简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Confused about various types of forex brokers? This article helps you understand different brokers i

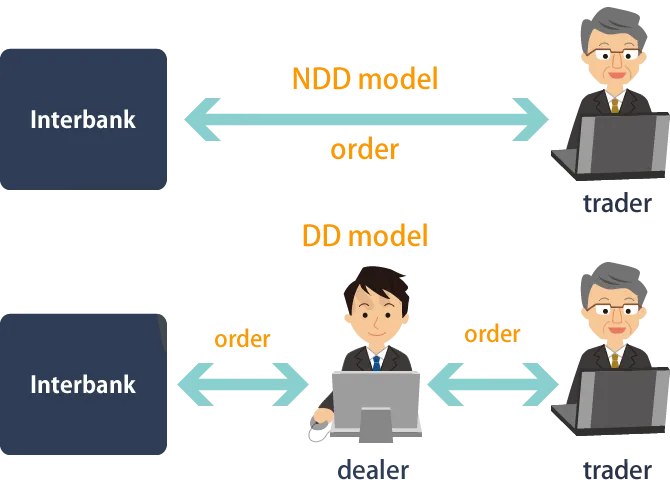

Abstract:Forex brokers can be divided two types: Dealing desk(DD) and No Dealing desk(NDD).

Dealing desk brokers are also known as market makers(MM). They usually have a trader background or processing background used to handle orders, while the spread is fixed. MM is the mainstream form of retail forex brokerage, as the trading scale of individual traders is usually small. Here, you also need to understand that the prices of currencies offered by forex brokerage companies and banks are different.

Dealing desk(DD) brokers make a profit through spread. Under certain conditions, when the trader wants to buy, the market maker sells it to the trader, and when the trader wants to sell, the market maker buys it.

Case sample:

If you want to buy a certain amount of EUR/USD from a DD broker,the broker, in order to fulfill the order, will first look for the same number of orders from its customers to sell the EUR/USD order, or give your order directly to the liquidity provider, this can reduce the brokers risks, because it makes a profit through spread without having to trade in the opposite direction with you. However, if there is no order that matches your order in the opposite direction, the broker will trade with you in the opposite direction.

In addition, Liquidity refers to the cost for investors to quickly execute a certain number of transactions at a reasonable price according to the supply and demand of the market. In other words, the higher the liquidity of the market, the lower the cost of real-time transactions. Generally speaking, lower transaction costs mean higher liquidity, or correspondingly better prices. The more liquid the forex market is, the smoother the transaction is, and the more competitive the offer is. Therefore, whether a broker's offer is attractive enough, whether it can provide a smooth trading environment, and whether traders encounter fewer slips with the broker, all depend on the liquidity of the broker to a large extent.

The top liquidity comes mainly from world-class banks, including Citibank, Deutsche Bank, HSBC, JPMorgan Chase, UBS, ABN AMRO and so on.

Declaration:

The evidences in WikiFXs exposure articles are verified via the following processes:

1: Evidence Collection: (Chatting history records, Trading history records, Banking Transaction records and video recordings from victim).

2: These evidences will be evaluated and verified by experts who have been work in forex industry for many years.

3: The editor will review it again before the article is published.

More details about how to download WikiFX App:

Please download WikiFX APP from links below or scan QR code :

Googleplay:https://play.google.com/store/apps/details?id=com.foreigncurrency.internationalfxeye

iosAppStore: https://apps.apple.com/us/app/fxeye/id1402501387?l=zh&ls=1

WikiFX App is a third-party inquiry platform for company profiles.WikiFX has collected 17001 forex brokers and 30 regulators and recovered over 300,000,000.00 USD of the victims.

It, possessed by Wiki Co., LIMITED that was established in Hong Kong Special Administrative Region of China, mainly provides basic information inquiry, regulatory license inquiry, credit evaluation for the listed brokers, platform identification and other services. At the same time, Wiki has set up affiliated branches or offices in Hong Kong, Australia, Indonesia, Vietnam, Thailand and Cyprus and has promoted WikiFX to global users in more than 14 different languages, offering them an opportunity to fully appreciate and enjoy the convenience Chinese Internet technology brings. WikiFXs social media account as below:

Facebook:

Singapore Area:https://www.facebook.com/wikifxsingapore/

USA Area:https://www.facebook.com/WikiFX.US

Nigeria Area:https://www.facebook.com/WikiFX.ng

LinkedIn:

Nigeria Area:https://www.linkedin.com/company/31506916

Twitter:

Nigeria Area:https://twitter.com/WikiFX_NG

Wiki Forum Forum Function:

In order to help more investors, WikiFX has launched the “WikiFX Forum” forum, which aims to provide urgently needed and professional services to Nigerian forex investors.

The exposure function of “WikiFX Forum” includes the following features:

1: Allow investors who have been defrauded by illegal broker to complain directly in the forum (as shown in the screenshots)

As long as there is sufficient evidence, a review panel and an executive team will contact the broker to discuss the complaint or expose it directly through the media. Here are the exposure channels:

2: Block low score brokers from entering the forum

3: Monitor suspicious communication in real time, and directly spot and deal with suspicious fraud;

4: Negotiate with highly reliable brokers selected by WikiFX in the secure environment of WikiFX Forum.

WikiFX APP exposure channel: https://activities.wikifx.com/gather/indexng.html

Information page to understand forex scam and exposure channel: https://activities.wikifx.com/gather/indexng.html

Website exposure channel: https://exposure.wikifx.com/ng_en/revelation.html

Worried about missing out latest trends in the volatile market? WikiFX ‘News Flash’ is here to help!

With 24-hour real-time update of forex market data by minute, you can seize the opportunity of every bullish market! Bookmark the link below and follow the market trends immediately!

Singapore Area:https://live.wikifx.com/sg_en/7x24.html

USA Area:https://live.wikifx.com/us_en/7x24.html

Nigeria Area:https://live.wikifx.com/ng_en/7x24.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

If you don’t know about spread, you will lose heavily!3mins to know critical skills in forex trading

Generally, currency pairs can be quoted in two different prices: The bid and ask price. The “bid” means to sell the base currency and the “ask” means to buy the base currency.

Must-know tool of forex trading! To know how to use the latest EA Cloud Host in 3 Mins

Generally, forex is traded in two forms, manual and EA. WikiFX is going to launch a global EA cloud host, which is a kind of cloud server exclusively designed for forex trading to provide a better trading environment for forex investors.

Want to handle the changeable forex market? Understand the development of forex in the past 600 year

Foreign exchange, in the eyes of many people, is an industry with only full screen numbers and candlestick patterns analysis, which does not need to be mixed with emotional needs. Endless market analysis puts too much pressure and risk on those forex salesmen every day.

Tutorial series for forex beginner!(Part 3) To learn how to read K-line in 3 mins!

Six bearish candlestick patterns Bearish candlesticks form an upward trend or prices rise slightly. They indicate that prices are about to turn or continue to fall.

WikiFX Broker

Latest News

eToro Expands Nationwide Access with New York Launch

Webull Partners with Coinbase to Offer Crypto Futures

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator