简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

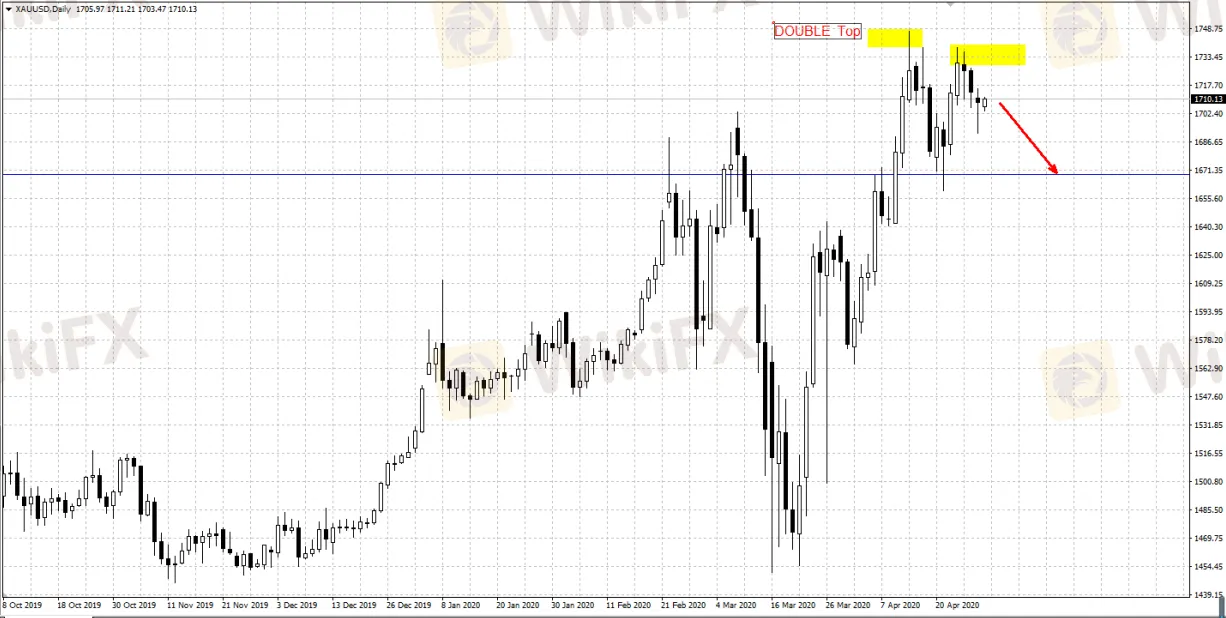

Gold Continues to Fall as Risk-aversion Sentiments Decline

Abstract:Gold price has been falling for the third straight day, as global governments’ measures of reopening economy and the stock market’s rally reduced part of the market’s risk-aversion demands.

Gold price has been falling for the third straight day, as global governments’ measures of reopening economy and the stock market’s rally reduced part of the market’s risk-aversion demands.

Investors are closely following the stimulus measures governments and central banks will implement to revive economy.

In addition, statistics also show that China and India’s gold imports have declined starkly, as lockdown measures and spiking gold prices dampen consumers’ demand of the precious metal. According to data from General Administration of Customs People’s Republic of China (GACC), China’s Gold imports dropped over 80% in March and over 60% in the first quarter this year.

China imported only 17.5 tonnes of gold in March, the lowest level recorded by GACC since January, 2018. Similarly, India’s gold imports are also near historical low.

Gold’s daily pivot point 1704-1706

S1: 1694 R1: 1719

S2: 1680 R2: 1730

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Market Technically Analysis

The trend of gold on the daily chart is in line with technical requirements.

Gold Price (XAU/USD) Struggling to Break Meaningfully Higher

Gold Price (XAU/USD) Struggling to Break Meaningfully Higher

Gold Q3 Fundamental Forecast: Outlook Deteriorates for Gold Prices

Gold Q3 Fundamental Forecast: Outlook Deteriorates for Gold Prices

Gold Price Forecast: XAU/USD has a good chance to regain the $1900 level – TDS

Gold Price Forecast: XAU/USD has a good chance to regain the $1900 level – TDS

WikiFX Broker

Latest News

One article to understand the policy differences between Trump and Harris

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

M2FXMarkets Review 2024: Read Before You Trade

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Bitcoin.com Introduces Venmo for U.S. Bitcoin Purchases via MoonPay

Currency Calculator