简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Stock Market May Face the Fuzziest Outlook in History

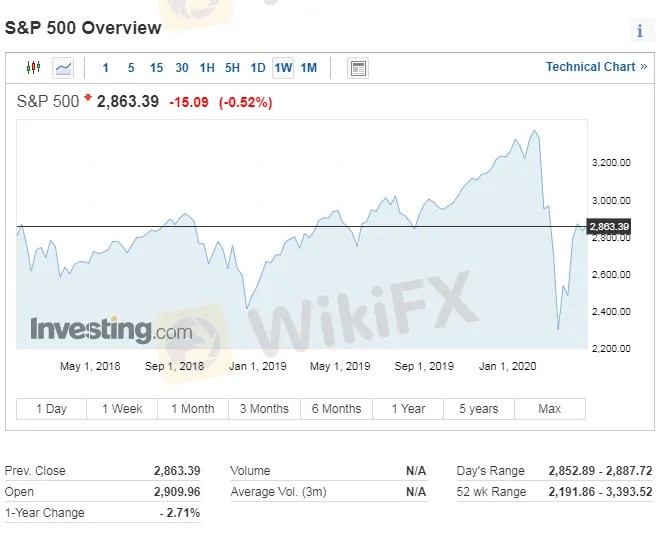

Abstract:After experiencing the strongest and fastest decline in history, market investors have placed high hopes on US stocks and expect to see an unprecedented swift rally. But what is the reality? We may get a few insights from the recent trend of US stocks.

After experiencing the strongest and fastest decline in history, market investors have placed high hopes on US stocks and expect to see an unprecedented swift rally. But what is the reality? We may get a few insights from the recent trend of US stocks.

According to the quarterly earnings reports released by several technology companies this week, quarterly revenues of companies such as Alphabet and Facebook turned out higher than Wall Street expected. According to data as of last Friday (April 24), technology stocks led the rise in the US stock indices on the week's last trading day. Although Thursday (April 23)'s unemployment figure totaled 26 million, the four major US indices (S & P 500, Dow Jones, Nasdaq Composite Index and Russell 2000) had been on the rise.

Last Friday, technology stocks pushed the Nasdaq index up 1.65%; SPX rose 1.39%, all 11 sectors were bullish, and technology stocks led the rise with a 2.12% gain. However, Friday's rise didn't level off the week's overall decline. The S & P 500 index fell by 1.32%, losing half of its gains in the previous week, while Dow Jones Industrial Average fell 2.02%, almost erasing all the gains of the previous week. Only Russell 2000 (small-cap stocks) rose 0.32%, still maintaining the overall upward trend.

To the surprise of many analysts, the current risky economic and market environment seems to boost demands for small-cap stocks. Some analysts observe that this is just a sign of greed. Despite the upward trend in the stock market, analysts still doubt whether much of the explosive surge was due to short-squeezing.

Now the market faces what may be the most uncertain outlook in history, because there are too many contradictory signals in the market without forming a positive prospect.

Carl Icahn, 84, is a well-known American investor and is known as the “Wolf of Wall Street”. He managed to make a precise bargaining when the oil prices plummeted on 20th of April and became a winner. Currently, the prestigious investor does not intend to buy stocks. He has been hoarding cash and shorting commercial real estates, while preparing for potentially greater damage from the coronavirus. Carl Icahn also said stock market was overvalued and doubted whether the economy could be turned on like a “spigot”.

For more financial information and forex market updates, please visit WikiFX official website or download WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Currency Calculator