简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.K. Government Debt Hits Level Not Seen in 57 Years

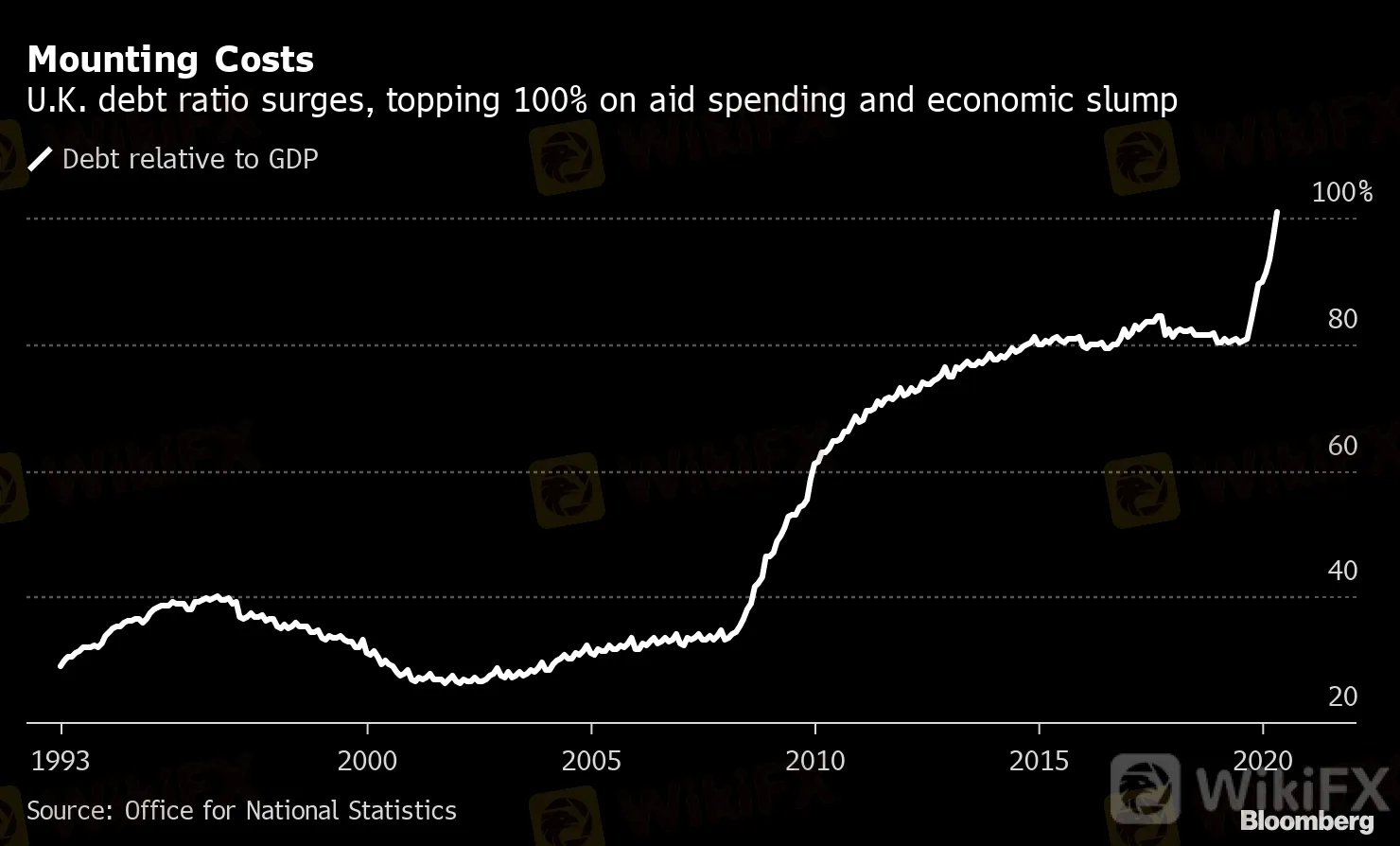

Abstract:U.K. government debt rose above 100% of gross domestic product in May for the first time since 1963, reflecting a precipitous drop in economic output and a surge in spending to counter the fallout from the coronavirus pandemic.

U.K. government debt rose above 100% of gross domestic product in May for the first time since 1963, reflecting a precipitous drop in economic output and a surge in spending to counter the fallout from the coronavirus pandemic.

Borrowing increased by more than 100 billion pounds ($124 billion) in the two months to May, as tax revenue plunged and authorities deployed a massive support package to save jobs and keep businesses afloat during the lockdown.

The recession ripping through the economy will strain Britain‘s public finances for several years to come. But the figures, released on Friday, will add urgency to efforts by Prime Minister Boris Johnson’s government to accelerate the recovery by lifting the remaining restrictions as the number of infections drop.

Mounting Costs

U.K. debt ratio surges, topping 100% on aid spending and economic slump

Source: Office for National Statistics

Spending on support programs to help economies weather the virus lockdown is blowing out budgets across much of the developed world, and Britain entered the crisis in better fiscal shape than many economies. Italy, among the worst hit and with a huge debt pile already, could see its ratio top 150% of GDP this year. Frances statistics office said Friday that its net debt ratio rose to almost 92% at the end of the first quarter.

U.K. figures show central government spending surged almost 50% in May from a year earlier and revenue plunged by over 28%, leaving borrowing at 55.2 billion pounds -- the highest single month on record.

Bond investors showed little signs of concerns, reflecting their reliance on the Bank of England to keep borrowing costs at record lows. The yield on 10-year debt was steady at about 0.23%.

Speaking to broadcasters, Johnson said the countrys ballooning debt load -- now just shy of 2 trillion pounds -- “matters hugely,” but insisted plans to spend on infrastructure, education and technology will go ahead as the government tries to reboot the economy.

“We will manage our finances as prudently and as sensibly as we can,” Johnson said. “There has been a huge economic cost to what has happened; there has been a massive lack of economic activity for a very long time. Of course thats going to be painful and expensive to make up.”

Separate data Friday highlighted the long road ahead. While retail sales started to recover last month from their steep drop during the lockdown, they remain well short of their previous trend.

What Our Economists Say:

“We now expect the economy to contract by 9.5% in 2020, down from our previous forecast for a slump of 7%. We also see a more modest rebound in activity in 2021 with the economy growing 6.5%. That compares with our earlier estimate of 9%.”

-- Dan Hanson, senior U.K. economist. Read his full INSIGHT.

The budget deficit in the current fiscal year, forecast to be around 55 billion pounds when Sunak took over, is now on course to top 270 billion pounds, according to the latest survey of private-sector economists compiled by the Treasury. Thats equal to about 14% of GDP, more than at any time since World War II.

The unprecedented 21 percentage-point increase in the debt burden over the past year -- announced on Johnsons 56th birthday -- means Britain owes more as a share of the economy than at any time since Harold Macmillan was prime minister, the Profumo scandal gripped the nation and The Beatles released their first album.

Debt Mountain

Britain faces the biggest debt burden since Harold Macmillan was premier

Source: Office for Budget Responsibility

Note: Figures show annual averages; debt is projected to peak at almost 111% of GDP in September

However, in an analysis of the figures the Office for Budget Responsibility said the debt ratio could be revised down as nominal GDP appears to be higher than previously assumed. In the absence of actual GDP figures for May, the ONS used an OBR scenario which projected a larger fall in output than now seems to be the case.

The fiscal pain may last beyond this year, with a report from the Institute for Fiscal Studies Friday warning that persistent economic weakness could mean that borrowing levels remain elevated well into the future.

Read more: BOE Fears Mount That U.K. Faces Jobless Recovery From Crisis

A slow recovery could mean borrowing as much as 70 billion pounds more in the 2024-25 fiscal year then was predicted in March, the IFS said, while even a faster rebound may mean the figure is 40 billion pounds higher.

The precise cost of the pandemic is so unpredictable that the Debt Management Office has only announced its issuance plans through the end of July. The total for the first four months of the fiscal year stood at 225 billion pounds, and the DMO will release an updated outlook on June 29.

A cash-based measure that determines bond issuance showed the deficit surging to 62.7 billion pounds, taking the two month total to 126.2 billion pounds. The government paid out almost 22 billion pounds in wage subsidies over April and May, with the program for furloughed employees accounting for more than two thirds.

The figures come one day after the Bank of England decided to increase its bond buying plan by 100 billion pound, leaving it on track to buy almost 300 billion pounds of government bonds by the end of the year.

— With assistance by Lucy Meakin, and Alex Morales

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator