简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What Are Pips And How Are They Priced? | KOL Analysis•Jay Tun

Abstract:In the last few weeks, you were introduced to the world of currency trading. This week, we are going to delve deeper into the world of Forex and looking at how can we tabulate our winnings or losses with the nominal value of any currency pair

Some of the terminologies used in Forex are different from those in stocks. In stocks, we measure price change in dollars and cents and percentage.

In the world of Forex, currencies move in cents or less. The change in price is measured as pips instead.

You must have realized that the quotes of some currency pairs are displayed differently. Some quotes are displayed up to 3 decimal places while some others are displayed up to 5.

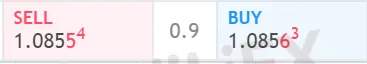

Example: EUR/USD

Example: USD/JPY

EUR/USD has 5 decimal places displayed, with the 5th decimal in a smaller font size.

USD/JPY has 3 decimal places displayed, with the 3rd decimal in a smaller font size.

#1 What Is A Pip?

A pip is the unit of measurement to express the smallest denomination change in value between

2 currencies. Most currency pairs are usually trading at 4 decimal places (ignoring the number that‘s in a smaller font size) except for Yen pairs. Yen pairs are at 2 decimal places (ignoring the number that’s in a smaller font size).

Is there anything smaller than a pip? Yes! It is called a pipette, which is commonly known as fractional pips.

Pipettes are those numbers shown in a smaller font size. Why are pipettes good? They allow you to trade with tighter spreads, effectively reducing your cost of trading!

Test Yourself

Source: babypips.com

Using the example above, GBP/USD is trading at 1.30543. When the value of GBP/USD rises to 1.30556, how many pips has this currency pair risen by?

The answer is..

1.3 pips! Did you get that right?

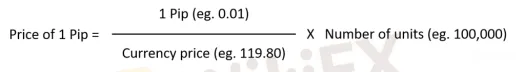

#2 How Much Is A Pip?

Forex is a leveraged instrument, so it is common for amounts in the thousands and tens of thousands to be traded by the retail traders.

| Lot | Number of units |

| Standard | 100,000 |

| Mini | 10,000 |

| Micro | 1,000 |

| Nano | 100 |

Lets assume the following:

· You trade 1 standard lot (100,000 units)

· USD/JPY is trading at 119.80

Using the formula, it works out to be US$8.34 per pip.

How much would you make if you shorted USD/JPY and it drops to 119?

You would have made 80 pips and that works out to be US$667.2! And 80 pips is achievable within a day!

Heres another example:

· You trade 1 mini lot (10,000 units)

· USD/CHF is trading at 0.9280

Using the formula, it works out to be US$1.06 per pip.

How much would you make if you long USD/CHF and it rises to 0.9380? You would have made 100 pips which works out to be US$106.

Conclusion

The knowledge of calculating pips comes in handy when you are deciding which Forex pair(s) to pay particular attention to. You want to maximize your trading capital and factor in opportunity cost.

What You Need To Do Now:

#1 Share a chart with this pattern on our Facebook Group as we support one another

#2 Get market updates delivered to you via Telegram

#3 Head over to our FREE Stock and Forex trading courses to find out how I screen for potential trades

See you around!

【About The Author】

An independent trader who seeks to educate through his own trading experiences, Jay began his own trading journey at the age of 22.

He is a self-taught trader who has read more than 200 books on trading and investment since college and created his trading methodologies modelling after several successful veteran traders.Jay has since amassed 10 years of experience trading different market conditions with consistency. Of the many disciplines in trading, he specializes in trading options, swing trades on equities, currencies,futures and contract-for-difference (CFDs).

WikiFX App is a third-party inquiry platform for company profiles.WikiFX has collected 17001 forex brokers and 30 regulators and recovered over 300,000,000.00 USD of the victims.

It, possessed by Wiki Co., LIMITED that was established in Hong Kong Special Administrative Region of China, mainly provides basic information inquiry, regulatory license inquiry, credit evaluation for the listed brokers, platform identification and other services. At the same time, Wiki has set up affiliated branches or offices in Hong Kong, Australia, Indonesia, Vietnam, Thailand and Cyprus and has promoted WikiFX to global users in more than 14 different languages, offering them an opportunity to fully appreciate and enjoy the convenience Chinese Internet technology brings. WikiFXs social media account as below:

Facebook:

USA Area:https://www.facebook.com/WikiFX.US/

UK Area:https://www.facebook.com/Wikifx.UK/

Nigeria Area:https://www.facebook.com/WikiFX.ng

Twitter:

Areas where English is an official language:https://twitter.com/WikiFX_Eng

More details about how to download WikiFX App:

Please download WikiFX APP from links below or scan QR code :

AppStore: https://apps.apple.com/us/app/fxeye/id1402501387?l=zh&ls=1

Google Play: https://play.google.com/store/apps/details?id=com.foreigncurrency.internationalfxeye

If you have any questions, please feel free to contact us at wikifx@wikifx.com

Worried about missing out latest trends in the volatile market? WikiFX ‘News Flash’ is here to help!

With 24-hour real-time update of forex market data by minute, you can seize the opportunity of every bullish market! Bookmark the link below and follow the market trends immediately!

UK Area:https://live.wikifx.com/uk_en/7x24.html

USA Area:https://live.wikifx.com/us_en/7x24.html

Nigeria Area:https://live.wikifx.com/ng_en/7x24.html

Wiki Forum Forum Function:

In order to help more investors, WikiFX has launched the “WikiFX Forum” forum, which aims to provide urgently needed and professional services to Nigerian forex investors.

The exposure function of “WikiFX Forum” includes the following features:

1: Allow investors who have been defrauded by illegal broker to complain directly in the forum (as shown in the screenshots)

As long as there is sufficient evidence, a review panel and an executive team will contact the broker to discuss the complaint or expose it directly through the media. Here are the exposure channels:

2: Block low score brokers from entering the forum

3: Monitor suspicious communication in real time, and directly spot and deal with suspicious fraud;

4: Negotiate with highly reliable brokers selected by WikiFX in the secure environment of WikiFX Forum.

WikiFX APP exposure channel: https://activities.wikifx.com/gather/indexng.html

Information page to understand forex scam and exposure channel: https://activities.wikifx.com/gather/indexng.html

Website exposure channel: https://exposure.wikifx.com/ng_en/revelation.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

One article to understand the policy differences between Trump and Harris

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

M2FXMarkets Review 2024: Read Before You Trade

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Bitcoin.com Introduces Venmo for U.S. Bitcoin Purchases via MoonPay

Currency Calculator