Score

Strifor

Mauritius|2-5 years|

Mauritius|2-5 years| https://strifor.org

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomContact

Licenses

Licenses

Licensed Institution:7 LUCKY TRADING (MAURITIUS) LTD

License No.:GB23202670

Single Core

1G

40G

1M*ADSL

- The Mauritius FSC regulation with license number: GB23202670 is an offshore regulation. Please be aware of the risk!

Basic information

Mauritius

MauritiusAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Strifor also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

strifor.biz

Server Location

Netherlands

Website Domain Name

strifor.biz

Server IP

78.140.140.218

strifor.org

Server Location

United Kingdom

Website Domain Name

strifor.org

Server IP

185.61.153.110

strifor.bid

Server Location

Netherlands

Website Domain Name

strifor.bid

Server IP

78.140.140.250

Company Summary

| Aspect | Information |

| Company Name | Strifor |

| Registered Country/Area | Mauritious |

| Founded year | 2022 |

| Regulation | Regulated |

| Market Instruments | FX, Metals, Indices, Crypto CFD, Commodities, Stocks, |

| Account Types | Basic, Advanced, Professional, Islamic |

| Minimum Deposit | $20 - $20,000 |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 0 pips |

| Trading Platforms | MetaTrader 5 |

| Customer Support | Phone +357 24812052, Email at help@strifor.ltd. , Email, Social Media |

| Deposit & Withdrawal | USDT TRC-20, USDT ERC-20, BTC, ETH, Vo/et |

Overview of Strifor

Strifor, established in 2022 in Mauritious, offers a wide range of trading assets including forex, metals, indices, and cryptocurrencies. With a user-friendly MT5 platform, it provides leverage of up to 1:500 and competitive spreads as low as 0 pips.

Is Strifor legit or a scam?

Strifor is regulated by FSC, with the license number of GB23202670. The current status is offshore regulated.

Pros and Cons

| Pros | Cons |

| Various trading instruments | High minimum deposit requirement for some account types |

| MT5 trading platform | Limited educational resources |

| Leverage up to 1:500 | |

| Responsive customer support | |

| Competitive spreads as low as 0 pips |

Market Instruments

Strifor offers a wide range of trading assets, totaling over 300+ assets.

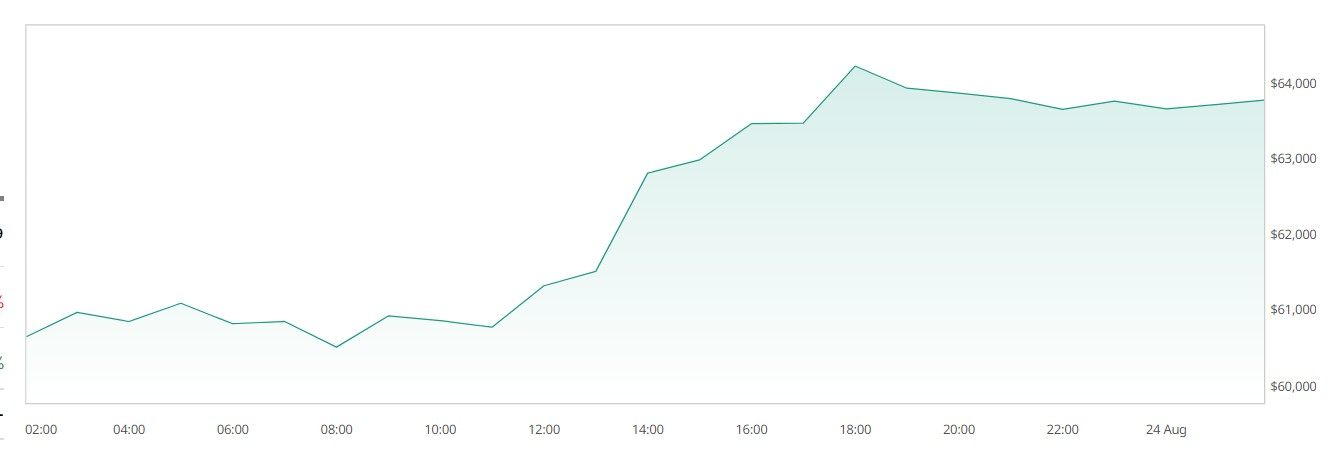

Among these assets are Cryptocurrency, providing access to various digital currencies such as Bitcoin, Ethereum, and Litecoin.

Additionally, traders can engage in the forex market through a selection of currency pairs, offering opportunities to trade major, minor, and exotic currency pairs.

The platform also features Contracts for Difference (CFDs), enabling users to speculate on the price movements of various financial instruments without owning the underlying assets.

For those interested in commodities, Metals such as gold, silver, platinum, and palladium are available for trading, providing exposure to the precious metals market.

Furthermore, Strifor offers trading options in Indexes, allowing investors to trade on the performance of stock market indices such as the S&P 500, NASDAQ, and FTSE 100.

Account Types

Strifor offers a variety of account types as follows:

The BASIC account type accommodates a wide range of clients, regardless of their trading experience or financial background. With a relatively low deposit requirement of $20, various currency options including USD, USDt, and EUR, and a maximum leverage of 1:500, it offers accessibility and flexibility. This account type features spreads starting from 0.1 point and allows trading in Forex, Metals, Indexes, and Cryptocurrency. While SWAP is enabled, there is no provision for Islamic rulings (IR), making it suitable for traders who do not require Sharia-compliant features.

The ADVANCED account serves users seeking more advanced trading capabilities and who can commit to a higher initial deposit of $10,000. Similar to the BASIC account, it supports multiple currencies and offers a maximum leverage of 1:500. However, it provides tighter spreads starting from 0 and extends trading options to include Cryptocurrency and Contracts for Difference (CFDs). This account type also includes SWAP functionality and accommodates Islamic rulings (IR), making it suitable for a broader range of traders, including those with Islamic finance preferences.

The PROFESSIONAL account type is tailored for experienced traders with a higher level of capital, requiring a substantial initial deposit of $20,000. It offers competitive advantages such as tighter spreads from 0, a maximum leverage of 1:200, and an expanded range of trading instruments including Cryptocurrency and CFDs. With lower commission rates per lot compared to BASIC and ADVANCED accounts, this option is ideal for traders looking for cost-effective trading solutions. Additionally, the PROFESSIONAL account offers the flexibility of Islamic rulings (IR), providing further options for traders with specific religious considerations.

The ISLAMIC account type is specifically structured to adhere to Islamic finance principles, making it suitable for traders who require Sharia-compliant trading options. With a modest deposit requirement of $2,000, it accommodates users seeking to align their trading activities with Islamic law. Offering trading in Forex, Metals, and Indexes, along with SWAP-free features, this account type ensures compliance with Islamic finance regulations. While it may have slightly higher commission rates compared to other account types, it provides a platform where traders can engage in financial activities in accordance with their religious beliefs.

| Aspects | BASIC | ADVANCED | PROFESSIONAL | ISLAMIC |

| Client Type | All | All | Professional | Islamic |

| Deposit | $20 | $10,000 | $20,000 | $2,000 |

| Currency | USD, USDt, EUR | USD, USDt, EUR | USD, USDt, EUR | USD, USDt, EUR |

| Max. Leverage | 1:500 | 1:500 | 1:200 | 1:500 |

| Spread | From 0.1 point | From 0 | From 0 | From 0.1 point |

| Trading Instruments | Forex, Metals, Indexes, Cryptocurrency | Forex, Metals, Cryptocurrency, CFD | Forex, Metals, Cryptocurrency, CFD | Forex, Metals, Indexes |

| SWAP | Yes | Yes | Yes | No |

| Commission | Per lot | Per lot | Per lot | Per lot |

| Forex | $8 | $7 | $5 | $12 |

| Metals | $8 | $7 | $5 | $12 |

| Indices | 0.00% | 0.00% | 0.00% | 0.01% |

| Cryptocurrency | 0.40% | 0.30% | 0.25% | - |

| Commodities | - | - | 0.01% | - |

| Stocks | - | 0.15% | 0.05% | - |

| Margin Call | 50% | 50% | 50% | 50% |

| Stop Out | 20% | 20% | 10% | 20% |

| IR (Islamic) | No | Yes | Yes | No |

How to Open an Account?

Opening an account with Strifor involves a straightforward process, typically completed in five clear steps:

- Registration: Begin by visiting the official Strifor website and locate the “Register” button. Click on it to access the registration form. Fill in the required personal information accurately, including your full name, email address, phone number, and country of residence.

- Verification: Once you've submitted the registration form, Strifor may require you to verify your identity and address. This step usually involves uploading scanned copies or photos of valid identification documents such as a passport or driver's license, as well as proof of address documents like a utility bill or bank statement. Ensure all documents are clear and legible before submission.

- Account Type Selection: After successful verification, you'll need to select the type of account you wish to open based on your trading preferences, financial capabilities, and risk tolerance. Strifor typically offers several account types, each with varying features such as leverage, spreads, and commissions. Choose the account type that best aligns with your trading objectives.

- Deposit Funds: Once your account type is selected, you'll need to fund your trading account. Strifor usually supports multiple deposit methods, including bank wire transfer, credit/debit card payments, and electronic payment processors. Follow the instructions provided on the platform to deposit funds into your account securely.

- Start Trading: With your account funded, you're now ready to start trading. Log in to your Strifor trading account using the credentials provided during registration. Familiarize yourself with the trading platform's interface, tools, and features. Then, analyze the markets, place your trades, and monitor your positions closely to seize potential opportunities and manage risk effectively.

Leverage

Strifor offers varying maximum leverage ratios across its account types.

For BASIC and ADVANCED accounts, the maximum leverage is set at 1:500, providing clients with the ability to control larger positions with a smaller amount of capital.

However, for PROFESSIONAL accounts, the maximum leverage is slightly reduced to 1:200, likely due to the higher level of capital and sophistication expected from professional traders.

Interestingly, the ISLAMIC account maintains the same maximum leverage as BASIC and ADVANCED accounts at 1:500, reflecting the platform's adherence to Islamic principles while still offering competitive leverage options.

Spreads & Commissions

Strifor offers different spreads and commission rates across its various account types.

The BASIC account features spreads starting from 0.1 point across all trading instruments, with commissions per lot set at $8 for Forex and Metals trading.

Meanwhile, the ADVANCED account presents an attractive proposition with spreads starting from 0 and slightly reduced commission rates of $7 per lot for Forex and Metals.

For those seeking a more cost-effective option, the PROFESSIONAL account offers the tightest spreads from 0 and even lower commissions of $5 per lot for Forex and Metals trading.

However, the ISLAMIC account, while maintaining competitive spreads from 0.1 point, presents relatively higher commission rates, especially for Forex and Metals trading, at $12 per lot.

Considering the fee structure, BASIC and ADVANCED accounts are suitable for all types of traders, while the PROFESSIONAL account is more appealing to experienced traders looking for cost-saving opportunities. The ISLAMIC account, despite its higher fees, may still attract traders seeking Sharia-compliant options within the platform's offerings.

Trading Platform

The trading platform offered by Strifor, primarily based on MetaTrader 5 (MT5), provides traders with a comprehensive and versatile trading experience. Strifor's choice of MT5 is justified by its robust features and functionality, aligning with the platform's commitment to offering a wide range of trading instruments, including Cryptocurrency, which is increasingly recognized as a significant asset class.

With MT5, traders on Strifor gain access to a plethora of tools and resources enhancing their trading strategies. The platform boasts advanced features such as Market Depth and Contract Specifications, allowing traders to gain insights into market liquidity and contract details for informed decision-making.

Furthermore, Strifor ensures accessibility to its trading platform by offering both mobile and browser-based versions, allowing traders to monitor and execute trades conveniently on-the-go. The platform also provides user notifications, including trading signals, to keep traders informed about market developments and potential trading opportunities.

Deposit & Withdrawal

Strifor offersUSDT TRC-20, USDT ERC-20, BTC, ETH, Perfect Money, Vo/et among its payment methods, allowing users to deposit funds using popular cryptocurrencies, appealing to those preferring the anonymity and security of blockchain-based transactions.

Customer Support

Strifor provides customer support primarily through its English-language contact number: +230 463 7993. Additionally, users can reach out via email at help@strifor.ltd. WhatsApp: 447488848238, Telegram: https://t.me/strifor_CustomerCare.

Conclusion

In conclusion, Strifor presents a compelling option for traders seeking access to various markets and competitive trading conditions. With a user-friendly MetaTrader 5 platform, traders can leverage up to 1:500 and benefit from competitive spreads as low as 0 pips.

The platform's high minimum deposit requirement for certain account types limit accessibility for traders with limited capital.

FAQs

What trading instruments does Strifor offer?

Strifor offers a wide range of trading instruments including forex, metals, indices, and cryptocurrencies.

What is the minimum deposit required to open an account with Strifor?

The minimum deposit ranges from $20 to $20,000 depending on the account type.

How can I contact customer support at Strifor?

You can contact customer support via phone, email, or social media channels.

What leverage does Strifor offer?

Strifor offers leverage of up to 1:500.

Keywords

- 2-5 years

- Regulated in Mauritius

- Retail Forex License

- MT5 Full License

- Regional Brokers

- Medium potential risk

- Offshore Regulated

News

News Strifor Launches New Year Promotion: Double Your Deposit!

Strifor Launches New Year Promotion: Double Your Deposit!From December 16 to December 30, 2024, Strifor offers traders a unique opportunity to boost their capital with a 100% trading bonus for deposit

2024-12-17 16:59

News New Year's Giveaway from Strifor!

2025 will be a special year for you! We've prepared a large-scale giveaway that will turn your January into a celebration of technology and privileges. Want to be among the winners? Then act now (http

2024-12-09 19:50

Review 16

Content you want to comment

Please enter...

Review 16

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

ManuelValenzuela

Spain

I have been using Strifor for a long time, and it is the most reliable platform I have found for withdrawing profits. Other brokers have given me problems, but everything works well here. The commissions are reasonable and there are deposit bonuses. The conditions set from the beginning have not changed, and I can withdraw funds at any time without any inconvenience. Highly recommended, although it should be noted that withdrawals to traditional bank cards are not available.

Positive

2d

OriolFajardo

Spain

A normal broker does not deceive its users, I recently started trading here and so far everything is normal, without any problems. The platform will attract beginners as everything is simple and clear here; no special trading knowledge is required. Commissions and spreads are within reasonable limits. There is access to all major trading tools, fast and, most importantly, secure withdrawals: I received everything down to the last cent.

Positive

11-02

NarayanSubramaniam

India

I've been trading here recently, I was the last one to join from my group of trader friends, and so far, everything is fine. Strifor allows every trader to adapt their strategy to their financial capabilities. I didn’t have enough funds for a larger deposit, so I started with the basic one, and it’s going well so far, no complaints. Low commissions and spreads, and the full withdrawal amount comes through. Overall, I’m very satisfied with my choice and recommend Strifor to everyone.

Positive

09-23

ReginaldRichardson

India

Strifor is an excellent choice for traders—you can make money with instant access via MT5 and a huge selection of trading tools. I liked the available commissions and spreads, thinking it was just a marketing gimmick, but it turned out not to be the case. The commissions and spreads are indeed quite low here. I had no issues with withdrawing money, there's no need to write anywhere or fill out forms, everything is very simple and very fast. I recommend it.

Positive

08-24

FX1166163761

India

Strifor is a great opportunity for those who want to explore new trading opportunities and, of course, earn good money. Personally, I value the opportunity to quickly earn on financial markets, and Strifor offers excellent conditions for this. There is almost everything here—from stocks to cryptocurrencies. Commissions and spreads are at a decent level, and the withdrawal process has never failed; I received all my funds in full. Strifor always pays.

Positive

08-18

Zamazdy

India

A quite workable broker, no problems with it, payments are stable. I also really appreciate the existing technical support of Strifor. When I have a question, they respond quickly and help me with everything. There are many trading opportunities here. I can trade both stocks and metals, and I have no problems with instant access thanks to MetaTrader. Withdrawals work, and you don't have to wait long for your money.

Positive

08-02

EdgarRobinson

India

For those who have not yet traded here, I recommend this broker, which offers all the necessary tools for successful trading. The access speed through MT5 is very high; there has not been a single case of delay or crash. At the beginning of trading, there were questions; I contacted them, asked questions, and always received complete and accurate answers from support. I really liked the commission sizes and spreads; I couldn't increase the deposit above the basic level, but even on this account, there are no strict restrictions, you can trade calmly and earn decent amounts.

Positive

07-30

Linex

Vietnam

Strifor is a fantastic choice for traders who want to minimize their costs. Their low minimum deposit and tight spreads make it easy to get started and maximize your profits.

Positive

07-19

KevinHammond

India

Honestly, I was hesitant to try Strifor, but a friend convinced me. Now, I see no issues with withdrawals; all payments are timely and complete. The platform offers various account types, and the support team is very helpful.

Positive

07-02

Chad Black

Argentina

Everything is fine with Strifor, from access to payouts. The platform is intuitive, with low commissions and diverse earning opportunities. The withdrawal process is stable, highlighting the broker's reliability.

Positive

06-27

Robert Anderson

United States

Joining Strifor has been a game-changer for me. Even with a basic account, I've been able to make good profits. The variety of trading instruments, including cryptocurrencies and stocks, is impressive. The withdrawals are always reliable and fast.

Positive

06-18

Robert Hill

Spain

A very reliable and calm broker, a safe haven where money is earned and withdrawn without hassle. Strifor is the most profitable broker in my trading career, offering low spreads, commissions, and stable payouts.

Positive

06-12

Richard Day

Finland

A good and reliable broker. I recommend Strifor for both experienced traders and beginners. Pay special attention to crypto here, as there are many different currencies. They guarantee order execution. I have been trading here for several months and receive stable income. Just remember to stick to your strategy. Trading is fast, and bonuses are available when funding your account. I am confident Strifor suits everyone.

Positive

06-04

FX1670584849

Cyprus

This platform is great and easy to manage. The only problem is how to forecast which market to trade off for a win.

Positive

04-30

Murugan2615

India

Recommend it, when signing up on this platform, they gave me a nice starting bonus. The range of trading tools was also pleasing, while fees and spreads remain low no matter what. The support service is decent, prompt resolution of all issues is guaranteed when contacting them. Interaction with the trading terminal runs without any delays, it’s comfortable to work with. You’ll need to use a crypto wallet to deposit and withdraw funds, but the withdrawal process itself is quick and stable.

Positive

04-18

George Boyd

India

A great broker, I recommend trying StriFor to everyone, the best MetaTrader 5 trading terminal works here, the fees are minimal, and there are so many crypto currencies that they make you dizzy. If you’re interested, the range also includes a variety of stocks, metals, and other assets. The deposit and withdrawal processes are strictly adhered to. There are four types of accounts to choose from; the one with a larger deposit offers more favorable terms.

Positive

04-17