简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Four Charts Showing How April Lockdown Hurt South Africas Economy

Abstract:As South Africa loosens its lockdown from Monday, data for April is proving just how bad the economy was hit by regulations that shuttered almost all activity except essential services during that month.

As South Africa loosens its lockdown from Monday, data for April is proving just how bad the economy was hit by regulations that shuttered almost all activity except essential services during that month.

The country will move to alert level 3 on Monday, from level 4, allowing most businesses to reopen and an additional 8 million people to return to work. However, restaurants will still be limited to offering takeouts, services such as hairdressing are prohibited and most movement of people between provinces, towns and districts remains restricted.

Click here to read how the new lockdown rules will affect business

These charts show some of the impact of the level 5 lockdown in April.

The trade balance swung to a record deficit in April. That was mainly due to a 55% slump in exports as the lockdown stifled mining activity, which accounts for about half of the South Africas outward shipments, and as restrictions abroad weighed that demand from most trading partners.

Disruptions at ports also affected trade in manganese, iron ore, coal and most bulk shipments, the Minerals Council of South Africa said on Friday. The export of mineral products, which includes coal and iron ore, dropped by 39%, while precious metals and stones and base metals fell by more than 60%.

“Hopefully, the systematic scaling back of lockdown restrictions in June, both locally and internationally, will allow South Africa to start to increase exports, albeit off a much lower base,” Kevin Lings, chief economist at Stanlib Asset Management in Johannesburg, said in a note. “We still expect the trade balance to remain positive on a trend basis, especially in the second half of 2020 -- assuming that lockdown restriction can remain at level 3 or lower.”

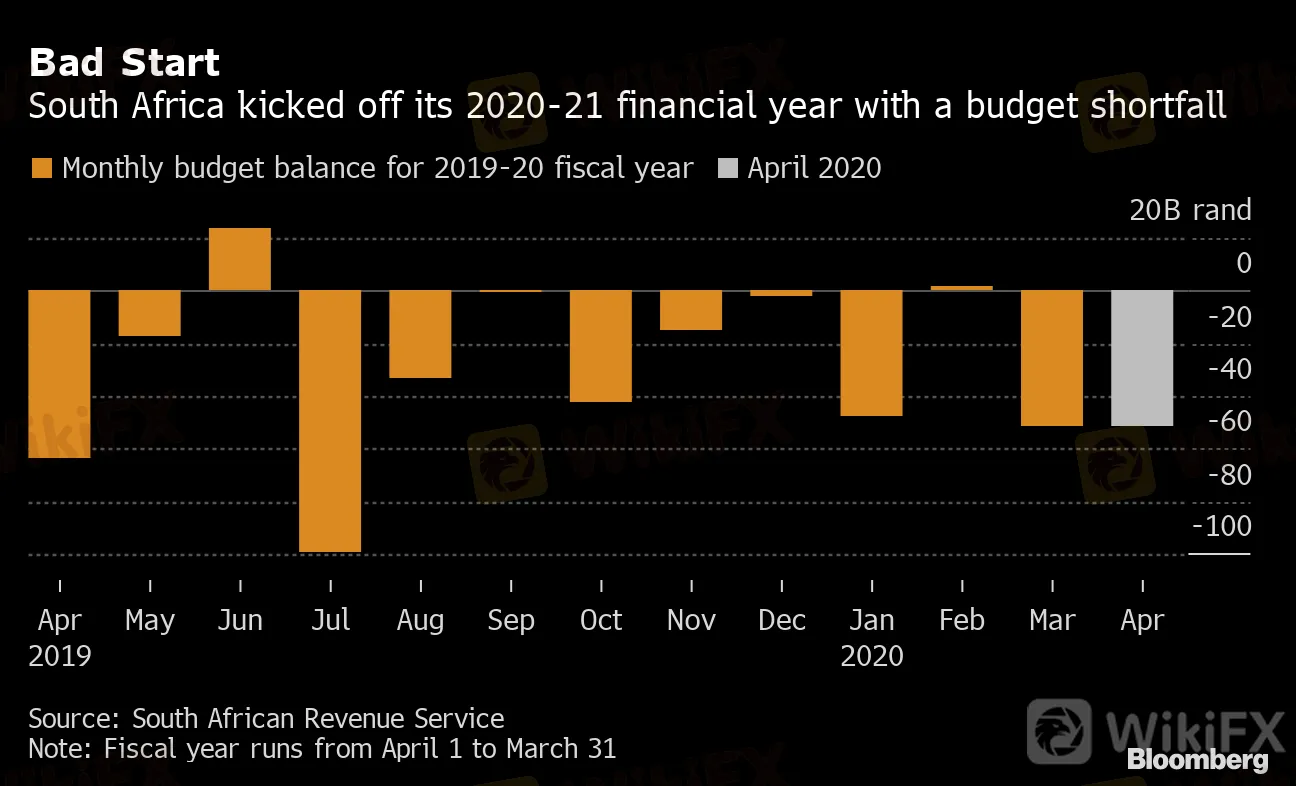

Bad Start

South Africa kicked off its 2020-21 financial year with a budget shortfall

Source: South African Revenue Service

Note: Fiscal year runs from April 1 to March 31

Business closures because of the lockdown and steps announced by the South African Revenue Service to give more time for tax payments to be made led to a budget shortfall of 52.1 billion rand in April, the first month of the governments fiscal year. While Finance Minister Tito Mboweni will only present an adjustment budget in late June, he has said the tax take could fall by 32%.

“For markets, the medium-term picture that is drawn with the end-June adjustment budget, with detail on spending as well as structural-reform plans, will be of far greater importance,” Razia Khan, chief economist for Africa and the Middle East at Standard Chartered Bank, said in an emailed note.

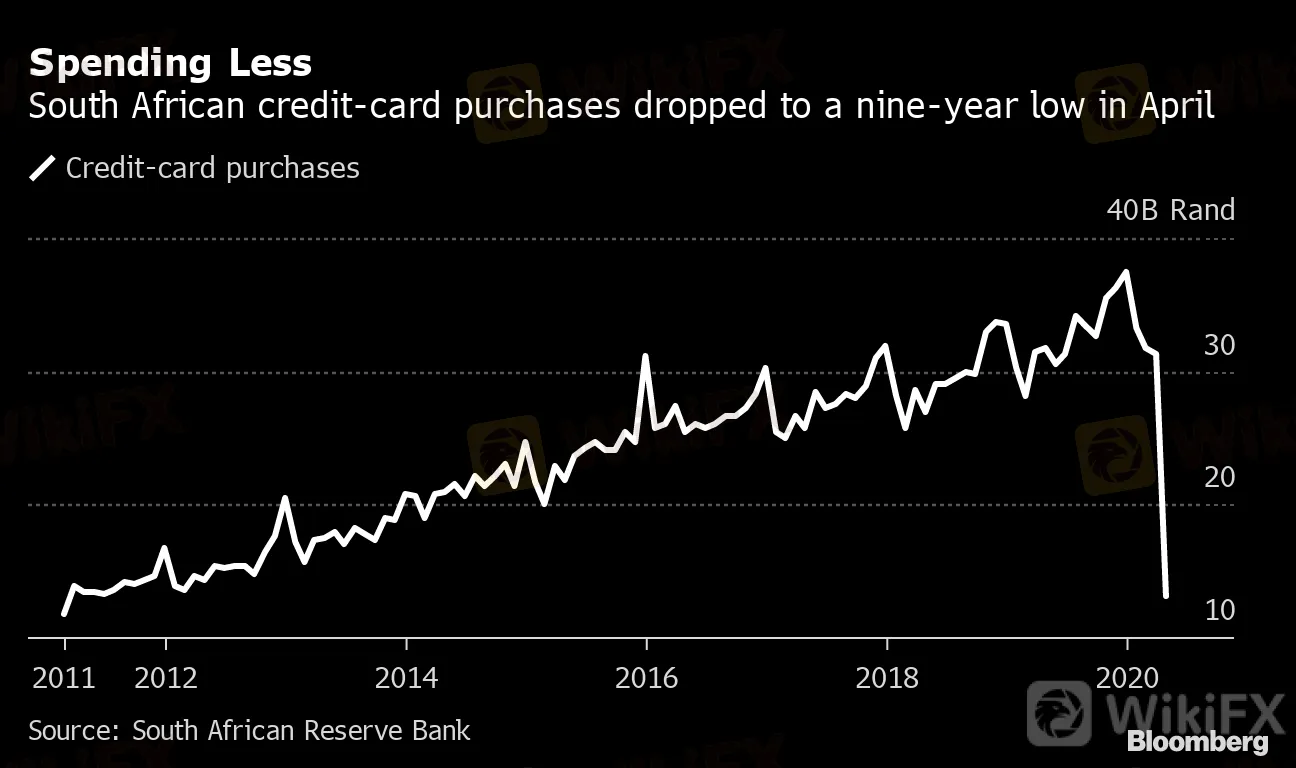

Spending Less

South African credit-card purchases dropped to a nine-year low in April

Source: South African Reserve Bank

Credit extended to households dropped month-on-month for the first time in three years. That was despite the central bank lowering borrowing costs by 225 basis points from the start of the year to the middle of April. The value of credit-card purchases dropped to a nine-year low.

“The economic fallout from the implementation of measures to contain the spread of the Covid-19 pandemic is envisaged to include job losses or salary reductions,” said Kamilla Kaplan, an economist at Investec Bank Ltd. “This will erode households ability to service debts.”

The sale of new vehicles dropped by 98.4% in April, the most on record, as car dealerships had to close their doors for the full five weeks of South Africa‘s level 5 lockdown. Although auto dealers could start trading again from May 1, subject to conditions, sales probably dropped by 86.3% in May from a year ago, according to the median of six economists’ estimates in a Bloomberg survey.

The National Association of Automobile Manufacturers of South Africa has reduced its domestic new-vehicle sales forecast by 23% to 405,000 units for the year, saying demand will continue to remain under pressure until there is greater economic stability.

— With assistance by Simbarashe Gumbo, Felix Njini, and Prinesha Naidoo

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator