简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bank of England Is Assessing Negative Rate Policy

Abstract:Bank of England Governor Andrew Bailey change his comment last week that negative rate “is not an approach we’re considering or planning to take” and said it’s the right time to review and assess all policy tools

May 25th from WikiFX News. Bank of England Governor Andrew Bailey change his comment last week that negative rate “is not an approach we‘re considering or planning to take” and said it’s the right time to review and assess all policy tools, indicating that the Bank of England is urgently evaluating the possibility of introducing negative rate.

Giving the green light to negative rate doesnt mean the central bank will immediately adopt a rate below zero. What the central bank is doing right now is planning for the next step after a potential shock in the future, and the pandemic accelerated the process. Currently the central bank is relying on QE as the main stimulus approach, the government has a rising demand for borrowing, and a risk of further shrinking economy also confirms the need for easing policies.

With the government launching unprecedented measures to prevent possible economic breakdown due to the pandemic, Britain‘s budget deficit in April climbed to an unprecedented high since the modern record was established in 1993, with central government spending surging 57% and income falling 27%. Even during the financial crisis, Britain’s monthly borrowing had never exceeded 22 billion pounds.

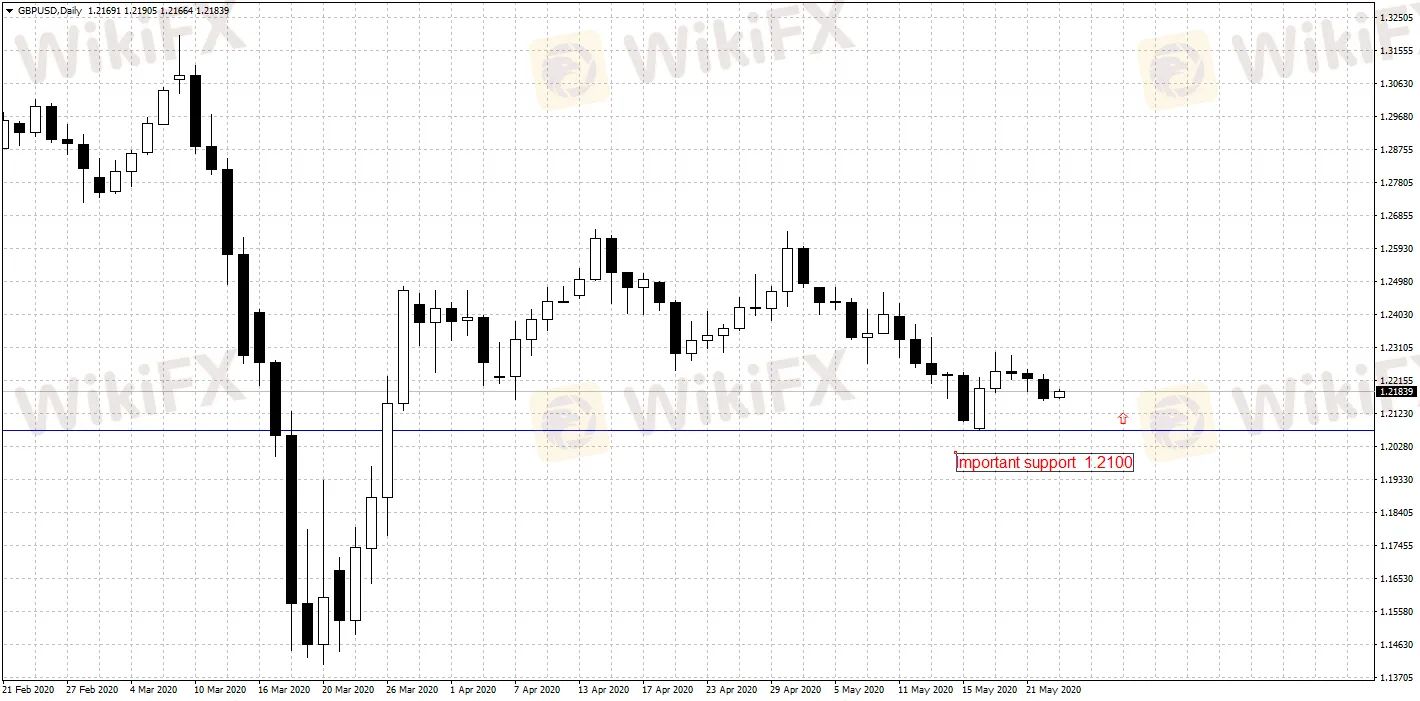

GBP/ USD daily pivot points 1.2176-1.2196

S1: 1.2140 R1:1.2212

S2: 1.2114 R2:1.2258

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Global Events Shaping Financial Markets Part 2

Recent developments include Labour's landslide UK election victory, geopolitical tensions from Eurasian security discussions, Trump's election impact on Japanese stocks, EU's tech regulatory actions, tentative Hamas-Israel ceasefire, continuity in Mexican policies, Toronto's housing market rise, Boeing's Starliner issues, SpaceX's ISS deorbit contract, Indian IT companies' earnings, Malaysian tech stocks upgrade, Philippine inflation easing, Eli Lilly's Alzheimer's drug approval, US housing mark

Key Global Events Shaping Financial Markets Part 1

Recent developments include Labour's landslide UK election victory, geopolitical tensions from Eurasian security discussions, Trump's election impact on Japanese stocks, EU's tech regulatory actions, tentative Hamas-Israel ceasefire, continuity in Mexican policies, Toronto's housing market rise, Boeing's Starliner issues, SpaceX's ISS deorbit contract, Indian IT companies' earnings, Malaysian tech stocks upgrade, Philippine inflation easing, Eli Lilly's Alzheimer's drug approval, US housing mark

British Pound (GBP) Price Outlook: More Losses Likely for GBP/USD

British Pound (GBP) Price Outlook: More Losses Likely for GBP/USD

GBP: What To Expect From BoE

GBP: What To Expect From BoE

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator