简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Stock market crash: Why the recent rally is a trap, 57% drop coming - Business Insider

Abstract:"My sense is that investors remain disoriented about where they actually are in the cycle," says John Hussman.

John Hussman — the outspoken investor and former professor who's long predicted a stock collapse — thinks the market is in the midst of setting a classic trap that's mirrors speculative bubbles of the past.He notes the wide divergence between historical, run-of-the-mill stock valuations and where the S&P 500 currently trades today.Hussman says that the market's recent oversold condition has been “cleared.”Using Hussman's logic, a return to historical norm valuations would imply about a 57% plunge in stocks from their current levels.Click here for more BI Prime stories.

After falling 30-plus percent in a little over a month, the S&P 500 clawed it's way back to just an 11% year-to-date drop.Some experts were encouraged by the market's stoicism and positive response to unprecedented monetary-easing efforts from central banks. Strategists at Goldman Sachs went as far as to declare that stocks have already bottomed for 2020, and boosted the firm's year-end forecast.It's safe to say that John Hussman — the former economics professor turned president of the Hussman Investment Trust — isn't prepared to give the same all-clear signal. He instead thinks current investor sentiment is falsely assuming that the ongoing market recovery will persist.“One of the characteristics of bear market periods is that they alternate between collapses to fresh spike lows, and advancing periods that serve to 'clear' the compressed, oversold condition of the market,” he penned in a recent client note.

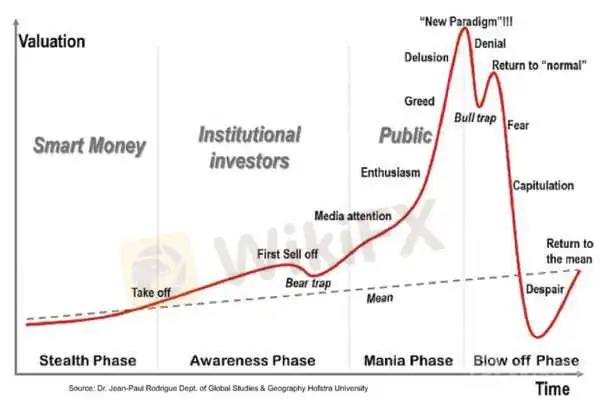

Hussman continued: “Having cleared the oversold condition that emerged on a few occasions in March, we now observe the fairly unusual combination of overbought conditions, renewed valuation extremes, and still unfavorable market internals (which we use to infer the inclination of investors toward speculation or risk-aversion).”That “unusual combination” is increasing Hussman's anxiety over the overall well-being of the market — one he thinks is setting a trap. His view is informed by the four-part “phases of a bubble” economic model popularized by renowned academic Jean-Paul Rodrigue in 2008, around the time of the last financial crisis. “The current position of the market is reminiscent of the 'return to normal' trap in Jean-Paul Rodrigue's familiar chart of speculative bubbles,” he said.For context, Hussman provided the following visualization of Rodrigue's chart. He argues that the “return to normal” fake-out is currently transpiring in the stock market — and warns of the massive drop that has historically followed.

John Paul Rodrigue/Time/John Hussman

The way Hussman sees it, the market's latest rally off the lows will likely be a short-lived, transient period which serves as a harbinger for an even further plunge.

“Similar points during the 2000-2002 and 2007-2009 include May 2001, December 2007, and May 2008,” he said. “All three, in hindsight, had unfortunate consequences.”Hussman added: “My sense is that investors remain disoriented about where they actually are in the cycle.”In order to remind investors where stocks currently stand from a historical viewpoint, Hussman provides the following chart dating back to 1928. The blue line represents the S&P 500 index. The green line represents the market's historical norm valuation. And the red line represents the market's “durable” level.

Hussman

“You'll notice that substantial market advances above that green valuation line were almost always transient, while 'durable' market advances typically represented upward moves toward historical valuation norms,” he said. “At present, run-of-the-mill valuations place the green line slightly below 1200 on the S&P 500 Index.”

Applying Hussman's logic, in order for the S&P 500 to reach “run-on-the-mill” valuations, it would need to plummet about 57% from its current level. A notion that seems to coincide with Hussman's assessment of Rodrigue's speculative bubble chart above.Hussman notes that, in times like these, it's best to be patient. Jumping back into the market at a time when it's historically overvalued, internals are weak, and conditions are overbought could easily rout unprepared investors.“It's clear that investors are already eager to 'look over the valley' to an economic recovery,” he said. “The problem is that post-recession bull markets typically begin at valuations about 40% of those we observe at present.”Hussman's track recordFor the uninitiated, Hussman has repeatedly made headlines by predicting a stock-market decline exceeding 60% and forecasting a full decade of negative equity returns. And as the stock market has continued to grind mostly higher, he's persisted with his calls, undeterred.

But before you dismiss Hussman as a wonky perma-bear, consider his track record, which he broke down in his latest blog post. Here are the arguments he lays out:Predicted in March 2000 that tech stocks would plunge 83%, then the tech-heavy Nasdaq 100 index lost an “improbably precise” 83% during a period from 2000 to 2002Predicted in 2000 that the S&P 500 would likely see negative total returns over the following decade, which it didPredicted in April 2007 that the S&P 500 could lose 40%, then it lost 55% in the subsequent collapse from 2007 to 2009In the end, the more evidence Hussman unearths around the stock market's unsustainable conditions, the more worried investors should get. Sure, there may still be returns to be realized in this market cycle, but at what point does the mounting risk of a crash become too unbearable?

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

February 23, 2024- US Stocks Hit Record Highs, Tech Sector Fuels Rally

Nvidia Soars, European Markets Gain, and Key Forex Trends

Market Resurgence: Stocks Rally, Cryptos Surge, and Forex Fluctuations - February 15, 2024 Update

Key Insights into Today's Market Dynamics and Profitable Trading Strategies

EBC Research Institute Hotspot Analysis | China Unleashes Major Moves, Stock Market Brews a Violent Reversal

The Chinese government has taken measures to boost the stock market, yet the market still faces challenges, and investors should proceed with caution.

Market Wrap: Stocks, Bonds, Commodities

U.S. Stocks Rebound, Yen Surges on BoJ Policy Hints

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator