to note that the specific leverage ratios may vary based on the asset class, market conditions, and regulatory requirements. KuFin emphasizes the significance of understanding the risks associated with leverage and encourages users to adopt responsible trading practices. The platform may implement risk management tools, including margin calls and stop-loss orders, to help users mitigate potential losses and maintain control over their leveraged positions. Regulatory compliance is also a key aspect to ensure the platform operates within established guidelines and safeguards the interests of its users.

Spreads and Commissions

KuFin implements a fee structure that includes spreads and commissions, with specific numerical values varying based on the asset class and account type.

1. Spreads: KuFin employs a variable spread model, where the difference between the ask (buy) and bid (sell) prices serves as the trading cost. For major currency pairs like EUR/USD, the typical spread might range from 1 to 2 pips during standard market conditions. However, spreads can widen for exotic currency pairs or less liquid assets.

2. Commissions: Depending on the account type, KuFin may charge commissions on trades. For example, on a standard account, the commission for stock trades could be $0.01 per share, while premium or professional accounts might enjoy reduced commission rates, such as $0.005 per share. Forex trades on a standard account might incur a commission of $5 per lot, with potential variations based on the trading volume.

KuFin prioritizes transparency, providing users with a detailed fee schedule outlining specific numerical values for spreads and commissions associated with different assets and account types. Traders are encouraged to review this information carefully to make informed decisions regarding the costs of their trades. Additionally, the platform may offer promotional rates or fee discounts, further enhancing its competitive pricing structure.

Deposit & Withdraw Methods

Deposit Methods: KuFin typically supports multiple deposit options to accommodate users globally. Common methods include bank transfers, credit/debit card transactions, and electronic payment systems. Users may also have the option to fund their accounts with popular cryptocurrencies. The platform prioritizes the security of financial transactions, employing encryption and other safeguards to protect user funds during the deposit process.

Withdrawal Methods: KuFin provides users with flexibility when it comes to withdrawing their profits. Withdrawals can often be initiated through the same methods used for deposits, promoting a seamless and user-friendly experience. The platform aims to process withdrawal requests promptly, ensuring that users have timely access to their funds. Verification procedures may be in place to enhance security and compliance with regulatory standards.

Minimum Deposit: KuFin typically establishes a minimum deposit requirement, which can vary based on the account type and the chosen funding method. For example, the minimum deposit for a Basic Account might be $100, while Premium or Professional Accounts may have higher initial deposit requirements. Cryptocurrency deposits may have different minimum thresholds. The platform communicates these requirements clearly to users during the account setup process, allowing them to make informed decisions based on their financial preferences and trading goals.

KuFin's commitment to user-friendly financial transactions, coupled with clear communication of minimum deposit requirements, contributes to a positive and accessible trading experience for its users. Traders are encouraged to review the specific deposit and withdrawal options and associated minimums based on their individual preferences and needs.Here is a comparison table of minimum deposit required by different brokers:

| Broker | KuFin | Exnova | Tickmill | GO Markets |

| Minimum Deposit | $100 | $10 | $100 | $200 |

Trading Platforms

KuFin leverages the MetaTrader 5 (MT5) platform to provide users with a robust and feature-rich trading experience. MT5 is a widely recognized and trusted trading platform known for its advanced functionalities, making it a preferred choice for both novice and experienced traders.

The MT5 platform offered by KuFin enables users to access a diverse range of financial instruments, including forex, stocks, commodities, and indices. The intuitive and user-friendly interface of MT5 allows for efficient navigation, making it easy for traders to execute orders, analyze market data, and manage their portfolios seamlessly.

One notable feature of MT5 is its advanced charting tools, providing users with in-depth technical analysis capabilities. Traders can employ various chart types, timeframes, and technical indicators to make informed decisions. The platform also supports algorithmic trading through the use of Expert Advisors (EAs), allowing users to automate their trading strategies.

KuFin's MT5 platform offers real-time market data and news feeds to keep users informed about the latest market developments. Additionally, the platform is designed to be accessible across multiple devices, enabling users to trade on desktops, web browsers, and mobile devices.

Customer Support

KuFin prioritizes customer satisfaction by offering a responsive and comprehensive customer support system. Users can reach out to KuFin's customer support team through the designated email address, support@kufinlimited.com. This email channel serves as a direct communication link for users to seek assistance, ask questions, or address any concerns related to their trading experience on the platform.

The customer support team at KuFin is committed to providing timely and helpful responses to user inquiries. They aim to assist with account-related queries, technical issues, and general information about the platform's features. The use of email communication allows for a structured and documented exchange, ensuring that users can easily refer back to correspondence for future reference.

Educational Resources

KuFin is dedicated to educating users about financial markets through a variety of resources. The platform offers an extensive knowledge base with articles and tutorials covering fundamental and technical aspects of trading. Users can access webinars and workshops conducted by market experts for interactive learning. Regular market analysis sessions keep users informed about current trends. Video tutorials provide a dynamic visual learning experience, catering to different preferences. KuFin also offers a demo account for risk-free practice before live trading, ensuring users can enhance their skills and confidence. Overall, KuFin's educational resources aim to empower users at all levels of expertise for more informed and strategic trading.

Conclusion

KuFin, established in 2021 and headquartered in the United Kingdom, presents a platform that offers a diverse range of tradable assets and account types, providing flexibility for traders of various experience levels. The utilization of the MetaTrader 5 platform enhances the overall trading experience, offering advanced features and accessibility. However, the platform operates without regulatory oversight, posing significant disadvantages such as potential risks to fund safety and limited dispute resolution mechanisms. The lack of adherence to stringent financial standards is also a concern. While KuFin provides educational resources and flexible leverage options, traders should exercise caution, carefully weighing the advantages against the inherent risks associated with an unregulated status.

FAQs

Q: Is KuFin regulated by any financial authority?

A: No, KuFin operates without regulatory oversight.

Q: What tradable assets are available on KuFin?

A: KuFin offers a diverse range of assets, including stocks, ETFs, futures, options, Forex, and CFDs.

Q: What account types does KuFin provide?

A: KuFin provides various account types such as Basic, Premium, Professional, Managed, and Islamic.

Q: What is the minimum deposit required on KuFin?

A: The minimum deposit on KuFin is $100, varying by account type and funding method.

Q: Does KuFin use the MetaTrader 5 platform?

A: Yes, KuFin leverages the MetaTrader 5 (MT5) platform for trading.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now