简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Understanding Negative Interest Rate Is to Protect Your Forex Investment

Abstract:The financial crisis in 2008 was the largest financial event in the world after World War II. In response to this unprecedented financial turmoil, the central banks of all countries have adopted very aggressive monetary policies and cut interest rates substantially.

The financial crisis in 2008 was the largest financial event in the world after World War II. In response to this unprecedented financial turmoil, the central banks of all countries have adopted very aggressive monetary policies and cut interest rates substantially. For example, the US Federal Reserve lowered the benchmark interest rate from about 5% to 0.25%; the Bank of England reduced it to 0.25% from about 6%; and the European Central Bank adopted near zero interest rate compared with previous 4%. Japan that struggled with liquidity trap had an interest rates around 0% before the financial crisis, so there was no room for further reduction.

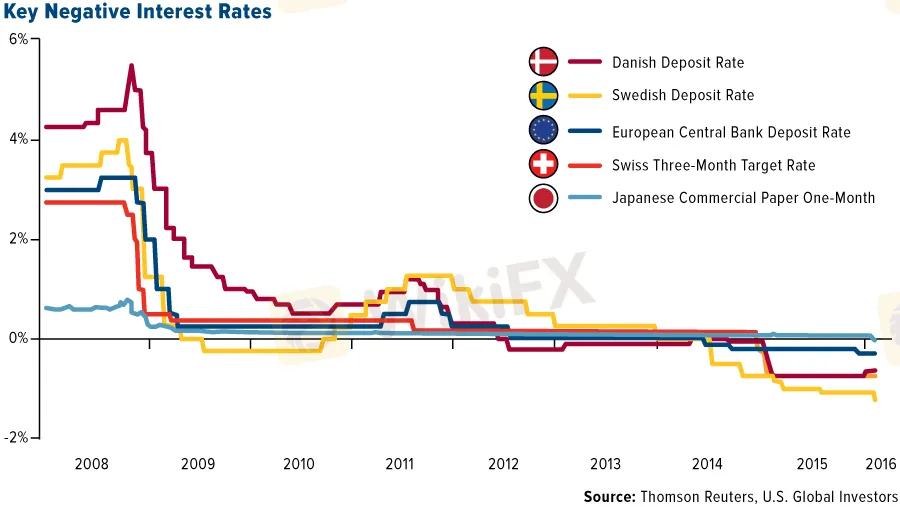

According to a report released by Reuters, the benchmark interest rates of all developed countries around the world were below 2% by September 2016. While many European countries, such as Sweden, Denmark and Switzerland etc, in addition to Japan, have adopted zero interest rate or even negative interest rate.

(Source: Reuters)

Generally, the purpose of negative interest rate is to stimulate banks to inject liquidity into the real economy and individuals, and finally promote production and consumption.

To be detailed, with a lower interest rate, households will increase consumption and spending as they will get lower interest on their savings in the bank, or they need to pay lower interest on their loans to the bank. The increase of household consumption can stimulate the economic growth of a country. Secondly, given a lower interest rate, the cost of corporate lending is lower, so they may borrow more money from the bank to invest. If the investment of enterprises increases, the economy of a country will be stimulated to some extent. Under the double effects of household consumption and enterprise investment, we may see the stimulating effect of low interest rate on economic growth.

Currently, as the epidemic is raging all over the world, the economies of all countries are deeply affected. As a result, many economies have dived and the central banks have tried to stimulate the economy by cutting interest rates. Negative interest rates have been adopted in more and more countries.

As a special tool, however, negative interest rates, if it doesnt perform as expected, can easily lead to a new weakness in the entire economic and financial system, making it difficult to revive themselves.

In July 2009, the Central Bank of Sweden announced that it would lower the deposit rate to -0.25%, and it would not return to 0 until the end of 2019. However, as of 2018, Sweden's GDP growth rate has not exceeded 0.8%.

In addition, negative interest rates would stimulate some risky behavior in economic activities. For example, the debt of market entities may expand in an unsustainable manner, which in turn may lead to overestimation of asset values, distortions in market risk pricing, and a decline in resource use efficiency.

(Source: Internet)

On the other hand, forex investors should understand what the negative interest rate means to forex market. Theoretically, one of the purposes of the negative interest rate is to prevent appreciation of the local currencies, such as Swiss franc(Switzerland). Thus, it will be an opportunity for investors to bet on the currencies of the countries that adopt negative interest rate and try not to strengthen the currencies.

To make matters worse, once a negative deposit interest rate occurs, people's demand for cash may rise rapidly, which will virtually lead to increased transaction costs for the entire society and a decline in economic efficiency. In particular, under the condition of negative interest rates on savings deposits, the size of bank deposits will inevitably be impaired, which will directly restrict the lending capacity of banks.

Negative interest rate is actually a new economic concept. It can perform well while it is truly a test for policy makers. As individual investors, we need to learn the pros and cons of negative interest rate and understand the impact it put on the economy for better investment.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiFX Review: Is PU Prime a decent broker?

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

Currency Calculator