简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Tips for Avoiding Forex Scams

Abstract:To help investors identify and stay away from the forex investment traps, WikiFX summarized the following tricks commonly used by illegal brokers.

As the saying goes, if something is too good to be real, it‘s likely not real. There’s no such thing as a shortcut in becoming rich. Forex scams may take countless shapes but they always end up in the same way: investors suffer heavy losses, while the brokers pocket the gains and often slip away before getting caught.

To help investors identify and stay away from the forex investment traps, WikiFX summarized the following tricks commonly used by illegal brokers.

Scam 1:

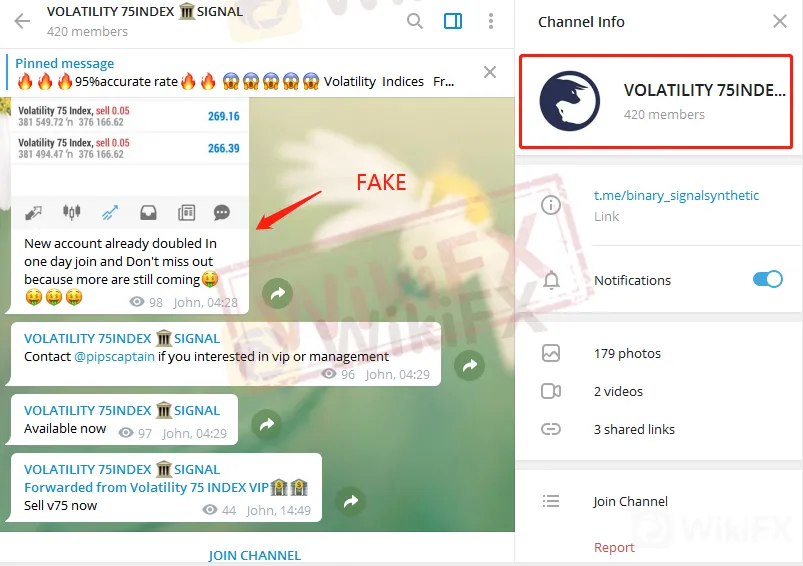

Swindling investors through groups on Facebook, WhatsApp or Telegram.

Scam 2:

Flaunting their wealth to lure potential victims on social media

Scam 3:

Attracting investors with the promise of “Bonus” or “Rebate”

Scam 4:

Stealing licenses of compliant brokers and assume a fake regulatory status

Scam 5:

Deliberately blow up trading account entrusted by investors

Scam 6:

Causing slippage through manipulated price and server lag

Scam 7:

Enticing client to raise investment and make more deposits before suspending account and blocking withdrawal.

Notably, the large and small illegal brokers in Asia typically use trading discussion groups on Facebook, Whatsapp and Telegram to trick investors. Such groups are usually ran by 1-2 group administrators who share trading signals, profit screenshots and even “5-star customer feedback” everyday to attract more investors. This method is cost-efficient and also makes it easier for the scammers to escape once theyre exposed.

As we know, Telegram group has a feature that enables users to remain anonymous, which also became a hiding spot for many illegal brokers. Through investigating and constantly tracking down some of these brokers, WikiFX found that theyre always creating new groups and channels which they swiftly delete as soon as they finished fleecing their victims, and more new groups will be established with Bot to attract online traffic and new victims. This was the trick that the notorious scam broker PTFX once used to defraud investors.

To wrap up, these are just a few common tricks of scam brokers, and amid a complex financial market environment, investors should remain prudent in investment and always remember to verify a brokers compliance to ensure a safer and more sustainable gold-digging experience.

So far, WikiFX App has included profiles of more than 18,000 forex brokers around the world, while integrating broker information query, exposure, news feed and other functions, protecting investors fund safety in forex trading. Click here to download WikiFX App, a guide to less risks and safer investment.→ Android /IOS: bit.ly/WIKIFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

List of Forex Scams Newly Revealed in 2021!

WikiFX has compiled a list of complaints recently received about scam platforms, which may help place investors on alert.

Three Indications to Spot Forex Scams

While forex trading features easy operation and low risks, it is fraught with pitfalls.

How to Identify and Avoid Forex Scams

There are many unscrupulous people who will try to scam individuals through Forex trading scams. Scammers are always somewhere nearby, trying to steal your money.

WikiFX Broker

Latest News

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Ghana Trader Jailed for $300K Forex and Crypto Scam

What Are The Top 5 Cryptocurrency Predictions For 2025?

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

XRP Price Prediction for 2025: Will It Hit $4.30 or More?

Exnova Scam Alert: Account Blocked, Funds Stolen, and Zero Accountability

T3 Financial Crime Unit Freezes $100M in USDT

BlackRock Bitcoin ETF Outflows Hit $332M in Single Day

Terra Founder Do Kwon Denies Fraud Allegations in U.S. Court

Dr. Sandip Ghosh, Ex-RG Kar Principal, Involved in Multi-Crore Scam

Currency Calculator