简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

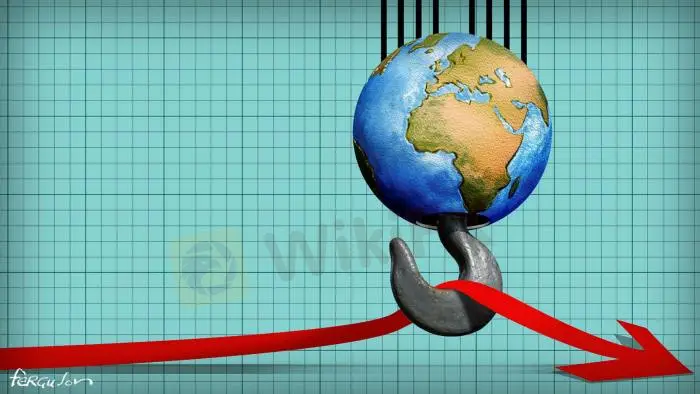

The Sum Of All Fears

Abstract:The Sum Of All Fears

Inflation hits a 26 year high

The distinction between inflation deflation and disinflation

What may happen next

Recent inflation data shocked the market with core CPI readings hitting a 26 year high as base effects, supply shortages and resurgence of demand created this biggest jump in price conditions in decades. Equity markets sold off on the news and bond yields rose, but while reaction in stocks was predictably violent the rise in yields was relatively tepid as fixed income investors remained skeptical as to the permanence of the price pressures.

There is no doubt that inflation expectations will now become the key narrative for capital markets and investors continually debate whether inflation risks are transitory or permanent. However before we examine the possible scenarios its worthwhile to examine the three distinct price regimes that rule the economy.

The distinction between inflation deflation and disinflationInflation is generally defined as the result of too much demand chasing too little supply. When inflation is purely demand driven its can abate relatively quickly as more supply comes on line and prices begin to stabilize. Inflation becomes a truly pernicious problem when demand rises while supply actually contracts. This was the case in 1970s when wages set by union based labor contracts continued to rise but supplies driven by oil which was a major input into almost every business process at the time contracted creating the absolute of both worlds as output declined while price rose.

Almost no analyst believes that the current bout of price pressures is similar to the 1970s scenario because the majority of the economy today is made up of non-tangible goods that have virtually no input costs. Even the well publicized chip shortage is not dependent on any resource constraint but rather manufacturing capacity. This is why the Fed remains convinced that inflation will be temporary as the bottleneck in supplies begins to ease and more capacity comes online. This seems like a reasonable assumption but there are some key caveats to consider.

If the current supply shortages are exacerbated by some act of nature, making them even scarcer such conditions could lead to hoarding. A small example of this behavior could be seen in the recent Colonial pipeline shutdown which created shortages for gasoline across the Eastern seaboard of the United States. Hoarding behavior is self-reinforcing and turns inflation from a purely economic problem into psychological one which creates runaway dynamics in price pressures that could be very harmful to the economy.

Disinflation is the constant pressure on prices from supply. As capacity expands and efficiency increases the continuous downward pressure on prices creates a virtuous cycle for the economy as output grows and prices decline. This has been the major story for the past forty years, especially with the rise of China and has been the single greatest reason why inflationary pressures have been muted despite massive fiscal deficits and monetary expansion as more demand has been met with ever greater amount of supply. For now the technological progress in many industry sectors and Chinas massive capacity and rapid rise on the value chain of production remain the primary disinflationary forces in place that should keep price pressures at bay.

The key risks to this dynamic are political rather than economic. China‘s aggressive expansionary policy in Hong Kong and its ever present threat to bring Taiwan under its control is the key geopolitical risk to the global supply chain. If Taiwan becomes a geo-political hotspot, the way the Middle East was in the 1970’s then the inflationary pressure on the economy from long term supply disruptions caused by economic embargoes would be highly inflationary to the system.

What may happen nextThe deflationary burst of the crypto bubble would certainly wipe out a lot of newly created wealth and would have an instantly moderating impact on price pressures. The falloff in demand would allow supplies to catch up and the market may even find a new equilibrium. The Fed as always would step in as the lender of last resort and reliquefy the key financial market players in the system.

The sum of all fears scenario however, could see the burst of the crypto bubble at the same time as military activity by China which would create disastrous consequences for both demand and supply as wealth disappears while resources become much more expensive. Such a scenario would be devastating for financial assets and while the chances of everything moving in this direction at the same time are small, the current risks in the system are such that it behooves investors to buy some long term protection in the form of puts, especially as volatility remains relatively low.

Finally deflation is essentially a collapse in demand typically caused by an asset bubble bursting. Deflationary pressures are highly negative on prices as demand disappears due to massive collapse in wealth. Right now, the single greatest bubble in the world – perhaps in all of human history – is in the crypto assets. Unlike the prior mini-bubble of 2017 the crypto market has exploded in growth to be worth by some estimates north of $4 Trillion. Stories of lucky investors turning $500 into $500,000 in a matter of days are now part of the social zeitgeist which always precede the massive collapse of such bubbles.

The problem with crypto as was the problem with the mortgage backed assets in 2007 is the massive build up of leveraged derivative positions that are largely non-transparent to the rest of the market. A quick 50% sell off in Bitcoin and Ethereumcould create cascading margin calls across the whole financial system. Imagine the Archegos fiasco but on a much larger, more damaging scale.

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

PIMCO raises $5.5 billion for private credit funds - Business Insider

The California-based manager wasn't immune to structured credit's disastrous March, but has been able to raise money to take advantage of the dislocation.

Warren Buffett's lack of stock purchases worries Leon Cooperman - Business Insider

The hedge fund boss said the restraint shown by the "greatest investor in my generation" is a red flag for investors.

Warren Buffett, Berkshire Hathaway sold its airline stocks in April - Business Insider

The famed investor said he was "wrong" to invest in American, Delta, United, and Southwest.

Deutsche Bank Q1 earnings: German lender posts 67% fall in profits - Business Insider

Deutsche Bank has had a challenging few years months including a restructuring and big losses. DB said it would be cutting 18,000 jobs last year.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator