简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Star fund manager closes short Treasurys bet after losing billions in assets - Business Insider

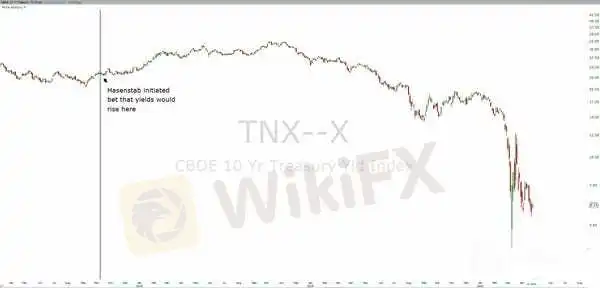

Abstract:Fund manager Michael Hasenstab of Templeton Global finally ended his three-year bet that Treasury yields would rise after seeing billions in outflows.

Franklin Templeton fund manager Michael Hasenstab has been betting on rising Treasury yields since 2017. In that same time period, Treasury yields have fallen to their lowest levels ever. After being on the wrong side of the trade for years, Hasenstab has finally thrown in the towel and exited the trade, Bloomberg reported.The flagship fixed-income fund that Hasenstab manages has seen its assets under management nearly cut in half, falling from $40 billion in 2017 to $22 billion today, according to Bloomberg. Visit Business Insider's homepage for more stories.

Fund manager Michael Hasenstab, who manages Franklin Templeton's flagship fixed-income mutual fund, has finally thrown in the towel on his money-losing short bet against Treasurys, Bloomberg reported.Hasenstab was betting that Treasury yields would rise, and initiated the short position back in 2017. Since then, Treasury yields have fallen to historic lows as the Fed launched a number of monetary stimulus policies to combat the economic damage inflicted by the coronavirus pandemic.

freestockcharts.com

A look at the Templeton Global Bond Fund fact sheet shows average duration, which measures the sensitivity of a fixed-income portfolio's price to changes in interest rates, turned positive to 2.06 years as of March 31. This is a dramatic change from the average duration reported as of December 31, 2019, of negative 1.01 years.Additionally, Bloomberg reported that the fund has tactically unwound its short position, citing a person familiar with the situation.Assets under management in the mutual fund that is often utilized by financial advisers fell $4.4 billion over the past three months to $22.55 billion today. Since the start of Hasenstab's short Treasurys bet in 2017, assets in the fund have fallen by $18 billion. The fund had nearly $70 billion in assets in 2015.

Read more: One of the world's best small-company fund managers tells us how he finds 'hidden growth' that others miss — and shares his 3 top picks for the year aheadPerformance for the adviser share class of the fund has suffered over the past five years, returning just 0.49% relative to its benchmark return of 2.96% as of March 31. Meanwhile, 10-year performance for the fund has outperformed its benchmark by 40 basis points.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Sum Of All Fears

The Sum Of All Fears

12 stock picks to buy, 8 to avoid during coronavirus economic recovery - Business Insider

Every investor wants to know what the recovery from the pandemic will look like, and Bank of America says China is providing important clues.

PIMCO raises $5.5 billion for private credit funds - Business Insider

The California-based manager wasn't immune to structured credit's disastrous March, but has been able to raise money to take advantage of the dislocation.

ESG stock picks to buy: 4 recommendations from Russell Investments - Business Insider

The investing world is getting increasingly focused on companies that possess ESG qualities. Here are 4 stocks that fit the bill.

WikiFX Broker

Latest News

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Macro Markets: Is It Worth Your Investment?

Trading is an Endless Journey

SEC Warns on Advance Fee Loan Scams in the Philippines

Russia Turns to Bitcoin for International Trade Amid Sanctions

Rs. 20 Crore Cash, Hawala Network, Income Tax Raid in India

Hong Kong Stablecoins Bill Boosts Crypto Investments

BEWARE! Scammers are not afraid to impersonate the authorities- France’s AMF said

Currency Calculator